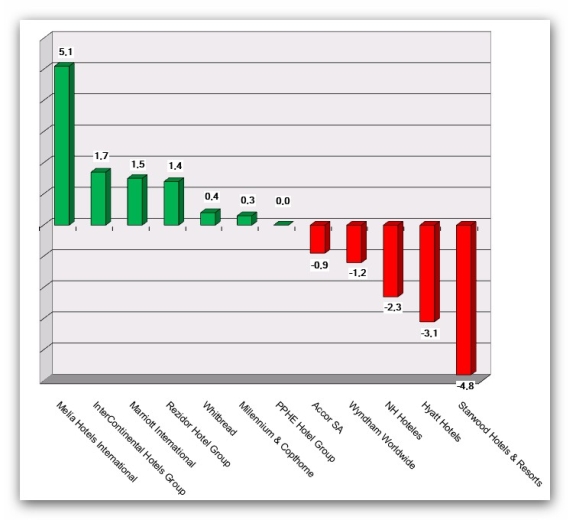

HI+Share price performance of the week 02/01/15 - 08/01/15

Changes %

Munich. The new Accor CEO Gilles Pélisson set the pace for September. Within the framework of risk minimisation, Accor is now looking for investors for a package of around 90 contracts.

Malta. International Hotel Investments plc of Malta, an investment subsidiary of the Maltese Corinthia Group, is increasing its issued capital to over Euro 500,000,000, welcoming Istithmar Hotels of Dubai as a new strategic investor and partner.

Stockholm. The IPO of the Rezidor Hotel Group was successful: Shareholder SAS said the offer was approximately 9 times oversubscribed, and it will book a capital gain of around 4.7 bln skr from the sale.

Brussels. As of next Tuesday, November 28, 2006, the first shares of Rezidor Hotel Group will be traded on the Stockholm Stock Exchange. The subscription period ends today, Friday.

Zurich. After Raffles and Four Seasons, Moevenpick Holding is now to be withdrawn from the stock exchange: Moevenpick's major shareholder, Carlton Holding AG located in Allschwil, made a corresponding bid to Moevenpick Holding in Adliswil near Zurich on Thursday.

Zurich. Rosebud's promises are becoming increasingly shaky. Now, the long-term delegate of the board of directors has thrown in the towel, obviously frustrated because of the many announcements and only few actions. Slowly but surely, nobody believes in the future of Buergenstock Hotels anymore.

Brussels/Stockholm. Rezidor SAS's going public still envisaged for this year is already making itself felt. The strongly expanding hotel group will change its name and the Scandinavian airline of SAS plans to sell its shares upon the company's introduction to the stock exchange.

London. The keynote address at the annual Hotel Booking Agents' Association Annual Forum, held in the UK, painted a worrying picture of the ramifications that property investor ownership means for European branded hotels. The keynote speaker predicts that assets will change hands far more frequently as well as a conflict between the operator and investor.