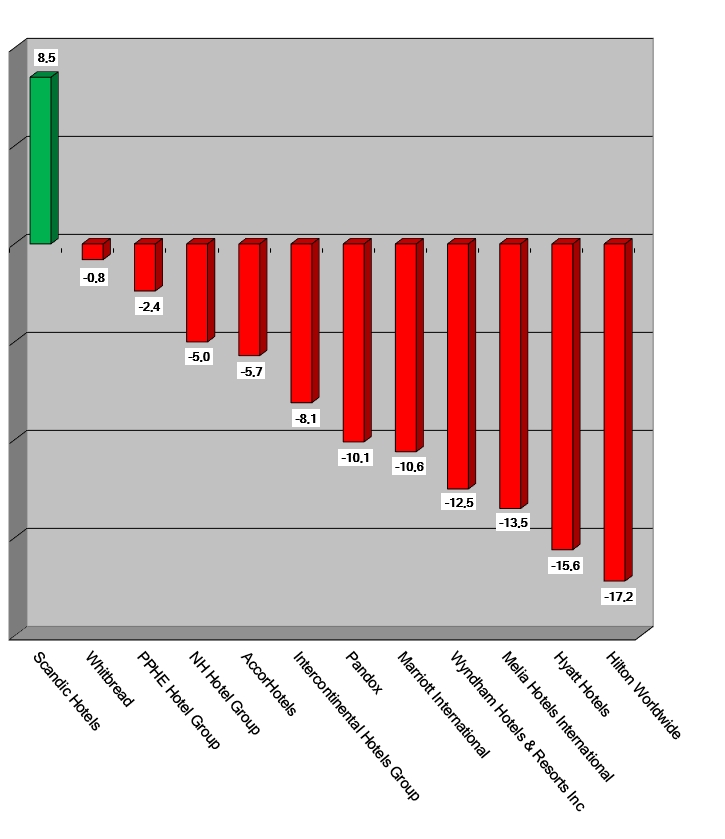

HI+Share price performance of the week 09/06/2022 - 15/06/2022

Change % compared to the previous week

Source: Reuters

powered by HVS EMEA Enews

Vienna. After a record year in 2019 with a transaction value of more than 1.25 billion Euros, the pandemic-related fall to approx. 280 million Euros also followed in Austria in 2020.

Wiesbaden. The wave of insolvencies in the German hotel industry is rolling in. Leading lawyers expect a sharp increase in insolvencies this spring, even among medium-sized and large groups. The second lockdown, the continued absence of the recovery and government's ineffective countermeasures leave many companies with no other option.

San Francisco. Despite facing regulation issues in many destinations across the world as well as multiple lawsuits, Airbnb just "broke" the stock exchange. The company's IPO surpassed its founders' hopes and topped a 100-billion-dollar valuation last week. Investors are betting on Airbnb to lead the travel rebound globally. Will the platform soon become the number one e-travel company? Most importantly, when will they start making money consistently?

Berlin. The full disbursements of November aid - promised firmly by the German government - for suffering hoteliers and restaurant owners continue to be delayed; they are therefore extended to December. In addition, the Bridging Aid III has been revised. And the insolvency application requirement remains suspended in January to prevent a first wave.

Wiesbaden. As the first large German hotel group, Novum Hospitality GmbH from Hamburg has secured a loan from the German Economic Stabilisation Fund and is thus one of seven companies of different industries so far to have been granted this support at all. The voices from the industry on this range from recognition to scepticism.

Berlin. A new investment company plans to build a portfolio of managed properties along the entire real estate usage chain: from serviced apartments, co-living, education, office-as-a-service, healthcare and elderly living to urban farming.

Amsterdam. While a second wave of corona cases has triggered tougher restrictions across Europe on travel and social gatherings, hoteliers are not sure they can make it to the end of the year. The biggest chains' share value is melting fast, giants like Accor and AccorInvest are seeking solutions. Suddenly banks and investors are turning their backs on the industry. All over Europe, the first insolvencies are there, and hotel closures are imminent. But consultants see support in the background.

Leipzig. Covid-19 is now also affecting the Private Equity funds. It is particularly difficult for companies with high levels of debt financing.

Munich. Invesco Real Estate, the real estate division of the global asset manager Invesco, has acquired the commercial real estate finance business unit, the real estate debt team and its European assets from Swiss asset manager GAM Investments.

Wiesbaden. The industry associations for the tourism and the hotel sectors continue to warn of an unprecedented wave of insolvencies in the wake of the corona crisis. The first branded hotels, including the Sofitel in Berlin, have already filed for insolvency. Others, such as the Hessischer Hof in Frankfurt, have announced their closure or, like the Maritim Potsdam, are looking to change operator. It is rumoured that the bargain hunters have been queuing up for a long while already. But how crazy is it really? And what do insolvency law experts and lawyers expect?