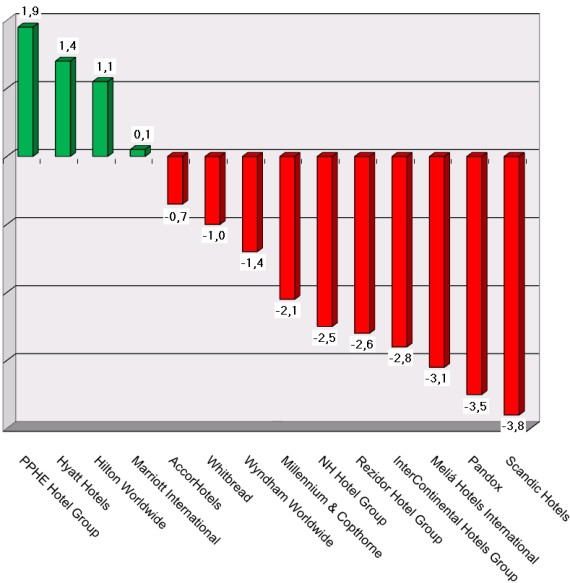

HI+Share price performance of the week 18/08/17 - 24/08/17

Changes %

Source: Faktiva / powered by HVS EMEA Enews

Berlin. Those investing in the Fundus Fund 34 – Grand Hotel Heiligendamm had to choose between the devil and the deep blue sea last week. They approved the hard capital reduction. Now, additional capital is required in order to implement measures to lengthen the season and pay back loans. If the funds aren't forthcoming, it could quickly again start to look tight for Heiligendamm.

Frankfurt. Invesco Real Estate, one of the largest real estate management companies dealing with direct real estate investments and shares from the US brings a wind of change to the hotel sector. The second special hotel fund has just been closed.

Frankfurt. Closed funds move large volumes of capital and it is impossible to imagine the world of financing without them – this applies to the hotel sector, too. However, the crisis hit them hard as well. Figures have almost halved since the fall of Lehmann. But an upward trend is expected. At the 2nd “VGF Summit” in Frankfurt two weeks ago, the sector celebrated itself a bit, but it was nonetheless well aware of what the reality looked like. There is still a lot to be done. This was the tenor – not absolutely outright, but between the lines.

Heiligendamm. The Grand Hotel Heiligendamm on Germany's Baltic Sea coast – a controversial fund property, a legendary conference hotel and host to the G8 summit in 2007 as well as a former Kempinski Hotel – seems to have more problems than the public have known about up to now. Recent figures are allegedly more satisfying, though the past seems to have left much deeper wounds than previously imagined. Now, only a brutal capital reduction can save the hotel. A financial restructuring plan foresees shareholders having nine-tenths of the value of their holdings shaved off. Also, fresh investment is to be ploughed into the hotel. Whether this will happen, remains an open question: The Annual General Meeting will vote on the future of Heiligendamm on March 11. The number of options available will be small though.

Vienna. Kneissl is ill-fated. In its 92-year company history, the Kneissl business from Tyrol had to file for bankruptcy for the third time. Following the business' founder and local redevelopers, Mohamed Ben Issa Al Jaber overextended himself with the Tyrol ski manufacturer.

Munich. The global upswing is gaining in breadth. The time-delayed emerging recovery in many property markets is also fueling liquidity in the investment markets. As a result, commercial real estate as well as hotels are slowly recapturing their place as a popular form of investment for foreign and institutional investors. However, without transparency, this will go no further. The investors themselves are not only picking through the high-yield locations, but are also progressively giving more time for the scrutiny of the business transactions. A current appraisal of the real estate movement in Europe.

Munich. The American hotel market has collapsed under the weight of the recent crisis, whilst the European market has emerged from the low point surprisingly well. Nevertheless, the Anglo-Americanisation trend with respect to finance, contracts and accounting continues to put its stamp on continental Europeans. Dr Joerg Frehse, Founder and Managing Partner of Frehse Hotel Corporate Finance GmbH & Co KG in Munich, has thought about developments on both sides of the Atlantic as well as our mutual dependences. His conclusion is the task for 2011 and subsequent years: Continental European market participants should move further together in future and concentrate on their strengths!

Zurich. Thanks to a new hospitality fund institutional investors can now invest all over Switzerland.

Munich. Transaction volumes are rising, markets are recovering. But despite all the euphoria, there is still need for caution on many markets. The very fact that investors are aware of that is evidenced most strongly by their changed investment decisions. They still prefer smaller core property in very good locations. And that is not going to change soon. Existing property has currently surpassed new buidlings in terms of popularity. When it comes to the market development, Germany ranks among the top in Europe; top markets remain fundamentally strong whereas Eastern Europe, Dubai and Abu Dhabi still give cause for concern.

Vienna/London. The shareholders meeting of Kneissl Holding on November 23rd went off very successfully for Kneissl's Managing Director Andreas Gebauer. Mohamed Ben Issa Al Jaber apparently wants to invest an additional 1.2 million euros in the business - apparently in order to protect his daughter.