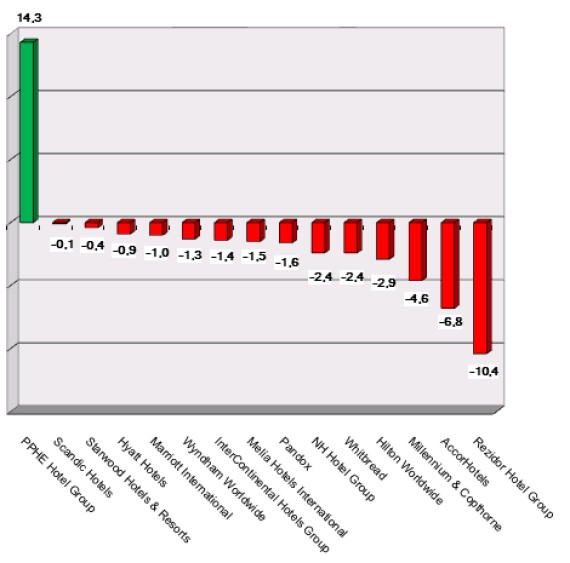

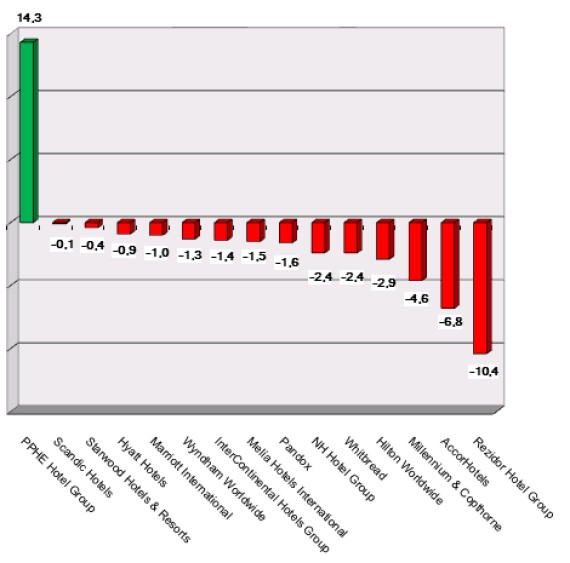

HI+Share price performance of the week 04/03/16 - 10/03/16

Changes %

Berlin. The financial crisis has a direct influence on the hotel industry in German financial centres as well as on certain projects. The Haus Cumberland at Kurfuerstendamm in Berlin will not become a hotel anymore. A Frankfurt-based bank reduced its hotel volume. On the other hand, new hotel complexes are still growing. Experts consider medium-sized businesses to be the ones to suffer. In the US, ill tidings have become more concrete and turned into figures: for the first time since 1988, the hotel industry faces declining demand.

New York. The collapse of the investment bank Lehman Brothers makes the world hold its breath. The extent of the disaster has not yet been perceived, but every hour, further news about the consequences arrives through telexes. It is likely that the hotel industry will also be affected by the implications of this "black Monday".

Interlaken. The Victoria-Jungfrau Collection, which alongside the Grand Hotel Victoria-Jungfrau & Spa in Interlaken also includes the Bellevue Palace in Berlin, the Palace in Luzern and the Eden au Lac in Zurich, registers new shareholders.

Pegnitz. In current litigation for the return of Pflaum's Posthotel in Pegnitz, hotelier Andreas Pflaum has been able to celebrate a first victory. On 14th July, the Higher Regional Court of Bamberg held that Pflaum had exercised the purchase right due to him for the hotel business of Pflaum's Posthotel Pegnitz and for relevant grounds in 2007. As hospitalityInside.com reported last November, the hotelier is fighting the case against his Russian private equity partner Staros.

Dusseldorf. Lindner Hotels made their debut in 1996 with Germany's first 'New Media Hotel' and the slogan 'internet in bed'. Today, Chairman Otto Lindner wants to make more 'sexy hotels' - and if he has his way, he'll establish only these. He sees the German market as saturated. Now, he's ready to make the move abroad. Since 2000, the number of Lindner hotels has tripled and eleven hotels have grown to 34, six of which are due to open before the end of 2009. But how does the medium sized Dusseldorf based hotel company finance such expansion? This is a question certain to have occurred not only to the Austrians. Across the border in neighbouring Austria, Lindner has opened two hotels since last autumn and a further three are in the pipeline. "We offer a full range," Otto Lindner answers meaning: Each decision is based on synergies drawn from within the Lindner Company Group. The company family network makes it possible to develop tailor-made solutions and flexible finance models. What hardly anyone knows: Lindner has initiated its own funds - a conversation with Otto Lindner on contracts, finance, views and predictions.

Dubai. In 2005, the German Maritim Hotels appeared proud to be represented in the booming metropolis of Dubai from 2007 on. Maritim Hotels wanted to operate a 1,050-room hotel, financed by funds of the company group Recker from Hamm. Now, in July 2008, the fund "Dubai 1000 Hotelfonds" with a set volume of 142 million euros is about to fold, according to the industry service's "fondstelegramm".

Frankfurt/Berlin. "After years of steadily increasing transaction volume on both in European as well as on German markets, we seem to have hit upon a limit," Markus Beike concludes, Director Germany for the Frankfurt and Berlin based hotel property agent and management consultancy company Christie + Co.. According to his figures, in the year 2006, around 22 billion Euros were invested in European hotels. In the year 2007 this figure fell 19 billion, though stayed constant at 2.3 billion for Germany. One year after the extent of the US credit crisis has became known, the property specialist gives his impressions of the future to hospitalityInside.com.

Cologne. The Ebertz & Partner group, Cologne, plans to capture new markets in cooperation with a British experts for commercial real estate investment. The new partner has acquired an interest by means of a profit-participating loan in Ebertz & Partner group. One E&P subsidiary is Germany's Neue Dorint GmbH.