News & Stories

Rockville. Global online sales are projected to reach 750 billion dollars in 2019 and Choice Hotels wants a piece of this cake. The hotel chain has invested close to 50 million dollars to develop ChoiceEdge, a cloud-based global reservation system which will allow the chain to support an ever-growing flow of transactions. A first in the industry.

Amsterdam. The pilot version of Booking.com's new service and support chatbot is now available worldwide. Booking Assistant already handles 30% of customers' enquiries automatically in less than 5 minutes...

Cologne. Via its tool HRS Destination Solutions, the OTA from Cologne has been linking to Airbnb indirectly for a few days now. It wants to make its subsidiary portal more attractive – as over this portal holiday accommodations, intermediary agencies and tourism centres market themselves – and wants to attract more providers, without any additional costs.

Berlin. New problems with OTAs: The Higher Regional Court in Duesseldorf has dismissed the appeal by Germany's International Hotel Association regarding the decision of a lower court in the Expedia case, and TripAdvisor now also plans to introduce a dubious warning badge. IHA has defended itself vigorously against looming damage for the sector. In return, the association now helps hotels with damage claims against HRS.

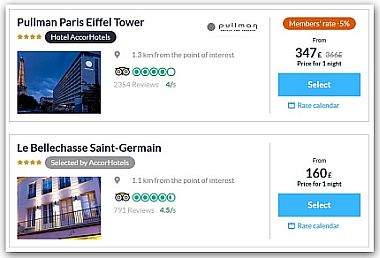

Paris. AccorHotels is shutting down its distribution platform, which allowed independent hotels to join its marketplace. A "lack of traffic" is the reason. Only 2,200 hotels signed in versus 10,000 expected. The news comes after the company dismissed Romain Roulleau, Senior VP eCommerce and Digital Services as well as the two co-directors of Fastbooking. 22 million euros later, AccorHotels has learnt its lesson the hard way. It's Sébastien Bazin's first defeat in a series of ongoing acquisitions and turnarounds since he took over as CEO. But the failure doesn't seem to be stopping the group. Transformation continues with a new digital team and the launch of AccorLocal this weekend.

Nuremberg. Smartphones are again the powerhouse in the area of technical consumer goods. In addition to a new record in global demand for smartphones in the first half of 2017, the average selling price also increased. In the wearables segment, smart watches and fitness trackers form the highest share. Earables and virtual reality are only marginally represented.

Bern. Now even in Switzerland the air is getting thinner for OTAs. Ten days ago, the Economic Affairs And Taxation Committee of the National Council adopted Motion Bischof on the "ban on adhesion contracts by online booking platforms against the hotel industry".

Wiesbaden. Demand for Serviced Apartments is increasing, and in Europe too, more and more are being developed. This attracts the attention of booking platforms looking to fill the many new beds. New regional IT developments and foreign booking systems have entered into competition with existing marketing portals. Yet the promise of direct online bookability can only rarely be fulfilled in this still young segment. There are certainly pitfalls.

Rome. After France, Austria and Germany, Italy is also prohibiting online booking portals to apply so-called most-favoured customer clauses towards their hotel partners. The respective law was passed on Wednesday, after 851 days of debate.

Madrid/London. Just in time for the summer season, a Liverpool court is hopefully going to soon send a message to British tourists in Spain. Here, vacationers obviously pretended to suffer from food poisoning "as a result of bad hotel food" and brought an action against hoteliers for damages. A playground for lawyers, who had discovered a legal gap ...