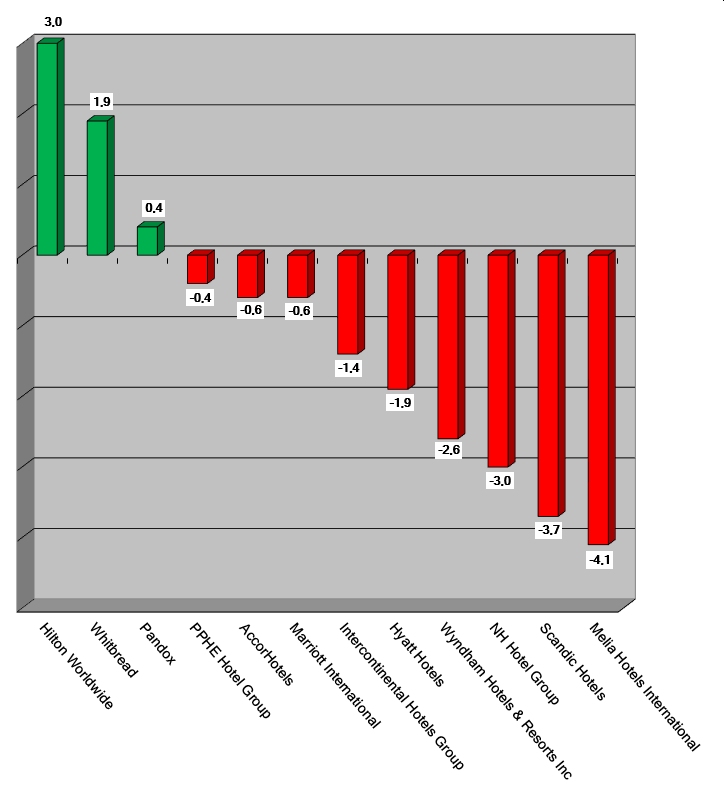

HI+Share price performance of the week 01/09/2022 - 07/09/2022

Change % compared to the previous week

Source: Reuters

powered by HVS EMEA Enews

London. The "UK Hotel Lending Report 2020" reports for the first time on the hotel investment and lending market in the UK. At the end of 2019, it was still worth around 135 billion pounds.

San Francisco. Last week, Airbnb shared its first earnings report since last December when the company went public and raised 3.5 billion dollars valuing it at more than 100 billion dollars. It was not a surprise that the company reported a declining revenue and a whopping 3.9 billion-dollar loss. A good space for Booking.com to step in and remind the public of being even more powerful.

Frankfurt. Uncertainty is severely affecting investor activity in the global hospitality industry in 2020. Transactions slumped by 60%. Private equity catches up. Future real estate needs clear profiles.

London/Frankfurt. Millions from British Green Bonds are to help Whitbread to continue its expansion and to make the hotels - especially in Germany - "greener".

Berlin. At the end of February, hotels and restaurants will have been closed for six months including the first lockdown. Regarding the third bridging assistance, the EU no longer imposed a cap, but Germany put it on again. This is a scandal. The current figures, facts and demands.

Paris. Pierre & Vacances Center Parcs, the European leader in leisure residences is bleeding cash and does not expect a return to profitability this year. That being said, the group which operates 45,800 apartments and cottages in 282 locations across Europe is confident it will bounce back as soon as travel resumes.

Bern. With a new test strategy and an increase in hardship aid, the Swiss Federal Council took important steps on Wednesday to overcome the crisis.

Brussels. Finally millions in aid for the larger companies? The EU has given the go ahead for Germany's outstanding part of the exceptional economic assistance for November and December and also extended aid to all companies until the end of 2021. The reaction from large hotel chains was cautious all the same.

Rimini. Renovations and conversion have gained importance in the pandemic. An Italian consultancy compared costs for different building types, from revamping to conversions and greenfield.

Frankfurt/M. In 2020, the transaction volume on the German hotel real estate investment market amounted to 1.95 billion euros. A minus of around 60% compared to the previous year. CBRE with additional information on the market.