News & Stories

Revo Hospitality Group currently operates around 220 hotels, it corrected after an inquiry from hospitalityInside. Today, we can provide additional transparency with a current list of around 150 insolvent companies! We also asked Anchor, a neutral insolvency law firm, whether the measures taken at Revo comply with standard procedures. And Wyndham admits to having invested $160 million in Revo.

Since there is no official overview of insolvent Revo hotels and there will not be one, hospitalityInside is conducting its own research. We published the first list exactly one week ago, and since then 15 more hotels have been added (now 52 in total). Support us!

German hotel industry in conflict: Interest in hotel real estate in the country is on the rise again, while more and more operators are falling on hard times. Insolvencies are rising. Owners are stuck with leases. Have control mechanisms failed? The consulting firms Hotour and Nemis, as well as Union Investment and Art-Invest, join the discussion.

Three weeks ago, Revo Hospitality Group filed for insolvency under self-administration. The industry still feels like it is in turmoil and there are still many unanswered questions. Yesterday, the first official reassuring email was sent out. Regardless of this, hospitalityInside has begun to compile a list of the hotels affected – with updates.

Accor's Pullman Schweizerhof hotel in Berlin is to be sold. Operator Revo Hospitality is fighting back. The 5-star hotel can no longer be booked on Booking.com or the Accor website. In addition, two top managers have left the company.

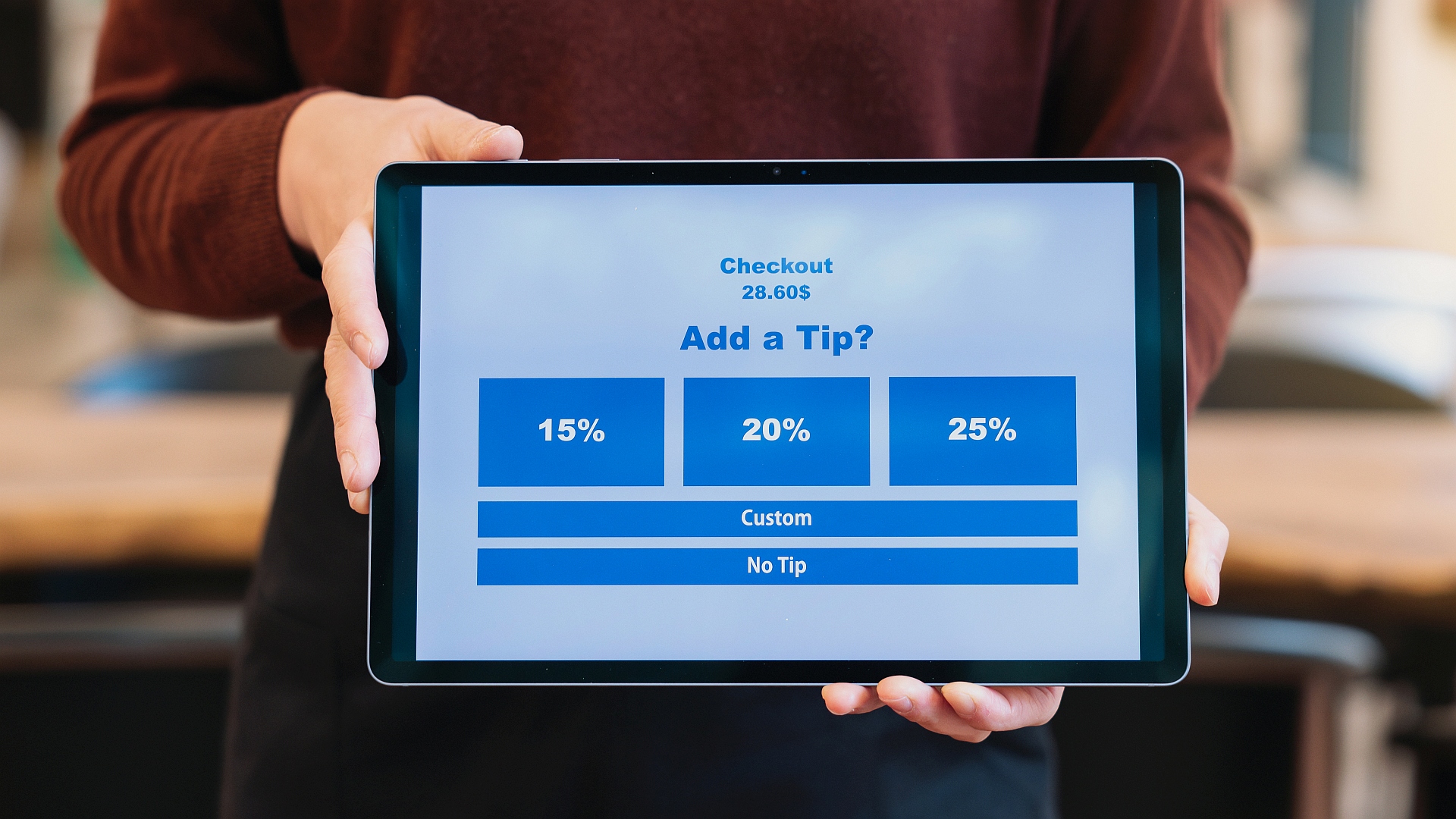

Tipping is becoming less common in traditional sectors such as the taxi industry and skilled trades. At the same time, the digital ‘tip button’ is fundamentally changing the psychological contract between guests and service staff.

The number of insolvent companies in Germany reached its highest level in more than ten years in 2025. Over the course of the year, 23,900 companies had to file for insolvency. The creditworthiness of the hospitality industry has reached the bottom of the scale.

Europe is passing budgets for 2026 in a moment of high pressure. Public debt stays heavy. Hotels, restaurants and airlines are easy to tax: they are visible, mostly local, and a part of the bill is paid by visitors who do not vote. The sector feels it every time budgets are tight, and 2026 is not an exception.

Lifestyle goes IPO! Accor's Board of Directors recently voted unanimously to begin preparations for a possible stock market listing of Ennismore, the group's lifestyle hotel and restaurant brand. Why?

Financing, capital and risk: These three pillars have so far made hotel projects bank-able. Now climate expertise is being added. Climate risks are increasing. As a result, value creation is changing - from short-term returns to lifecycle-oriented strategies. ROI, Return on Investment, is now RoI, Return on Impact.