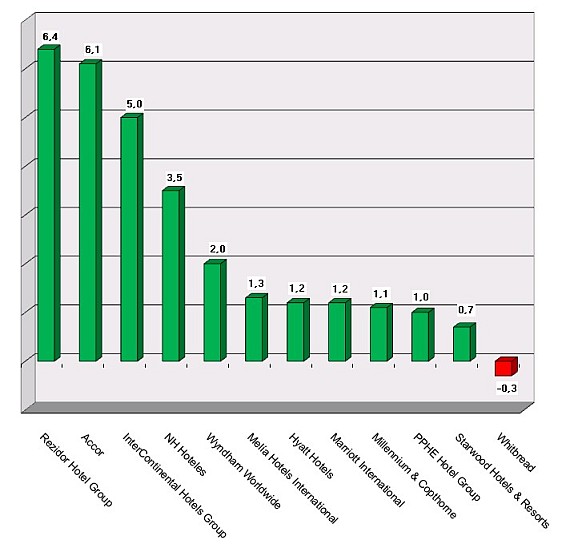

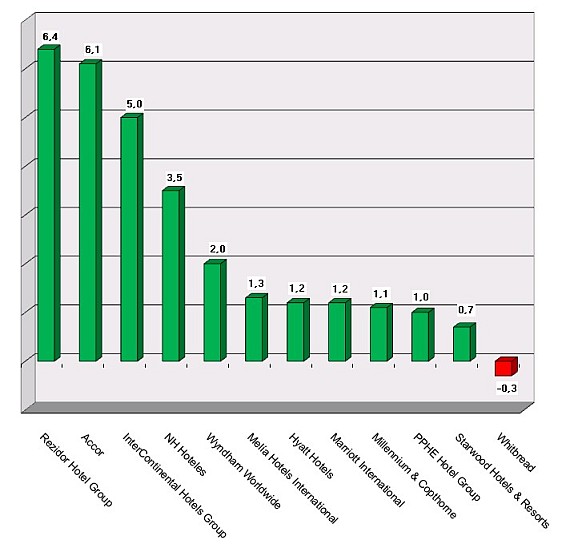

HI+Share price performance of the week 23/05/14 - 29/05/14

Change %.

Norderney. The construction works for the planned 5-star Steigenberger hotel on Norderney Island in the North Sea have been delayed. Financial difficulties leave the fund project of Claus Cohrs, a former member of the Fundus group, pretty shaky. Anton Schattmeier, Steigenberger board member, said in the course of the press conference on financial statements on Tuesday that his company's contractual engagement required secure financing.

London. In a move to place the UK market under the same business model as the rest of the world, Marriott International has this week found an institutional investor to buy its interest in the 50/50 joint venture with Whitbread.

Frankfurt/Eschborn. With a balance sheet total of almost 240 billion euros, Eurohypo is the tenth largest bank and fifth largest private financial institution in Germany. As regards the hotel industry, Eurohypo finances large portfolios as well as individual hotels of major chains. It is also open to individual private hoteliers says the bank.

White Plains. Starwood Hotels & Resorts Worldwide, Inc. has closed on a sale of 28 hotels - including hotels under the Sheraton, W, Westin, St. Regis and Luxury Collection brands - to Host Marriott Corporation.

Berlin. The US finance investor Blackstone has now officially announced interest in the acquisition of the Grand Hotel Esplanade in Berlin. Hotel owners maintain their silence.

Munich/Berlin. Three of the five winners of the current "Investment-Ranking Hotellerie 2006" come from the mid-price segment. This will be announced by Treugast Unternehmensberatung tomorrow, March 8, at the ITB in Berlin. Apart from that, numerous minor changes in the ranking display a varied state of the industry.

Berlin. Banks still regard hotel financing as a risky investment. However, most of the time, they lack the feeling for market trends and courage to take on niche hotels. Flexible contract models and private equity raise a glimmer of hope among operators.

London. UK-based 4-star hotel chain Macdonald Hotels is joining the long list of hoteliers undertaking a sale-and-manage back deal in order to raise funds. The 65-strong group has appointed Deloitte to advise it on the £ 200 million-plus sale of about 20 properties.

New York. In its latest deal Blackstone paid 10,45 US-Dollar a share or a 5,2 percent premium on MeriStar's closing price. The price represents 13 times projected 2007 earnings for MeriStar. Scooping up these hotels has led to speculation on Wall Street that Blackstone is preparing an initial public offering for its hotel property unit.

Munich. 2005 was an extraordinary year for fund initiators in Germany. Due to numerous legal and fiscal changes investors were up one minute and down the next. It is all the more astonishing that despite all this, an outstanding placing success was achieved to the tune of 12.3 billion euros. This is the result of the "Marktanalyse der Beteiligungsmodelle" by the journalist and analyst Stefan Loipfinger. Hotel real estate, however, is experiencing losses. They are performing against the trend.