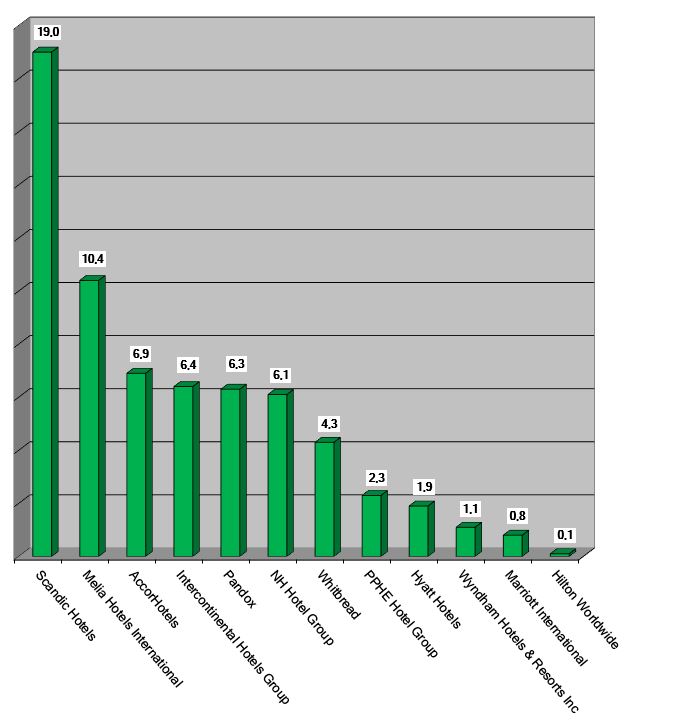

HI+Share price performance of the week 12/01/2023 - 18/01/2023

Change % compared to the previous week

Source: Reuters

powered by HVS EMEA Enews

Berlin. Those who were able to bridge the long cash pause on their accounts and then got the sums that were calculated will now - presumably - survive. Bridging Aid III Plus can now be applied for anew in Germany. Solutions Holding, Deutsche Hospitality, RIMC, Motel One and HRG Hotels comment on the status.

Neuss. The big pandemic-related wave of company insolvencies in Germany continues to be absent. Nevertheless, there are negative trends that could only become noticeable at the end of the year or New Year. But two hospitality lawyers do not see a wave or a tsunami.

Bern. Further aid for the Swiss hotel industry has been initiated: The Swiss Federal Council has adapted the Hardship Regulation. As of tomorrow, there will be further travel facilitations and relaxations.

Berlin. The German government will extend economic aid for particularly hard-hit companies until the end of September. Not every tourism association is happy with this. Larger hotel groups are likely to be relieved. Basically, however, the existential need remains severe. Dehoga Managing Director Ingrid Hartges comments to us on what has been achieved.

Berlin/Bern. The German government apparently wants to extend its corona aid until at least autumn, including the short-time allowance. Switzerland also plans to extend it, but no further subsidies. HotellerieSuisse takes a critical view on this.

Vienna. Following the pandemic, the Austrian hotel industry, and in particular the resorts, will take on more debt in order to secure the financial relief necessary for their survival. Banks are no longer helping. This has given rise to new attempts to combine equity capital, crowdfunding and Blockchain. The model.

Munich. The banks, which have to look out for themselves and their severely hit customers at the same time, will have to struggle with two additional topics in future: the strongly increasing number of non-performing loans and insolvencies. The standards for hotel loans have been increased significantly.

Berlin. While numerous German hotels are still struggling to survive, experts already see light on the horizon. In the promotion of large companies, the cap is finally to fall; Dehoga is optimistic. In addition, consumer sentiment is on the rise.

Stockholm. From the end of February 2020, Scandic experienced a dramatic drop in demand, yet the Scandinavian group is sticking to its ambitious plans in the area of sustainability.

London. Banks are "very quiet" currently when it comes to hotel financing, a Hotel Finance webinar in London revealed. Credit funds fill the gap and ground leases gain ground.