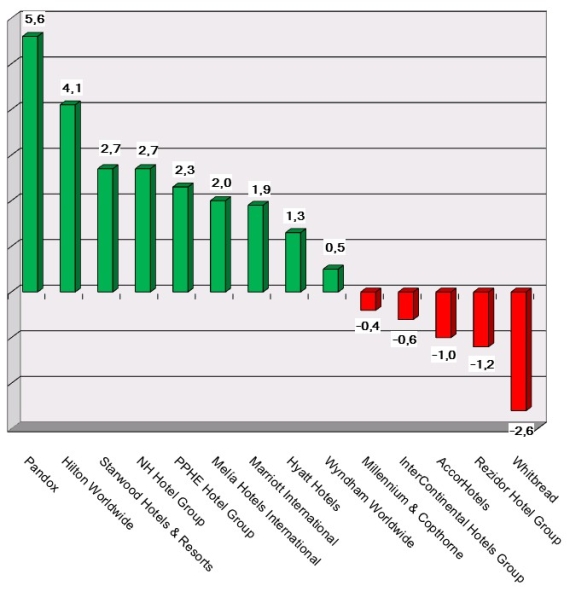

HI+Share price performance of the week 04/09/15 - 10/09/15

Changes %

Munich. The year 2007 was, simply said, a good year for hotel developments and transactions. Though it should have been the best year of all for estate agents, transaction advisors and specialists. This, it certainly wasn't. Stephan Gerhard, Managing Director of the Treugast Solutions Group based in Munich, looks back on 2007 with slightly mixed feelings.

Cologne. Important changes are taking form in the company management of funds initiator Ebertz & Partner, Cologne: Partners Dr Herbert Ebertz and Dr Karl Bartel will withdraw from active management of the Group by 31 December 2007. Following their departure, third company partner, Dirk Iserlohe, will go on to restructure the company.

Frankfurt/M. For four months now the subprime crisis and its consequences have been keeping the international financial market in suspense. Many banks are still unwilling to pass on liquidity, and it is still unclear what risks lure inside the books of the individual market participants. In Germany, the turbulences had an impact on Basel I, the currently valid bank risk management system. For most German and European banks will not be introducing the new Basel II equity capital regulation before 2008. The banks are optimistic that they will again be able to grant loans as of January. Martina Fidlschuster, Managing Director of the Hotour consultancy in Frankfurt and member of hospitalityInside.com's circle of experts, explains the situation.

Duesseldorf. Heavily rising costs can lead to hotel real estate calculated a year ago no longer being realisable.

Berlin. Two days prior to anniversary celebrations at the Kempinski Hotel Adlon in Berlin, shareholders attending the Fundus shareholders meeting decided to place shares to the amount of 30 million Euros for the sister hotel in Heiligendamm at the Baltic Sea. Over 90% of the 1,900 shareholders were in favour of the motion that the new shareholders will get their dividens preferentially to elder shareholdes. Following the G8 summit and the budget-bed campaign, occupancy rates at the luxury hotel will in 2007 for the first time cross the 50% threshold.

London. The Austrian Jakob Forstnig refuses to accept the term "locust": His employer, the British Mountain Capital Ltd., was a serious private-equity partner with a considerable interest in the German-speaking and European markets. Actually, there is a connection to Germany: Mountain Capital is backed by two Jewish families of German origin. They have bought and repositioned hotels in Germany and fetched the German luxury hotelier Thomas Althoff as operator to London in the meantime. Jakob Forstnig, who worked for private hotels and for Marriott in the operational hotel business, and was a consultant at Treugast in Munich and HVS International in London, represents Mountain Capital in continental Europe.

Berlin. DekaBank, the biggest provider of open real estate funds in Germany, wants to continue to conquer new markets and increase investment, above all in hotel property outside Europe. The plan was announced at the Expo Real in Munich.

Munich. When will the first hotel REIT appear and how will it be structured? While the panel of experts at the Expo Real weren't giving much away on the matter, renowned companies have been discreetly working on a hotel REIT for quite a while.