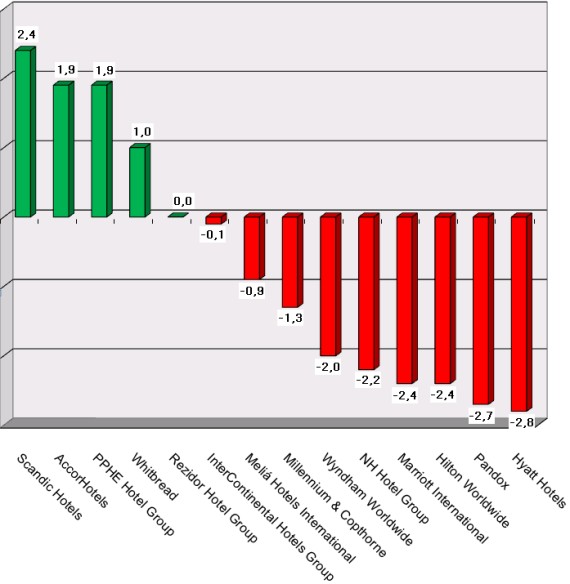

HI+Share price performance of the week 03/03/17 - 09/03/17

Changes %

Source: Faktiva / powered by HVS EMEA Enews

Cologne. In spite of many difficulties, Anno August Jagdfeld is still holding the Fundus empire together. Nevertheless, annoyance at his business practices is growing among investors. Now, a recent decision from the Regional Court in Aachen could cause problems.

Munich. Times aren't good for real estate funds, neither of the open or closed-ended varieties. As if lost investor confidence weren't enough, pressure has now been added by the politicians. Berlin and Brussels have now announced measures which would affect both asset classes. The success-spoiled industry isn't quite so used to this sort of negative attention. And the financial crisis has certainly forced funds managers to change approach - sometimes quite radically. A background report.

Vienna. Hoteliers have been busy rating their banks since January of this year - similar to the principle used on internet hotel ratings platforms. Now, initial results are available. Vorarlberg's banks were rated best. Renowned banks such as Uni Credit Austria were rated below average.

Paris. The principal shareholder of B&B Hotels is currently reviewing its investment in the expansion-friendly budget group right now. The B&B Hotels Group is in a due diligence right now as it has been confirmed to hospitalityInside.com.

Berlin. Prior to the shareholders meeting for the Fundus Fonds 31 on 17 March there was talk of a shareholder revolt. Initiator Anno August Jagdfeld managed to prevent such an act. Jagdfeld owes the fund rent with his Adlon Holding.

Berlin. Similar to the ITB, the positive mood among investors has returned, though little of this is concrete. Since hotel financing has a lot to do with psychology, many attending the 13th International Hotel Investment Conference in the InterContinental Berlin last week were happy about the slight improvements seen on the disaster year 2009. The gaps between the countries, respectively destinations, are still wide though and investors are still an endangered species. Banks still form the bottleneck. The persisting growth euphoria among the CEOs of global hotel groups shouldn't deceive though, after all those speaking on the IHIF CEO panel all have sufficient sponsor budgets left to be invited to speak.

Berlin. The annual general meeting on March 17 might receive a lot of attention and provoke strong emotion. On that day, Anno August Jagdfeld, initiator of the Fundus fund, will demand from his investors that they renounce lease agreements worth several million euros.

London. Sir Rocco Forte in finanziellen Turbulenzen? Gerüchte haben es bereits vorausgesagt; diese Woche bestätigte er, dass er eine neuen Finanzvereinbarung getroffen hat, um den künftigen Betrieb seiner 13 Hotels umfassenden Gruppe abzusichern.

Zell am See. As of immediately, the first Austrian online evaluation platform for banks will go online. Behind the action is the Austrian Hotel Association. The idea comes from its member Dr Wilfried Holleis. The tax consultant and hotelier wanted to turn the tables following the rating of his businesses under Basel II.

Munich. The real estate hype between 2005 and 2007 got hold of the hospitality industry for the first time in dimensions unknown so far. Accordingly, the hospitality sector is still suffering the effects of the financial and economic crisis. Dr. Joerg Frehse*, founder and Managing Partner of Frehse Hotel Corporate Finance GmbH & Co. KG in Munich, thinks that the hospitality industry is being stylized as a victim of a crisis, among other things, caused by the fault of some major hotel companies. Maria Puetz-Willems asked him about this conclusion. An interesting, contemplative retrospective view at the end of 2009.