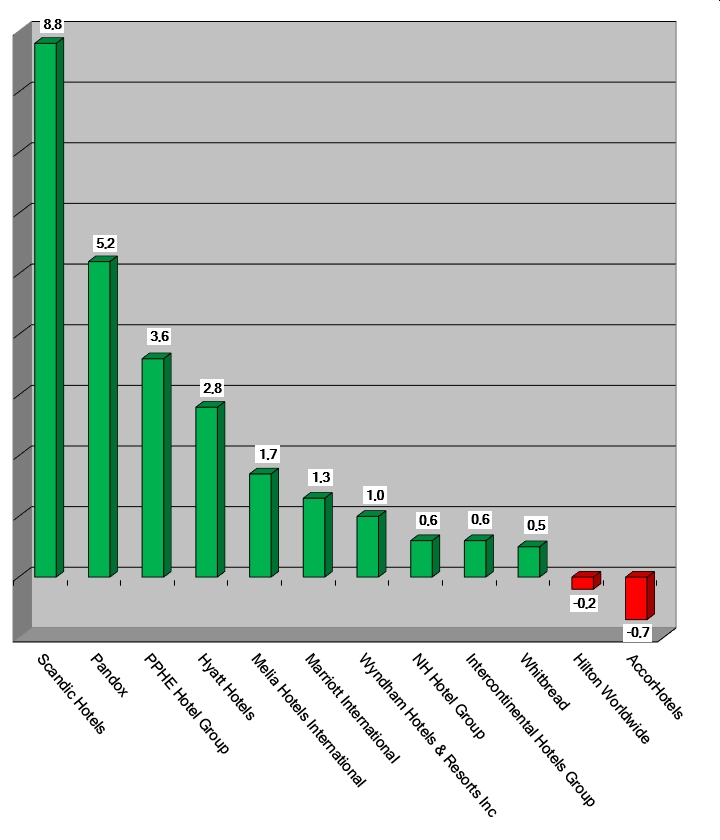

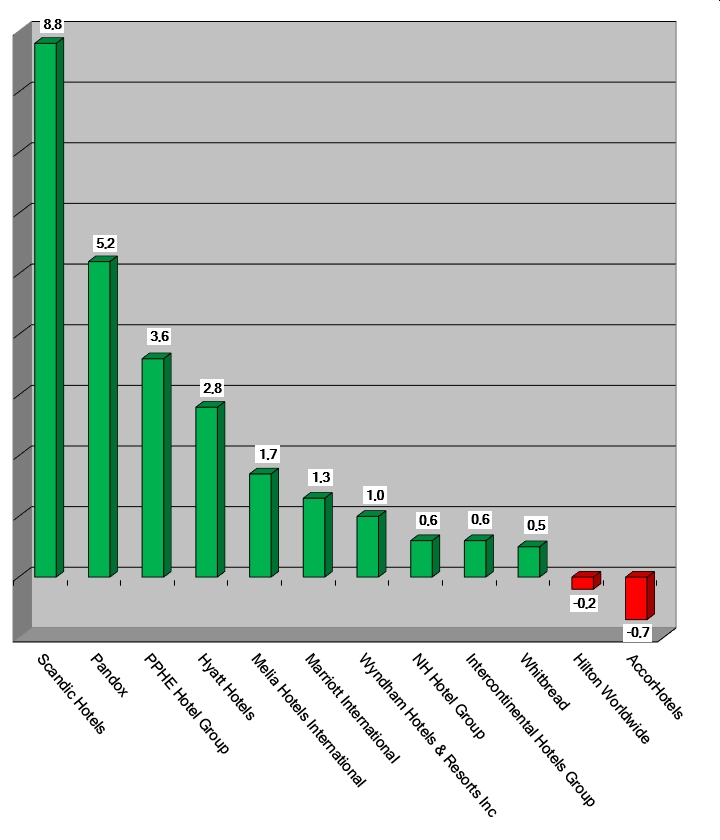

HI+Share price performance of the week 27/01/2022 - 02/02/2022

Changes compared to the previous week in %.

Source: Reuters

powered by HVS EMEA Enews

Wiesbaden. Another setback for the German hotel industry: The government is not prolonging the three-month protection for tenants who are unable to pay their rent because of the corona crisis. This keeps the uncertainty of survival at a high level. The only real help has been the short-time allowance, everything else is missing its target – for various reasons. hospitalityInside.com asked hotel groups and franchisees to assess the measures taken so far. H-Hotels, Deutsche Hospitality, Motel One, Vienna House, SV Group and Bierwirth & Kluth answered.

Frankfurt/M. At the end of next week, the German parliament will retire for the summer recess. By the time it returns at the end of August, the hotel scene in Germany may well be very different – If further bridging assistance for the medium-sized hotel groups is not provided. Discussions in the industry are becoming quieter, not louder. Martina Fidlschuster, Managing Director of Hotour Hotel Consulting, once again soberly sets out the current state of play. She coolly shows why hotels will systematically drift towards insolvency in the continued absence of help. The numbers are the silent cry – a cry aimed at politicians.

Munich. Empty hotels, closed restaurants. The corona lockdown hit the hotel industry hard. Despite the easing of the restrictions, businesses are still not earning any money, yet costs continue to weigh heavily. The core issue remains rents/leases, or more specifically their deferral or reduction. Operators seeking accommodation on this from their landlords will sooner or later also touch upon investors in open-ended real estate funds. The funds therefore face a dilemma. On the one hand, they want to keep their tenants, but by law they are also obliged to protect their investors. This balancing act is almost impossible to achieve, as Covid-19 is already having a noticeable impact on the profitability and risks of the fund portfolios.

Rome. During the Covid-19 crisis, Italian institutions approved three different emergency decrees. All of them are currently fully applicable, only one has paragraphs explicitly dedicated to tourism and hotels. A review with advantages and risks. The hotel associations comment.

Berlin. The amounts are too small, the durations too short: this is the criticism of the German tourism industry and the Dehoga Bundesverband on the 120 billion euro economic stimulus package which the German government passed on Wednesday.

Paris. The pace of growth of Asian hotel groups has increased enormously in recent years. Five of the 15 largest hotel groups by number of rooms now come from China, but other Asian countries have also made the leap into the top 20. What effects does all this have on EBITDA and the corporate values of the big players?

Berlin. As of this Tuesday, the German hotel and restaurant industry began its gradual reopening. The exit will take place in stage until the end of May. Yet two core problems remain: rental costs and the broad plans for support loans that are still not reaching the industry. Mass insolvencies seem inevitable. As regards rents, the Central Real Estate Committee, Germany's largest real estate trade association, supported Dehoga and submitted a proposal to German government outlining a possible solution. Asset expert Theodor Kubak of Arbireo Capital AG is working on further ways to be able to share the rent burden more equitably.

Berlin. Five weeks ago, the German Minister for Economic Affairs, Peter Altmaier, announced that another emergency rescue fund would be set up for the hospitality sector.

Berlin. As much as German hoteliers and the associations have so far been pleased about the German government's quick financing decisions after Corona, they are annoyed that politicians do not want to understand how hotels are financed. The anger about the KfW conditions is great. A wave of bankruptcies is approaching. The industry is currently losing around 750 million euros in turnover every week.

Wiesbaden. For ten years and until a few weeks ago hotel groups announced bulging pipelines and investors praised the high professionalism of their operators as well as their own hotel real estate competence team. Now, however, the question arises as to what the much-praised partnership between the parties is still worth in view of Corona.