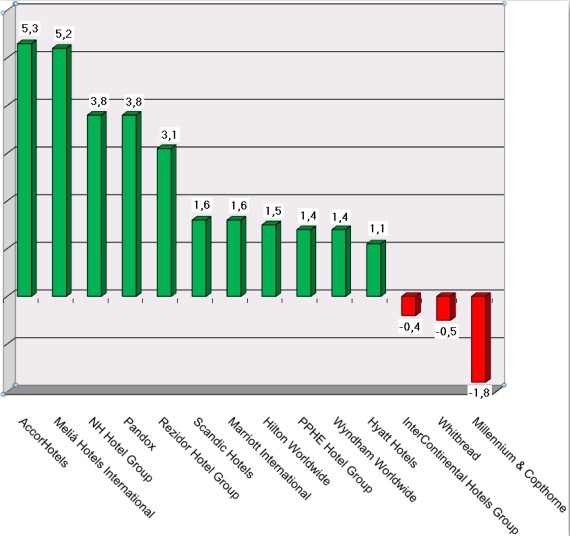

HI+Share price performance of the week 14/10/16 - 20/10/16

Changes %

Source: Factiva / powered by HVS EMEA Enews

Munich. Cruises are considered to be the growth market of the future. The performance of river cruises hasn't been quite as spectacular as high-sea cruises over the last year, though is still positive. Now, the Deilmann insolvency has cast a shadow over the boom segment. Yet to attribute everything to the financial and economic crisis would be wrong – also in respect of Deilmann. The good news from the crisis year 2009: Sales have again increased. Above all the Americans, the main passenger group in this segment, are again making reservations.

Chicago. The going public of Hyatt Hotels Corporation announced on August 5 has raised questions throughout the industry. Stock market experts, consultants and journalists alike are speculating about the true motives behind this step in the current situation. However, it could make sense for the owners.

Munich. Both investors and providers of open-ended real estate funds are still holding their breath. Since Morgan Stanley announced an unplanned revaluation of the entire portfolio of its P2 Value fund, the whole sector has been thrown into turmoil. Following the suspension of redemptions, the announcement that the fund will now also suspend acquisitions hit hard. Other fund providers now fear a renewed loss of confidence in all funds which may result a massive outflow of investor capital. The scenario is certainly not to be excluded. Unless of course a line is drawn under the open funds and the cards are laid on the table.

Munich. The crisis has brought an old subject back on the agenda for banks, investors and operators alike: leases. Whilst some require this form of contract as security, others don't even want to consider it. Compromise is what's needed. The best lease is after all not the highest lease. Ursula Kriegl, Executive President Germany with Jones Lang LaSalle in Munich gives her opinion on the new contract focus in the crisis and gives an example profit calculation for a 150 room hotel under fixed-lease, turnover lease and management contract.

Berlin. The fund initiator Anno August Jagdfeld's Adlon Holding GmbH is currently in financial straits. The company confirmed in the last week that is would suspend million EUR lease payments. At the end of last week, an agreement was allegedly reached. fondstelegramm was the first to confront the problem openly and referred to a lawyer with precise knowledge of the situation. He represents the protective association of Adlon investors founded recently. In an interview with hospitalityInside.com, the lawyer gives details of the situation both past and present and throws new light on Jagdfeld's financial dealings.

Heiligendamm. With a large surety from the state in the millions, the financially battered Grand Hotel Heiligendamm in Germany is to be able to effect an about-turn. However, industry experts expect permanent problems due to lacking infrastructure.

New York. In the USA, the looming insolvency of the Extended Stay Hotels is causing a stir. The company operates more than 680 hotels in the US and Canada, which mainly focus on long-term guests. The Lightstone Group bought Extended Stay from Blackstone in June 2007.

Paris. Hotel values are down 20% to 60%, ‘cap rates’ are soaring, revenues are falling and there is a liquidity squeeze… At the first ESSEC "Annual Forum on Commercial and Hospitality Real Estate", held on 5 June in Paris experts said the the return of banks to hotel financing may take long. The hotel sector will probably have to wait until the office building and other commercial property segments have recovered again. Right now, banks may force sales, even if they have to book losses on the loans. An up to date excursion into the world of hotel financing.

Nuremberg. For the majority of companies in Germany, lending by banks has not yet been cut. Just six per cent of companies so far are claiming that financial institutions have cut lending, terminated ongoing finance agreements or limited credit in the wake of the economic and financial crisis. This means the feared credit crunch is so far barely noticeable on the market.