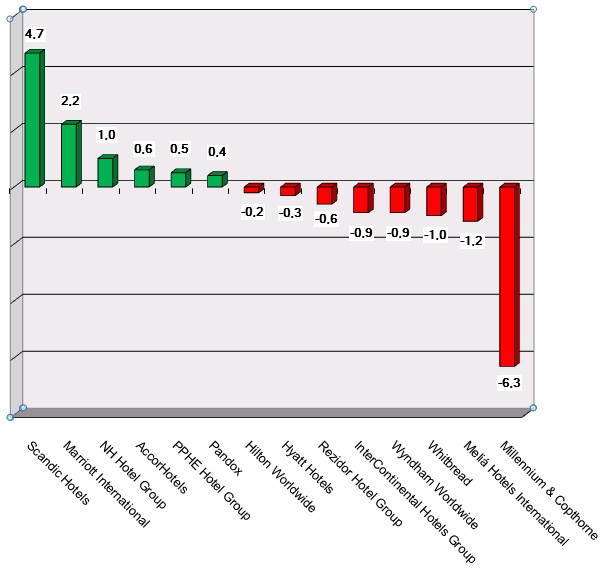

HI+Share price performance of the week 26/01/18 - 01/02/18

Changes in %.

Source: Faktiva / powered by HVS EMEA Enews

Brussels/London. At the Rezidor Hotel group's "Capital Market Day" in London on December 2nd, the company announced their "Route 2015 Strategy" - a number of initiatives to improve the group's EBITDA margin.

Augsburg. The strong Swiss franc raises a dramatic question at the end of the year: will Switzerland witness the death of several hotels next year? Not only hotels in Switzerland are affected by the test of endurance related to the Swiss franc and the euro, but also foreign companies headquartered in Switzerland and forced to make out their balance sheet there as well. In addition, all hotel companies are affected that are located outside Switzerland but have financed their loans in Swiss francs. On both sides of the border, the mood is rather depressing at the moment. In Switzerland, tourist numbers are collapsing, more and more Swiss are spending their holidays in Austria or Switzerland. A snapshot of Austria, Switzerland and Germany.

Zurich. One year ago, Credit Suisse launched its "Credit Suisse Real Estate Fund Hospitality" and with it made an "attractive addition" to its asset class real estate, Lucas Meier explains, Fund Manager of CS REF Hospitality in Zurich. The recent financial and economic crisis had delayed the launch, which was originally planned for 2007/2008. Though CS is more than satisfied now: The hospitality quota in the 900 million CHF fund is already as good as exhausted. Yet the aim is to grow further - also with the other hospitality residential options found in this very diverse fund. Lucas Meier on the "CS REF Hospitality" and its portfolio.

Patergassen. A number of providers in Austria have jumped on the "chalet village" waggon. Almdorf Seinerzeit in Carinthia occupied this niche even before the "sustainable wave" began to breathe new life into this type of accommodation. And for this reason, the earthy concept originally developed by Seinerzeit founder, Karl Steiner, still remains unmatched. The wooden chalet village has recorded some the highest average rates in German-speaking Europe. Now, the 28 chalet complex of lodges, hunting lodges and chalets will be transformed into a complex twice its original size and is to be marketed using real estate principles which maintain its extraordinarily original and natural character. The brains behind the design is Rupert Simoner who has worked with Karl Steiner as a partner for one year only. He intends to turn Almdorf Seinerzeit into an exclusive mini-brand.

Munich. Selling hotels is getting increasingly difficult. Despite shortfalls in funding among banks, some major deals have been concluded already this year, which was only possible thanks to the coffers of private investors, i.e. pension funds and insurance companies that are filled to the brim. However, the situation has worsened in the meantime. Selling hotels to new investors has become significantly more difficult and volatile. The entire range of moods and arguments was reflected in the "Financing, Refinancing, Sell - Hotel Real Estate on the move” panel discussion at the Expo Real hotel conference last week. Hosted by Christoph Haerle of Jones Lang LaSalle Hotels, the panel featured Marty Kandrac, Managing Director of Blackstone, Thomas Wagner of the Erste Abwicklungsanstalt "bad bank”, and Sym Keun Lee of Ascott International.

Munich. Messe München described the 14th commercial real estate fair, Expo Real, as a "stability anchor for the industry" last week. Exhibitors and visitors, on the other hand, are confronted by less stable ratios, even if the general mood was positive. "The reading from the 2011 business thermometer is good," concluded Reinhard Kutsche, Board Chairman of Union Investment Real Estate, before adding: "Nevertheless, a cooldown is increasingly expected going forward". This is also true of the hotel industry, as was clear from many discussions. The positive mood prevails, but there is also much concern. This was clear both at the Hospitality Industry Dialogue as well as from hotel exhibitors.

Munich. Operators and investors can only achieve success if they each come to a mutual understanding. This is not the same as becoming friends. However, professionalism in one's own job, regular communication and bearing a common responsibility are a must. And so, the results of a discussion round in the "Hospitality Industry Dialogue" at the Expo Real 2011 on the subject "Investors and Operators - Friends or Enemies?"

Augsburg. In the German hotel sector, the majority of revenue is generated by hotel chains, while the structure of Germany's hotel landscape remains dominated by medium-sized businesses. As times get harder and margins keep declining, the question is: Will the banks let small and medium-sized companies survive – and if yes, for how long? Hotel consultancies have identified two extreme core trends in this respect – and a great number of challenges. However, most of them do not see any sign of an insolvency wave on the horizon.

Berlin. To date, investors in the Fundus Fund 31 have had little reason to toast their investment. Yet the move to reorganise senior management failed. Last Friday, August 26, Anno August Jagdfeld received approval to remain Managing Director of the Adlon fund.

Berlin. The hotel project developer, HOPAG Hotel Property AG, Berlin, is planning the first German Hotel REIT. They have sharply increased their share capital and by doing so, have prepared for their initial public offering. This was announced by the company.