News & Stories

Frankfurt/M. Deutsche Hospitality is expanding its partner offering in the areas of franchising, management and lease contracts. The new service toolbox for franchisees is characterized, among other things, by a variety of digital solutions.

Geneva. The Global Hotel Alliance officially launched the digital rewards currency for its loyalty programme "GHA Discovery", announced last July, this Wednesday. It is an industry first. From January, 36 hotel groups with over 800 hotels and 11 million members will benefit from this.

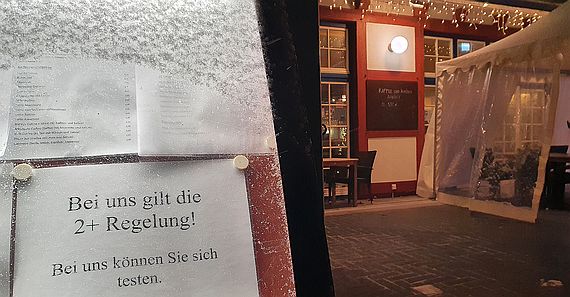

Wiesbaden. Business has become brutally tough, the authorities are using hoteliers and restaurateurs for the purposes of public control, revenues are plummeting more dramatically than a year ago, yet almost every hotel group wants to avoid closures. The German hotel industry is suffering a massive hit from the new corona rules under the 2G and 2G+ regimes. How do the groups handle the challenge? Deutsche Hospitality, HR Group, Ruby Hotels, B&B, Premier Inn and Dorint report.

Berlin. On Wednesday, Ingrid Hartges was still holding in her hands a draft bill from the "traffic light" coalition, which stated that there would be no closures of restaurants and no bans on overnight stays. 24 hours later - yesterday - the second part of this sentence was no longer true. Across party lines, the 16 minister-presidents were suddenly in agreement: the "full" toolbox must be available. The Dehoga Managing Director on the current, unmotivating situation shortly before Christmas.

Berlin/Brussels. The fourth wave of Corona is rolling unchecked across Europe. Almost every country is fighting massive increases in infection and hospitalisation rates. A short foray through the chaos - and 14 lines about the future of tourism in the new German government paper. That is sheer mockery. This industry must finally stand up, together and across borders.

Brussels. Almost 30% of EU residents have booked a room in a private residence, or an apartment or house via a sharing economy platform. But who are the heavy users? Who is still restrained? And who are the typical hosts?

Salzburg. Staff shortages are forcing people to get creative, at least on the entrepreneurial side. Yet cost-cutting measures in the wrong area annoy guests, as the practical examples we bring you today make abundantly clear. On the other hand, the 4-day working week is no problem. Not even legally. But far too few hoteliers are making use of this useful work-life balance tool. Positive example: the Hotel Aviva in Austria. It has been practising a 4-day work week since 2018.

Geneva. In mid-September, the Kempinski Group announced that the Supervisory Board of Kempinski AG had prematurely extended Bernold Schroeder's mandate as Chairman of the Management Board of Kempinski AG and confirmed his role as CEO of the Kempinski Group. With this announcement, the company has now drawn a line under the recent leadership change, which began with the surprising departure of CEO Martin Smura on 10 December 2020. A review.

Munich. "What's left of hotel DNA after the pandemic?" A lot - and a lot of it is new. There's a desire to forget to pain of corona, and the growing optimism of a recovery of the market is accompanied by new opportunities and trends. Six established hoteliers and newcomers whetted investors' appetites for the new diversity with their insights and concepts.

Berlin. On 1 November 2021, the German government will make use of a paragraph that denies wage payments to the unvaccinated in case of quarantine. In addition, the country continues to debate intensively about the sense or nonsense of 2- or 3-G regulations. But at least there are now hopeful economic forecasts for the hospitality industry.