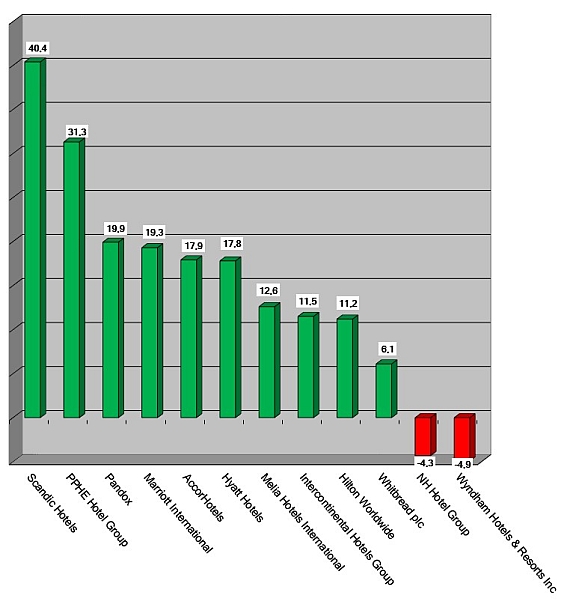

HI+Share price performance of the week 02/04/20 - 09/04/20

Changes compared to the previous week in %.

Davos. The engagement with the "Golden Egg" in Davos has not turned out to be a lucky find for the InterContinental Hotel Group up to now. With the execution of the tenant's bankruptcy, they must now forego cash.

Berlin. The environment is changing slowly but steadily for the hotel industry at ITB. The world's largest tourism trade show, which ended with the consumers' days last Sunday in Berlin, recorded growing numbers again. This was not always noticeable at the "hotel hall" 9. However, noticeable and visible everywhere: just like the tentacles of an octopus, the number of eCommerce and technology exhibitors is increasing and spreading out to more halls now. In general, the exhibitors registered that the majority of trade visitors clocked their appointments mainly between Wednesday noon and Thursday evening. Therefore, on Friday, hall 9 seemed to be less frequented than in the previous years.

Berlin. There are enough flashpoints in the world, yet despite all of these, the hospitality sector together with its investors at this year's International Hotel Investor Forum shows itself to be in extremely positive almost "dangerously" good mood. Money is flowing, lots of money, and more than a billion guests per year travel, and the trend is rising... And with all of these, many of the current gyrations are having precious little impact. In terms of hotel real estate, Europe appears pretty much to be comprised Germany alone. And even where there are problems at the moment, in Russia for instance, the sector expects the difficulties to soon pass. Why are they so super optimistic and where do they have at least a little cause for concern?

Munich. There's more than enough money! Since last year, this sentence has been heard often, also among hotel developers. Above all institutional investors stand under pressure to invest: Their capital experts manage billion euro sums: Alone the German insurance industry needs to securely invest millions of euros every day and in so doing generate a return. In the current environment, this is anything but easy. After all, the low interest phase in Europe and the US will not change in the near future - nor will the short supply of core properties on the real estate market. In order to meet their real return expectations, insurance companies, pension funds and sovereign wealth funds are increasingly on the look out for new business fields and asset classes. Renewable energies, infrastructure, but also niche assets such as project developments, residential property and hotels are becoming increasingly interesting. Often though, this introduces risk into the game.

Munich/London. The real estate investment company of Invesco Real Estate is carefully entering the world of hospitality. In 2006, the company launched its initial fund revolving around hotels, the classic special real estate type. In November 2014, the company was seemingly overcome by boldness investing in the small Generator Hostels group. This gave the industry a jolt. Low-budget investments in the world of conservatives? Invesco, however, plans to open up even further, opportunistically investing in hotel niches and niche providers on a pan-European level, says Marc Socker, Senior Director Fund Management Hotel at IRE.

Frankfurt/M. Closed-ended funds are struggling. Last year, they managed to collect a paltry EUR 81 million from private investors in Germany. At one time, they managed EUR 13 billion per year. Following recent scandals and excessive commissions, the sector is now reinventing itself. The sector is now government-controlled like securities, has refined its profile and has a clear intention to focus fully on core competences - especially in the real estate sector. With such changes abroad, hotels and other niche products such as serviced apartments and student accommodation have again moved into focus. A snapshot of the current mood.

Vienna. The minimum euro exchange rate for Swiss francs was abandoned two weeks ago on 15 January by the Swiss National Bank. The impact is now also being felt in Austria. Of course, the Austrians are hoping to see increased numbers of guests from Switzerland, though at the same time they fear price rises in the hotel and catering industry. Financial experts and hoteliers are, however, currently much more concerned with the question of higher costs of loans taken out in Swiss francs. Errors from the past return with a vengeance here.

Bern. The decoupling of the Swiss franc from the euro on January 15, 2015, made already expensive Switzerland yet another 20 percent more costly overnight. Not only did this measure stir up the share and real-estate markets heavily, it also entails a great many consequences. The biggest problems resulting from the decoupling are an increase in the price of Swiss products, a drop in tourism and, primarily, currency speculation with the franc with respect to funds. The latter is turning out to be a highly problematic issue – particularly where closed funds are concerned. But every coin has two sides. Beatrix Boutonnet puts the effects on the financial sector in perspective.

Berlin. Hotels aren't necessarily on banks' preferred lists of finance partners. This was confirmed in a discussion of experts from mortgage and cooperative banks, savings banks and institutional investors in Berlin last week.

Milan. Rocco Forte Hotels recently announced a strategic partnership with Milan-based Fondo Strategico Italiano Spa. The Italian sovereign fund is investing about 76 million euros in the UK-based hotel group and is taking a 23-percent stake in the hotel group in exchange. The hotel association Confindustria Alberghi is surprised to see Italian money flowing into a UK company but Rocco Forte Hotels stresses its will to expand in Italy – but not only there. The first city names in the US and Asia are popping up in Rocco Forte's business plan.