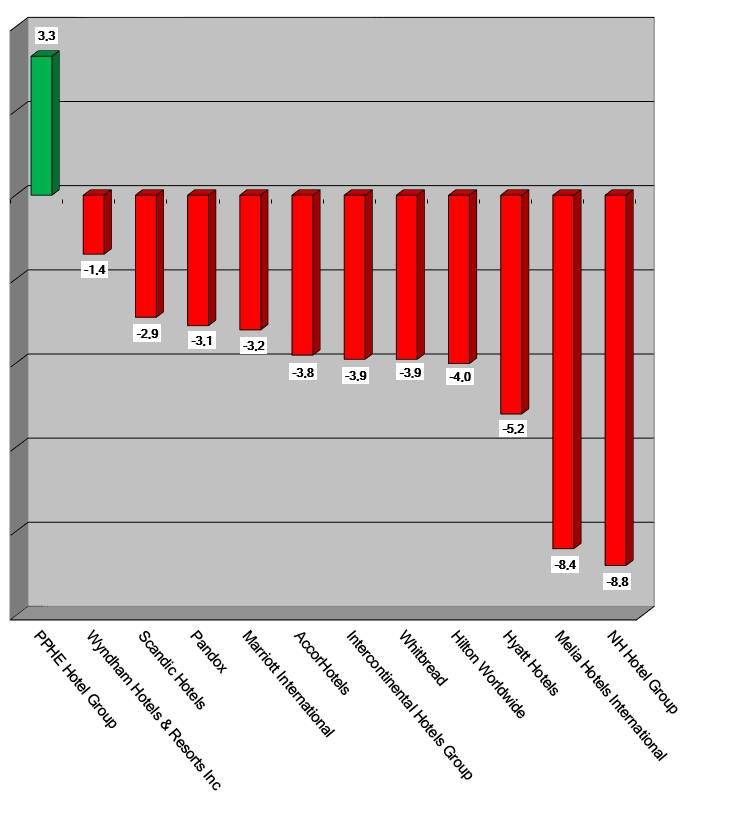

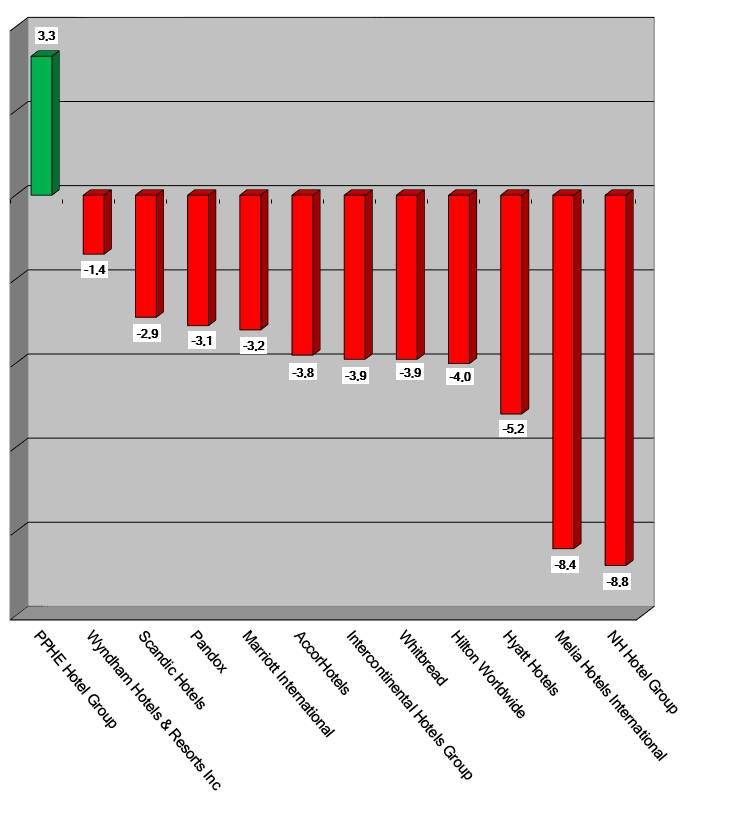

HI+Share price performance of the week 24/06/2021 -30/06/2021

Changes compared to the previous week in %.

Source: Reuters

powered by HVS EMEA Enews

Vienna. Hotel properties are increasingly in the focus of private and especially institutional investors. Currently, SoReal Invest is creating a new hotel fund, which is designed as an open and specialized AIF fund. Five projects are already named.

Berlin/Munich. The Bayerische Versorgungskammer, a big pension fund has established a hotel fund. In the first stage, it will receive EUR 500 million in capital. Partner is the Berlin project developer GBI AG who will in future select the hotels in Germany, Austria and Switzerland as well as their operators for BVK.

Tel Aviv. The Fattal Group and Spring Ventures founded the business Journey Ventures together, an investment fund for technology companies from the hotel and tourism sectors.

Wiesbaden. Commerz Real and Deutsche Hospitality enter into a new partnership: Hotels are to be acquired via a joint fund and operated by Deutsche Hospitality. The focus will be on Europe. The minimum entry volume for hotels is lower than for Commerz Real's previous funds.

Paris. AccorHotels reaffirms its ambitions and targets including the doubling of its EBITDA by 2022 and, at the same time, announces the launch of a Tender Offer for 100 percent of Orbis shares. Orbis already is the largest hotel operator in Central & Eastern Europe and the exclusive master franchisee of certain AccorHotels.

Frankfurt. The USA is driving the global hotel investment market, although the travel and tourism industry is growing worldwide. However, investors are now looking for various investment vehicles. Debt funds are thus gaining in importance. The first of these are also to be found in Europe.

Munich. The discussion on return is taking a new path: It's no longer looking for the classical performance data but for new "KPIs" like revenue per square meter – given that hotel operators and investors alike are open-minded to check out new hybrid brand models, innovative services and new partners coming in from the non-hotel industry, such as co-working providers for instance. There is not much choice since from the outside, guest demand and local residents are urging the hotel groups as well. Facing the next downturn – the only question is when? – hotel investors, lateral entrants, and hotel operators discussed at Expo Real last week how to secure a stable ROI for the near future.

Munich. Boom times are times of inspiration. Strong demand from German and international investors has catapulted the hotel sector to new heights. The main challenge now is in project development. There, the sector's ascent has meant an enormous change. Investment funds also support growth. A discussion round at the "Hospitality Industry Dialogue" last week, the hotel conference at Expo Real, focused on the deals of today.

Milan. Non-performing Loans have been a hot topic in Italy for a long time: bad debts are impacting national bank performance and remain a critical issue in discussions about the European credit system regulation. In tourism, however, NPLs are often viewed as an opportunity: a way that Italian and international investors could explore in order to acquire assets at competitive prices, to renovate or convert them into brand-new hospitality projects. But beyond many generic commitments, no one has tried to quantify the actual scale of these opportunities up to now. What is the value of these assets? And above all, which is their appeal towards investors?

Amsterdam. The Lehman crash ten years ago also changed the hotel industry. Many funds were created, the rate of return increased enormously and then became more modest, and the asset-light model of the hotel operators bore fruit. Parallel to the – still – increasing demand among tourists, new, young and fresh brand concepts appeared. The next crisis should not cause any severe harm to the hotel industry, according to Dirk Bakker, CEO Netherlands & Head of Hotels EMEA at Colliers International, Amsterdam – even if the industry has not learned anything from the crisis. An assessment for the opening of Expo Real Munich, which will start next Monday.