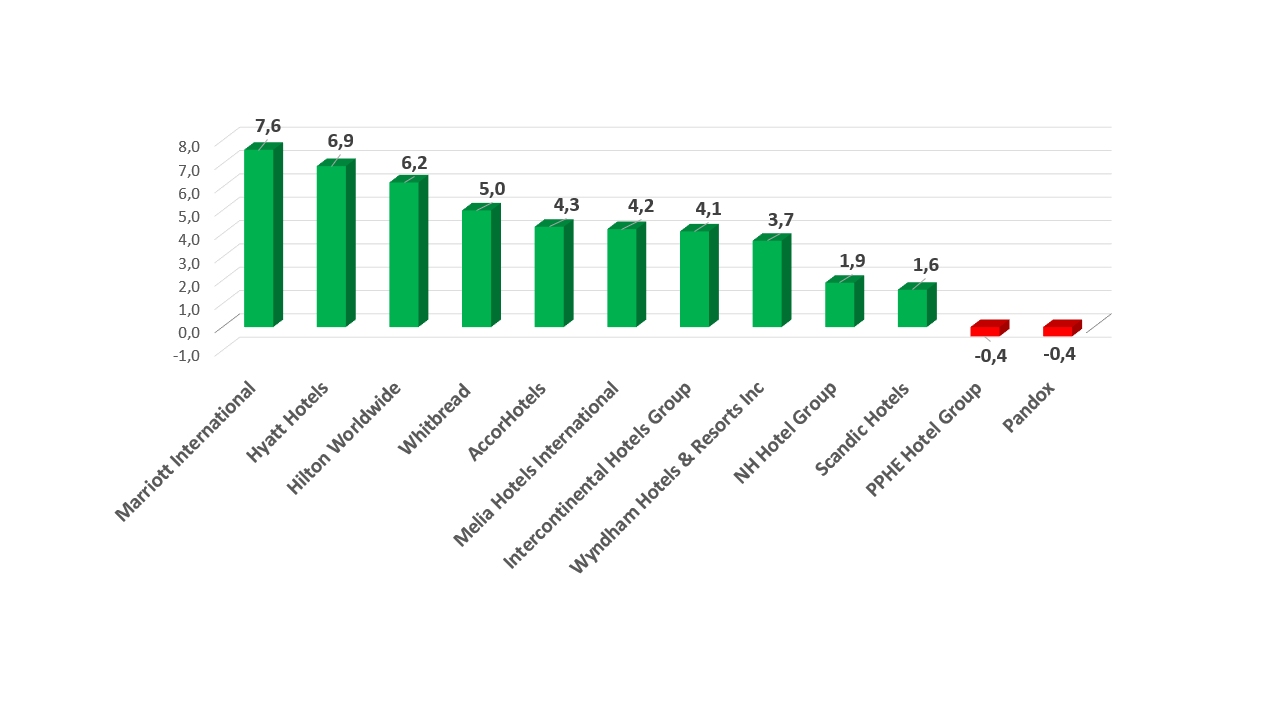

HI+Share price performance 13.4.2023 - 19.4.2023

Change % compared to the previous week.

Source: Reuters

powered by HVS EMEA Enews

London/Amsterdam. London & Regional Properties, one of the biggest hotel owners in the UK, announced on Wednesday, 25 January, the formation of LRO Hospitality, a value-add joint venture with the goal of investing up to 1 billion euro in European hotel assets.

Hanover. Tour operator TUI reports an improvement in its result and a noticeable increase in bookings at the turn of the year and for summer 2022. The company describes its great flexibility as a major asset in the current situation.

London. A global alliance of financial institutions, investors and companies has announced the launch of a central platform for corporate sustainability data. It is intended to make ESG data more available and comparable, thus ensuring greater transparency in terms of sustainability.

London/Frankfurt. The hotel group Whitbread PLC has placed two bonds with a total value of GBP 550 million in the UK. This will be used to finance existing and planned sustainability projects, including the construction of hotels and the use of renewable energies as well as to secure ethical supply chains. Mark Sommer, Managing Director Finance at Premier Inn Germany, explains how Green Bonds work, what the "Greenium" is and what the role model functions mean for the industry.

Berlin. More than half of the companies in Germany are currently unable to fill vacancies - noticeably more than even before the outbreak of the Corona crisis. Solutions are needed now, for example, employees from abroad. The government-to-be knows this, too. And the Holiday Inn Munich Unterhaching tells how it works.

Wiesbaden. Austria is already in lockdown, in Germany individual regions are affected, others could follow. Stricter Corona regulations lead to the next revenue losses in the hospitality industry. As in the previous year, the task now is to secure liquidity! How?

Rome. In Italy the pandemic situation is still relatively under control, but now contagious spreading is also threatening the touristic winter season. As of this week, 11 million bookings have disappeared.

Milan. A fantastic summer doesn't cancel two challenging years. Yet, there is still room in Italy for investments in the luxury hospitality segment. Which means: Mainly foreign investors move in, take hold of high-quality assets in primary locations and finance them with capital from abroad. At the same time, local investors and operators are struggling with the pandemic crisis threatening many with closure.

Munich. Green bonds are slowly becoming the stars of climate financing. And now they have arrived in the hotel industry. The British hotel group Whitbread has issued green bonds with a value of 550 million pounds. Premier Inn in Germany has also profited from this move. Aareal Bank is now offering a green loan to Cerberus and Highgate for the refinancing of the Dorsett City London hotel. What is behind the green bond euphoria?

Vienna. The conservative-green government in Vienna has laid the cornerstones for its tax reform 2022. The tourism minister calls this a win for the industry, but the hotel industry is criticising the reform, especially when it comes to labour costs.