News & Stories

Berlin. The Grand Hotel Heiligendamm Ltd still hasn't recovered from financial difficulty. The refinancing of the Fundus fund 34 is taking its time. But Anno August Jagdfeld, the funds initiator confirmed that negotiations were underway for new financing. A sensitivity analysis explains the steps and figures for the next years.

Rigi Kaltbad. The hotel and wellness project in Rigi Kaltbad in the Swiss canton of Lucerne has come to a halt. As the project costs a few millions more than the budgeted 45 million francs, the planning committee put the project on ice for the time being. Financing was no longer guaranteed. This means a loss of face for the Swiss star architect Mario Botta, to whom wellness competence has been ascribed since the opening of the Tschuggen Grand Hotel in Arosa.

Berlin. Gesellschaft fuer Beteiligungen and Immobilien-Projektentwicklungen mbh in Berlin sold two profitable hotel investments to Lloyd Fonds AG in Hamburg.

Vienna. Not one, but two commissions of inquiry are presently busy at work in Austria with Austria's largest state bank, the Carinthian Hypo Group Alpe Adria. The subsidiary Carinthia Holding Investment plc, created for regional development projects, acquired the famous Velden Palace from Gunther Sachs four years ago at a price tag of 22 million Euros. Now, Austria's houses of parliament have turned their attention to the bank.

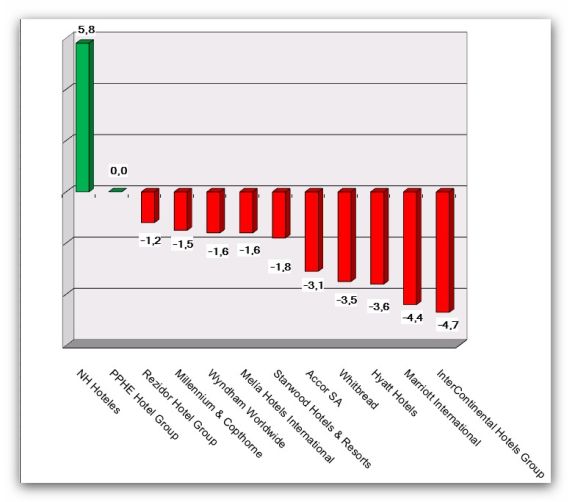

Berlin. The hospitality real estate industry is conquering the capital market. This results in high demands with regard to added value to investments from a hotel's and a real estate's point of view. At the "Hotel Dialogue Asset Hotel Real Estate - A complex management composition" staged by Bernd Heuer Dialog GmbH in Berlin, the requirements of this development were highlighted.

Berlin. In Great Britain, a country which in least in terms of financial innovation is more than a short head in front of Germany, busy work on a hotel-REIT is underway. This particular REIT consists entirely of hotel real estate. The Royal Bank of Scotland together with the real estate giant Richard Balfour-Lynne now intends to bring the biggest part of its hotel property under the name Vector to the stock exchange and do more than just quickly convert the properties into cash.

Barcelona. Meridia Capital Partners, a private equity group based in Barcelona, Spain, closed its first fund, "Meridia Capital Hospitality I".The fund will invest in the luxury hotel sector, buying or developing hotel real estate, preferably in Europe, the Caribbean and Latin America, Morocco, Turkey and India.

Madrid. Morgan Stanley's investment funds bought 6,5 percent of the share capital from NH Hoteles. The deal was supported by Ponte Gadea.

Madrid. Everything is just one big misunderstanding. This is at least the view being taken in the headquarters of Santana Cazorla on Gran Canaria. There, everyone is convinced that the corruption accusations made against their boss are "completely unfounded". All of the group's activities are, it was stated, "completely above board and legal". Yet Club-Aldiana owner and property developer Santiago Santana Cazorla now enjoys his freedom on borrowed time, after he was arrested and interrogated on corruption charges on 5 February of this year. In the Spain of today, this is no single occurrence.

Rosenheim. The real estate industry can be more than satisfied with 11.6 billion Euro investment capital after the omission of tax benefits. Not even the optimists expected this result. Real estate funds even achieved an increase of about one billion Euro reaching 4.96 billion Euro. This positive trend was also apparent with regard to hotel investments, but on a lower level. Only about 5.1 percent of the investment total was attributed to hotels. A few days ago, the renowned fund specialist Stefan Loipfinger from Rosenheim presented his fund analysis.