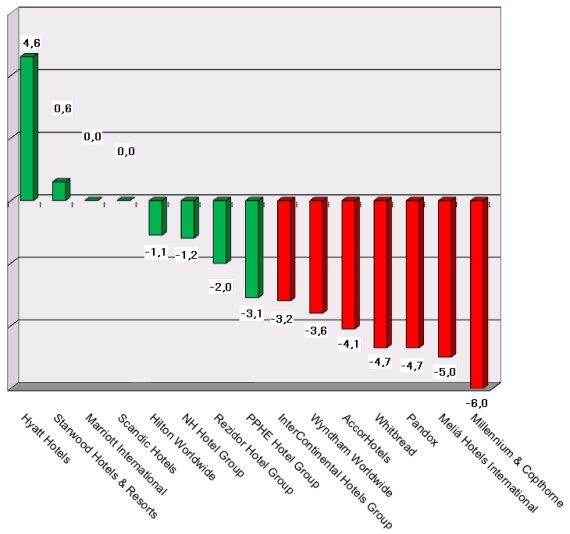

HI+Share price performance of the week 29/04/16 - 05/05/16

Changes %

Berlin The current financial crisis has resulted in a lasting loss of confidence among German investors in financial world in general. Only seven percent of German citizens trust the credit market, whereas 70 percent express open mistrust. Following the collapse of English and American investment houses, it was first the hedge funds that suffered. Now, finance investors have been drawn into the storm as the crisis reaches open real estate funds.

Bern. By the year 2010, the Schweizerhof in Bern is to shine in new glory thanks to investment by its new owner, Barwa, Qatar. Experts doubt, however, that the planned sum will be enough.

Augsburg. The consequences of the financial crisis are slowly, very slowly, becoming apparent. Results of stock market listed hotel groups for the third quarter have almost all plummeted and better prospects for 2009 aren't expected. Companies and consumers are tightening their belts and the banks all seem to be following their own erratic strategies. That next year will be a tough one for the hotel industry seems to have escaped nobody. "The end to the hardship won't come until 2010," one management consultant predicted, "when the hotels currently in construction open their doors and are no longer able to access their capital." Consultants and project developers on the current situation.

Munich. The financial crisis is getting private equity companies into trouble. Their concept of selling off companies bought and restructured within a relatively short period of time and make a profit no longer works. At the same time, the restrictive financial policy these days makes new takeovers more difficult. In a panel discussion at the "Hospitality Industry Dialogue" in the course of the Expo Real Munich real estate trade fair, the industry definitely refused to give in.

Frankfurt/M. The Danish investor and asset management company Euro Ejendomme plc and DTZ Corporate Finance Frankfurt commence their cooperation with a hotel fund. Euro Ejendomme plc has initiated the "Euro Ejendomme SICAV-FIS Hotel Fund I" for German and European institutional investors.

Berlin. The financial crisis has a direct influence on the hotel industry in German financial centres as well as on certain projects. The Haus Cumberland at Kurfuerstendamm in Berlin will not become a hotel anymore. A Frankfurt-based bank reduced its hotel volume. On the other hand, new hotel complexes are still growing. Experts consider medium-sized businesses to be the ones to suffer. In the US, ill tidings have become more concrete and turned into figures: for the first time since 1988, the hotel industry faces declining demand.

New York. The collapse of the investment bank Lehman Brothers makes the world hold its breath. The extent of the disaster has not yet been perceived, but every hour, further news about the consequences arrives through telexes. It is likely that the hotel industry will also be affected by the implications of this "black Monday".