Behind which doors are the solutions to the current problems? The hotel industry is still confident, but the doubts for 2023 are palpable.Photo: 1STunningART

Augsburg. The current crises are leaving their mark: The Ukraine war and its aftermath, as well as pent-up industry problems, have significantly weakened the 2019 upswing in the hotel industry. The subdued outlook is also putting the brakes on investments and transactions, though has not shaken faith in economy hotels or the tourism and leisure segment overall. This is the result of the current Investment BAROMETER, the autumn survey by the specialist publisher HospitalityInside, Augsburg, and Union Investment, Hamburg.

"We consider the budget and midscale segment, which is significantly more cost-efficient than other hotel segments, to be particularly resilient in this crisis phase. But not only here. The luxury segment, where guests tend to be less price-sensitive - even in recessionary phases, also shows resilience" says Andreas Löcher, Head of Investment Management Hospitality at Union Investment.

Because higher personnel and energy costs are squeezing margins, Löcher believes that full-service hotels, which offer a full range of services from lodging and food & beverage to fitness and wellness, are having a harder time in the current situation.

Economic outlook puts more pressure on the brakes

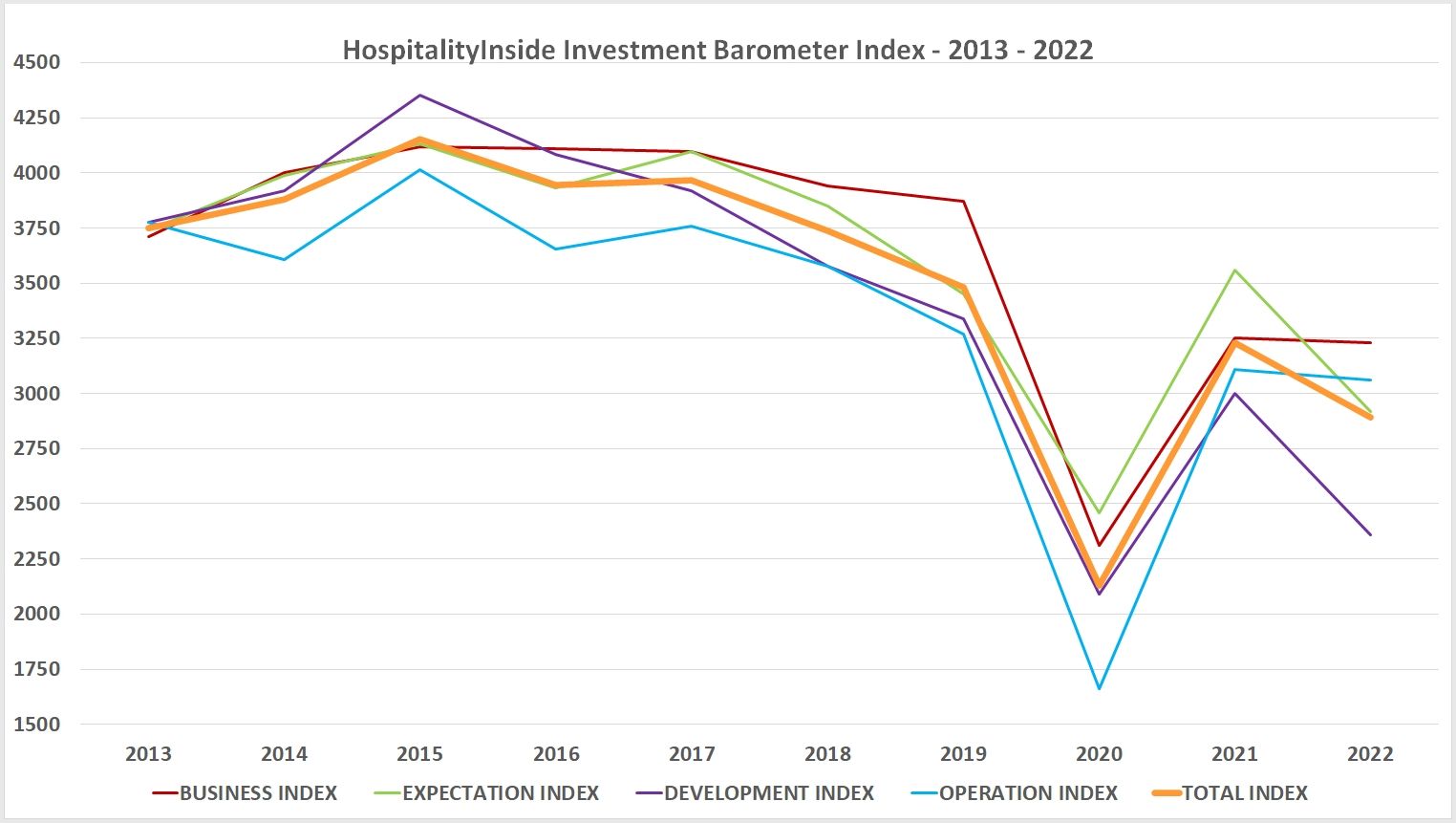

The autumn survey was conducted between 23 September and 24 October 2022 and clearly shows: Seven months after Russia's attack on Ukraine, all indexes are falling again, but not comparable to the dramatic drops in the corona year 2020.

Graphic: HospitalityInside

Consultants/brokers, hotel operators, project developers, owners/investors and financiers were most represented in the survey. 74% reported operating in the German-speaking Europe region, 34% also in the rest of Europe.

Supply chain disruptions, inflation, interest rate hikes, endless employee attrition, higher wages, and higher input costs, especially for energy... The burdens on hotel owners and operators alike are massive. It is therefore not surprising that the transaction volume in the DACH region is virtually at a standstill. The vast majority of respondents are unable to say when purchasing volumes will return to pre-corona levels.

A clear majority sees the subdued economic outlook as the cause of the slowed investment market, ahead of higher interest rates and the Ukraine war.

Budget and Leisure remain attractive

The hotel experts draw hope from individual segments: 58% of respondents consider economy/budget hotels to be the most attractive segment in the next 12 months. No wonder: With their lean cost structures, they overcome almost any crisis largely unscathed. And the unexpected travel boom in the corona summer of 2021, as well as this summer, strengthen the confidence of experts in the tourism and leisure segment. Travel is now simply part of the population's leisure DNA. This summer, for example, the hotel industry was able to push through significantly higher prices across the board for the first time.

"With increased professionalisation and the less pronounced seasonality, resort hotels will continue to gain in appeal in the future and also establish themselves as an interesting asset class for institutional investors," says Andreas Löcher. "Ultimately, resort hotels offer fundamentally attractive opportunities for portfolio diversification, with long-term value growth even across economic crises, due to their crisis resilience."

Two indices are stable

So, the hotel experts do not despair, despite the current multiple stresses. However, doubts are certainly visible in the survey results. In the Business Index, the majority of respondents in September/October still rated the market situation for their own company as good or satisfactory, so that the index remains stable at the previous year's level.

The picture is similar for the Operation Index, which asks about the current mood in the hotel industry with regard to revenue development: There, the mood is good at 27%, satisfied at 54% and sceptical at 18%, thus the index remains stable compared to the previous year.

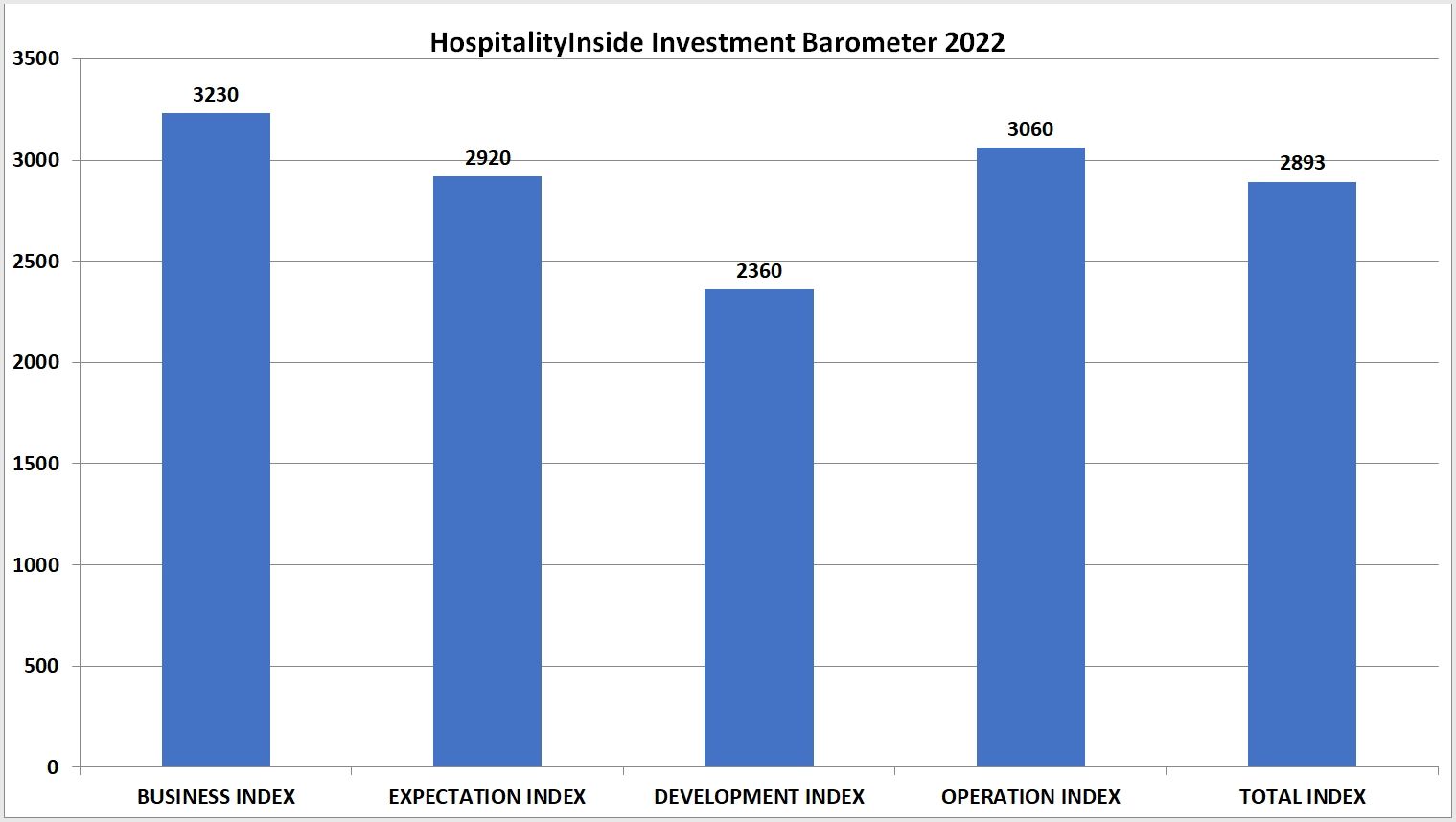

The Development Index, on the other hand, falls the most, by -21%. New construction projects find it almost impossible to find finance, a fact which is reflected in expectations: For the majority of respondents, the outlook is poor or very poor - compared with 36% satisfied and 6% with good and very good expectations.

Business expectations as a whole are down "only" by 17% compared with the Expectation Index of the previous year. For the next six months, business expectations remain the same for 43% of respondents, but 29% expect a worse development and 27% hope for good business.

At 2893 points, the overall index is down 10.5% from a year ago, but it remains well above the record low from the year 2020, when the overall index stood at just 2130. / kn

The Business and Operation Index have remained stable compared to the previous year.

> Subscribers will find the complete results in the magazine.

> Extracts of the latest results are also published on the Union Investment website,

(www.union-investment.de/realestate)