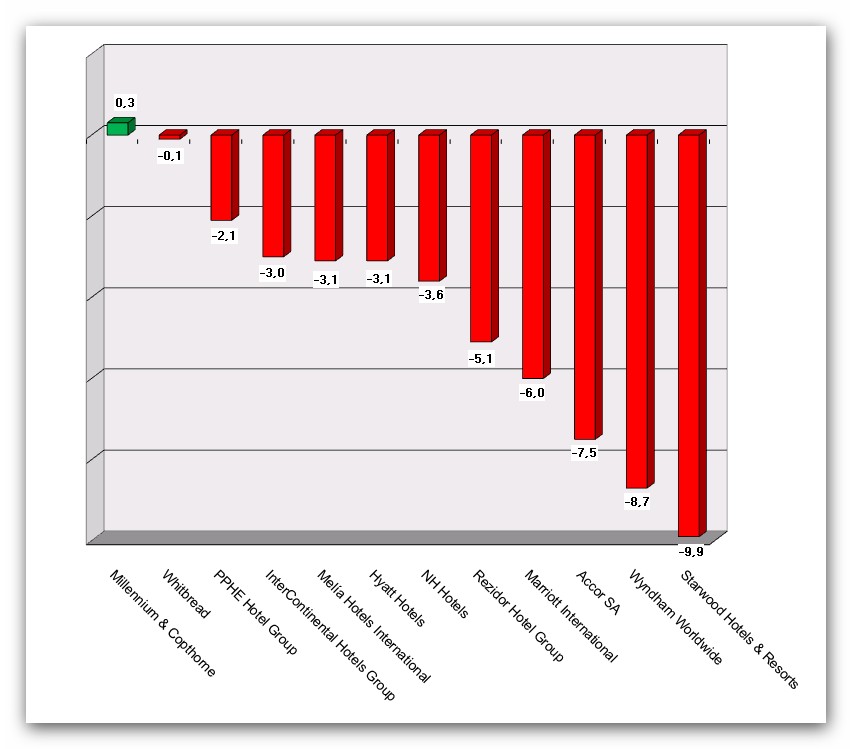

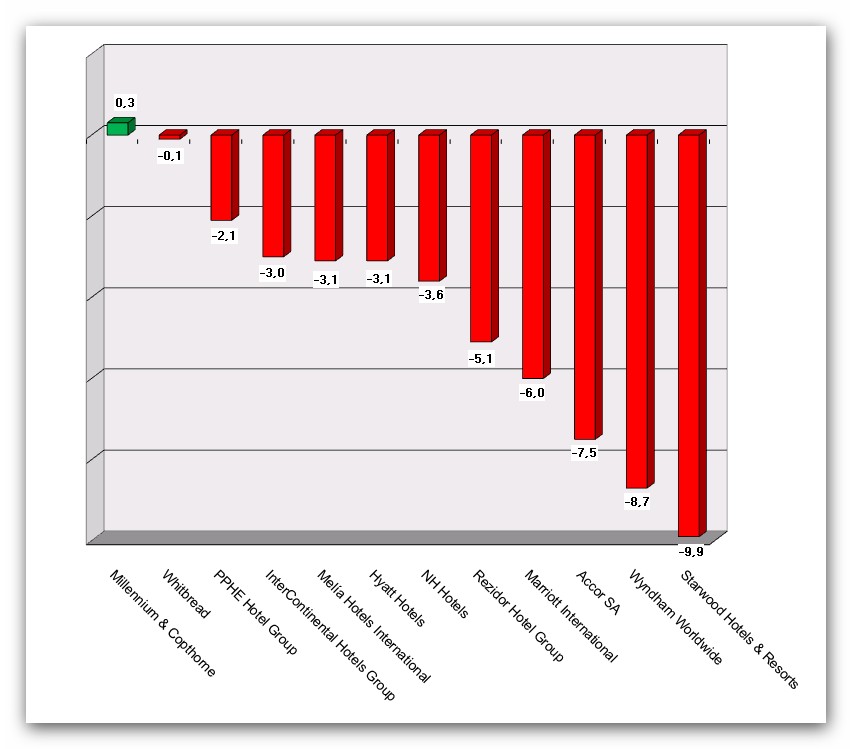

HI+Share price performance of the week 10/10/14 - 16/10/14

Change %.

Source: Reuters powered by HVS EMEA Enews

Frankfurt/M. Private Equity companies are stirring up the German economy. They invest capital of anonymous institutional investors in real estate or companies of various types. Their exit within the following ten years is to bring the investors the desired profit. Financial experts from Germany recorded chances and risks of these takeovers. A look at the mood in the market and at its conditions.

Singapore. CapitaLand, which owns 59% of Raffles Holdings, said it planned to delist its Raffles Holdings and will offer minority shareholders an exit price of 6 Singapore cents a share.

Frankfurt/M. Private Equity funds still look at the travel industry bearing too many risks. This was one opinion in the Travel Industry Club's discussion in Frankfurt. Another panellist sounded different and seemed willing to enter the hospitality industry. But Private Equity funds will only take the best. Two hotel experts confirm the continuous trend in the hotel industry.

Wiesbaden. Aareal Bank is well positioned in the hotel financing segment. Despite this, its experts regard the hotel business as the high-risk segment of the real estate industry.The financing strategy favours business and conference hotels, mainly outside Germany.

Munich. The hotel investment volume reached a nationwide 682 million euros in the first half of 2006. This extraordinarily high level is 22% above the average volume from 2001 through to 2005. Jones Lang LaSalle Hotels expects 2006 to be a record year with a likely volume of more than one billion euros.

Munich. Merrill Lynch Capital Markets Bank and Aareal Bank have concluded a contract with Capital Partners for the refinancing of the Ritz-Carlton Hotel in Moscow at a price of over 160 million Euros. At the same time, the sale of the Hotel Arts in Barcelona, another Ritz-Carlton Hotel, was completed to become the biggest single real estate transaction in Spanish history.

Muenster/Osnabrueck. The brochure leaves many questions unanswered. This is why, the fondstelegramm.de online service cautions against a fund that plans to erect and then rent an airport hotel at Muenster/Osnabrueck Airport. Arcadia Nord GmbH is the lessee and operator of the hotel. It will conclude a franchise agreement with the Holiday Inn chain.

London. InterContinental Hotels Group plc has agreed to sell a portfolio of seven InterContinental branded hotels located in Continental Europe to the Morgan Stanley Real Estate Funds. IHG previously announced in January 2006 that these hotels had been put on the market.

Berlin. Open property funds are ever more on the look out for lucrative investments promising high gains and at the same time securing portfolio diversity in terms of location and usage. Even the Commerz Grundbesitz Investment Company, the real estate subsidiary of the Commerzbank plc, is no exception. Although their activity in the hotel industry is limited, CGI is open for new projects with well known operators.