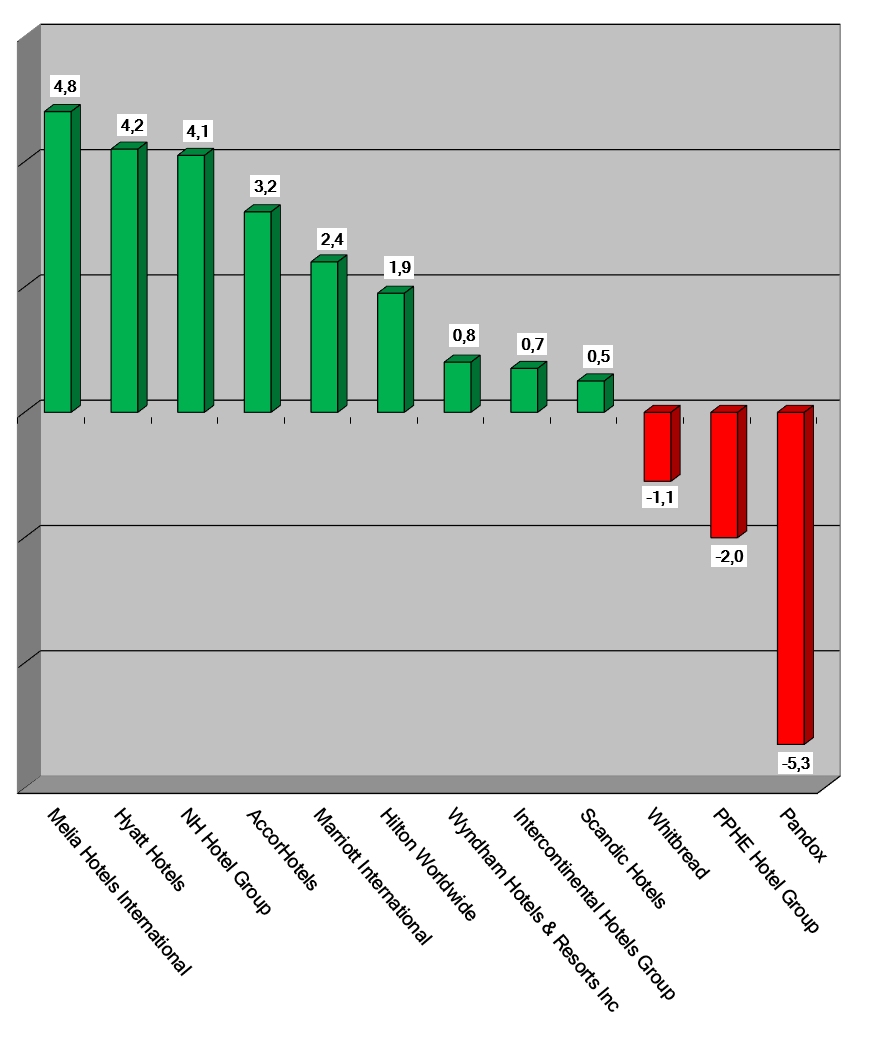

HI+Share price performance of the week 24/11/2022 - 30/11/2022

Change % compared to the previous week

Source: Reuters

powered by HVS EMEA Enews

Munich. The banks, which have to look out for themselves and their severely hit customers at the same time, will have to struggle with two additional topics in future: the strongly increasing number of non-performing loans and insolvencies. The standards for hotel loans have been increased significantly.

Berlin. While numerous German hotels are still struggling to survive, experts already see light on the horizon. In the promotion of large companies, the cap is finally to fall; Dehoga is optimistic. In addition, consumer sentiment is on the rise.

Stockholm. From the end of February 2020, Scandic experienced a dramatic drop in demand, yet the Scandinavian group is sticking to its ambitious plans in the area of sustainability.

London. Banks are "very quiet" currently when it comes to hotel financing, a Hotel Finance webinar in London revealed. Credit funds fill the gap and ground leases gain ground.

Munich. The third wave seems to have been broken, the rate of vaccination is finally picking up, some companies are exceeding expectations, and Germany's banks express confidence. So, all okay then? No. Experts continue to expect bank consolidation and are also suffering from the complete lack of any perspective for openings. Government support measures are pushing foreseeable developments into the future. A look behind the scenes.

Berlin. "The hospitality industry is in the seventh month of the second lockdown. Many of our businesses are at the end of their tether - financially, psychologically, emotionally," said Dehoga President Guido Zöllick, presenting figures on the lack of aid and impending insolvencies.

Munich. Criticism of politics, historic minus figures in the balance sheet and cautious expansion plans characterised Motel One's press conference on Wednesday. Founder and CEO Dieter Müller will hand over to a new board team in May.

Berlin. As recently as October 2020, the co-living provider Quarters wanted to expand big, but on 15 January 2021 it filed for insolvency in the USA and terminated its leases.

Berlin. The Bridging Aid III support has not been the saviour that large affiliated companies were expecting. In Germany, as well as in Austria, new questions repeatedly crop up. It remains complex and the limitations continue to mean inadequate compensation.

Augsburg. Owner Invesco has found a new operator for the former insolvent hotel portfolio of Event Hotels/Tidal Operations. The Star Inn hotels are less fortunate and have to close.