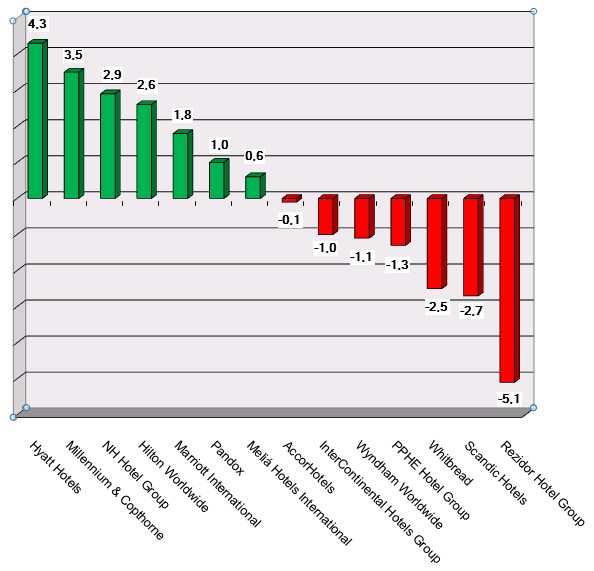

HI+Share price performance of the week 09/03/18 - 15/03/18

Changes in %.

Source: Faktiva / powered by HVS EMEA Enews

Berlin. The Berlin real estate developer, Chamartin Immobilien AG, announced insolvency on the 6th of March, 2012. A holding company for around 15 project companies is hidden behind it that will, however, not be concerned by the insolvency.

Berlin. China, Russia, South America: Emerging markets continue to bring a sparkle to developer eyes. Yet also in other regions, investments can make sense, provided the preparatory work was thorough enough. Non-Europeans didn't paint a rosy picture of Europe, and attempts were made to correct prejudices with regard to Russia. Market analyses presented by various experts at the 15th International Hotel Investment Forum last week in Berlin this time took better account of individual country idiosyncrasies, yet the contents still only scratch the surface. And on the CEO panel, the gentleman again basked in their strategies and pipelines. There was no more to be seen or heard of the IHIF motto "Vision for the Future".

Berlin. Adlon GmbH, the company which operates the restaurant and spa in the south wing of the Adlon, is finally back in the black. A comprehensive restructuring concept by a renowned hotel consultancy is now to herald the turnaround. Yet this alone is hardly sufficient to solve the problems faced by Fundus Fund No. 31, as hefty loan repayments are due in 2016.

Munich. Closed and open funds have financed hotels quite often in the past. But this has changed since both asset classes have had difficulties. Reason enough for hospitalityInside.com to take a closer look at both types of funds. In the first part, fund specialist Beatrix Boutonnet examines closed real estate funds. An examination of open real estate funds will follow in the sequel.

Heiligendamm. Now it's official. The fund which owns the Grand Hotel Heiligendamm filed for insolvency before the Administrative Court in Aachen at the beginning of this week. The hotel will continue to operate, as 300 staff will have their salaries guaranteed for three months under Germany's insolvency scheme. The decisive question for employees and investors will be: what comes after that?

Munich. Low-interest loans denominated in foreign currencies were once the fund industry's favoured instrument for tweaking profitability. Main Dorint financer, the fund initiator Ebertz & Partner, made especially frequent use of this cosmetic trick for its funds. Yet the continued strength of the Swiss franc has now botched many an investor's forecasts. Dividend pay-outs are now being cancelled as more money is required for interest and amortisation payments on higher loan sums. This has resulted in an urgent need for new liquidity. Accordingly, the Ebertz Fund Portfolio no. 64 has now sold a hotel: the Dorint Hotel Charlottenhof in Halle/Saale. In practical terms, the hotel has all but been retained - just in a new fund.

Brussels/London. At the Rezidor Hotel group's "Capital Market Day" in London on December 2nd, the company announced their "Route 2015 Strategy" - a number of initiatives to improve the group's EBITDA margin.

Augsburg. The strong Swiss franc raises a dramatic question at the end of the year: will Switzerland witness the death of several hotels next year? Not only hotels in Switzerland are affected by the test of endurance related to the Swiss franc and the euro, but also foreign companies headquartered in Switzerland and forced to make out their balance sheet there as well. In addition, all hotel companies are affected that are located outside Switzerland but have financed their loans in Swiss francs. On both sides of the border, the mood is rather depressing at the moment. In Switzerland, tourist numbers are collapsing, more and more Swiss are spending their holidays in Austria or Switzerland. A snapshot of Austria, Switzerland and Germany.

Zurich. One year ago, Credit Suisse launched its "Credit Suisse Real Estate Fund Hospitality" and with it made an "attractive addition" to its asset class real estate, Lucas Meier explains, Fund Manager of CS REF Hospitality in Zurich. The recent financial and economic crisis had delayed the launch, which was originally planned for 2007/2008. Though CS is more than satisfied now: The hospitality quota in the 900 million CHF fund is already as good as exhausted. Yet the aim is to grow further - also with the other hospitality residential options found in this very diverse fund. Lucas Meier on the "CS REF Hospitality" and its portfolio.

Patergassen. A number of providers in Austria have jumped on the "chalet village" waggon. Almdorf Seinerzeit in Carinthia occupied this niche even before the "sustainable wave" began to breathe new life into this type of accommodation. And for this reason, the earthy concept originally developed by Seinerzeit founder, Karl Steiner, still remains unmatched. The wooden chalet village has recorded some the highest average rates in German-speaking Europe. Now, the 28 chalet complex of lodges, hunting lodges and chalets will be transformed into a complex twice its original size and is to be marketed using real estate principles which maintain its extraordinarily original and natural character. The brains behind the design is Rupert Simoner who has worked with Karl Steiner as a partner for one year only. He intends to turn Almdorf Seinerzeit into an exclusive mini-brand.