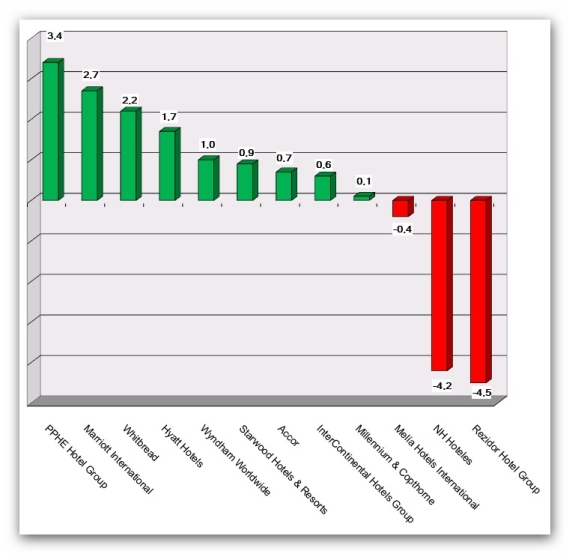

HI+Share price performance of the week 18/07/14 - 24/07/14

Changes %

Augsburg. A subsidiary of an Israeli real estate company has just a few days ago put its signature to a contract for the purchase of up to ten hotels in a range of German cities including Munich, Bonn, Frankfurt and Essen.

London. Hospitality Europe B.V., the pan-European hotel owning and asset management company, completed its sale to BRE/Hospitality Europe Holding B.V., an entity owned by funds managed by The Blackstone Group. The sale includes wellknown properties, such as the Sheraton Airport Hotels in Frankfurt and Amsterdam and the Pulitzer in Amsterdam.

Berlin. Hotels as lucrative and "nice" investments are appreciated by open investment funds. As additions to the portfolio they are appreciated by initiators and investors, as they guarantee the desired mixture of office buildings, city quarters, shopping malls and commercial areas. "This well-balanced portfolio is especially interesting for long-term oriented investors," says Ingo Hartlief, Board member of Deutsche Immobilienfonds AG. Difa is one of those investment fund companies that are open-minded about the hotel industry.

New York. The U.S. hotel market is sizzling. Hard statistical evidence gleaned from interviews of U.S. hotel investors and lenders suggest that domestic hotel markets are at all-time height. But there is increasing evidence that the industry may be closer to the peak of this cycle than the beginning.

Cologne. With a letter from 24 May 2006, funds initiator Anno August Jagdfeld informed investor participants of "Fundus Fund 31 - Hotel Adlon", that on 31 August 2006, loans taken in 1996 would be renegotiated with the bank consortia. The reason behind the refinancing move, as set out in the letter, was a desire to take advantage better interest rates. This motivation must be questioned.

Cologne. On Wednesday of this week, Event Management and The Blackstone Group acquired nine hotel properties from the DS funds of the Dortmund based Dr. Peters Group. The deal represents the biggest single sale of hotel real estate in Germany in recent history. Seven of the properties are presently run by Accor under three different brands, two are run by the Treugast Solutions Group.Group.

Norderney. The construction works for the planned 5-star Steigenberger hotel on Norderney Island in the North Sea have been delayed. Financial difficulties leave the fund project of Claus Cohrs, a former member of the Fundus group, pretty shaky. Anton Schattmeier, Steigenberger board member, said in the course of the press conference on financial statements on Tuesday that his company's contractual engagement required secure financing.

London. In a move to place the UK market under the same business model as the rest of the world, Marriott International has this week found an institutional investor to buy its interest in the 50/50 joint venture with Whitbread.

Frankfurt/Eschborn. With a balance sheet total of almost 240 billion euros, Eurohypo is the tenth largest bank and fifth largest private financial institution in Germany. As regards the hotel industry, Eurohypo finances large portfolios as well as individual hotels of major chains. It is also open to individual private hoteliers says the bank.