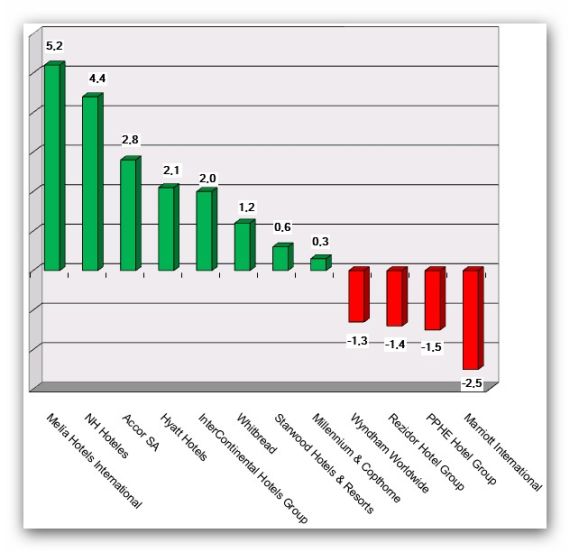

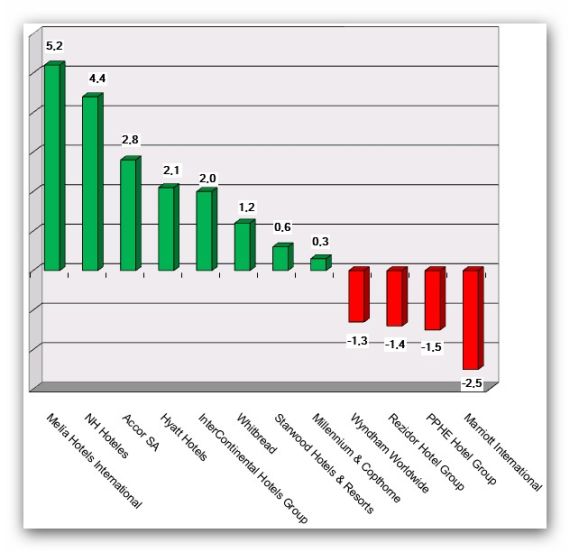

HI+Share price performance of the week 19/06/15 - 25/06/15

Changes %

Munich Hotel real estate as investment opportunity is presently experiencing an all time high. But what buyers are currently active on the European market and where are they looking to invest? What types of contract will be used in future? Has the recent credit crisis already had ramifications on property prices? Questions such as these were addressed by numerous panels of experts at the 10th Expo Real in Munich.

Munich. Interest rates of the Bavarian Mittelstandskreditprogramm have been reduced by 0.25 percent for investments of existing companies. Even the clearly lower interest rates for business start-ups will be reduced by another 0.1 percent. This also includes the hotel industry.

Berlin. Thanks to the marked improvements in the world economy and favourable conditions on the capital markets, for the last few years German banks have been able to continue on their commercial expansion course and record positive yield trends; almost forgotten is the crisis from 2001/2002. The German financial economy, clustered around the Rhine-Main region and the city of Frankfurt, is strategically one of the world's most important business centres. A MasterCard survey on stock exchange locations placed Frankfurt in 7th position, before Paris, as direct competition on the European continent. All the same, the German banking industry has recently yet again come under the spotlight. Insiders talk of Germany as being "over-banked" and rigid - and the same words were used well before the recent turbulence surrounding the IKB and Sachsen LB. Yet both incidents are good illustrations of the current problem. A background report.

Chicago. For the first time in their history, Hyatt allows foreign investors to step in: Tom Pritzker, Chairman of Global Hyatt Corporation,

announced yesterday that Madrone Capital Partners, a private investment firm affiliated with Wal-Mart Chairman Rob Walton and his family, and entities affiliated with Goldman Sachs Capital Partners have agreed to invest a total of 1 billion USD to acquire equity securities in Global Hyatt Corporation.

Frankfurt/M. The recent furore on the international finance markets was impossible to miss: The real estate crisis in the USA has pulled some European and German banks down with it, much to the surprise of some experts. The consequence: Central banks responded with cash injections of a total of 270 billion Euros to secure the normal functioning of the money markets. According to the European Central Bank, with this, the storms of recent days have blown over. All the same, the questions remain: What happened? What were the causes? And what ramifications will it have for the currently heavily real estate focused developments in the hotel industry? Hotel expert Martina Fidlschuster, Managing Director of Hotour Consulting in Frankfurt, sheds light on a difficult subject, exclusively for hospitalityInside.com.

Augsburg. Hotel real estate moves between the hands of different owners more quickly than ever before. According to Jones Lang LaSalle, the sale of a hotel attracts an average of four potential buyers per property. This year, hotel real estate to the tune of 80 billion Euro will change hands - a sum which will again break the record set the previous year. Does such reselling increase the value of a hotel property? What happens with existing operator contracts? Consultants and asset managers have a whole spectrum of answers up their sleeve.

London/Munich. A fund of the finance service provider Morgan Stanley, London, has bought a 35% stake in Motel One Management Ltd, Munich. "Location development will hopefully accelerate," Dieter Mueller says, joint founder and Board Chairman of Motel One plc, in reference to the strong network the new British partner brings with it. The low budget design hotel chain Motel One has gained enormously in strategic influence through the deal and has ensured its position as a force to be reckoned with in the European budget market. The agreement represents Motel One's second strategic deal in four months. For Morgan Stanley Real Estate though, the deal is the first European investment in this segment.

London. The announcement was made last April, now the deal is closed: Morgan Stanley Real Estate completed the acquisition of eight European Hilton hotels by one of its funds. Two more hotels are to follow.

London. Some weeks ago Park Plaza Hotels announced its intention to float on London's Alternative Investment Market. Insider say the point of time is right. Last night, Boris Ivesha, President and CEO confirmed: "Park Plaza Hotels has gone public!"