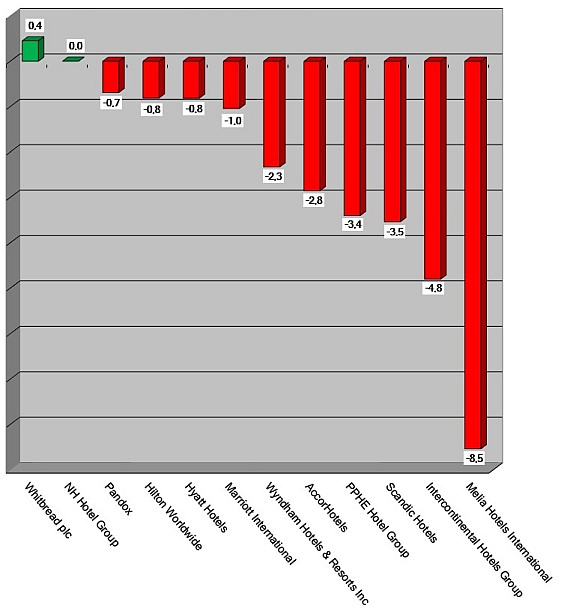

HI+Share price performance of the week 23/01/20 - 29/01/20

Changes compared to the previous week in %.

Cologne. The Dorint Hotel Maison Messmer in Baden-Baden paid its lease debts this week and continues to remain a Dorint Hotel. The action for eviction and notice of termination have been pulled from the table as a result, Dirk Iserlohe from E&P Holding explained to hospitalityInside.com yesterday.

Dortmund. For the first time, the Dortmund fund initiator, Dr. Peters, is planning a hotel special fund for institutional investors. In its beginnings, the issuing house had funded a few hotels, but had subsequently focused on ships and aircraft. It is now returning to the hotel industry.

Warwick. Firms are far less likely to take on more debt when their CEO is compensated through options according to new research.

Vienna/New York. After 8 years, it's time again: The American Hotel & Lodging Association has presented a revised edition of the "Uniform System of Acounts for the Lodging Industry". It is the 11th update since it first appeared in 1926. Whilst at first glance, there are no major changes to the P&L rules and to standard reporting, the many minor amendments are considerable and take good account of the changes experienced by the hotel industry over the past decade. "Globalisation" is the buzz word here. Michael Regner, partner to the consultancy MRP hotels in Vienna, explains the current system in today's guest contribution.

Doha. Katara Hospitality teams up with the InterContinental Hotels Group to bring five iconic IHG properties in key European cities back to full glory.

Davos. The insolvency concerning the InterContinental Davos has had first consequences: Lucas Meier, fund manager at Credit Suisse Real Estate Fund Hospitality, resigned from his position. This week on Monday, Credit Suisse Real Estate Asset Management, which is responsible for the real estate funds and real estate investment foundations of the Swiss major bank, announced that the fund manager "decided to leave Credit Suisse after nearly three and a half years in order to take on a new challenge"; he had been responsible for the fund's fortunes since its launch in November 2010. The market sees this as a "sacrificial lamb" – too many questions remain unanswered.

Davos. Only six months after the hotel opening, the tenant of the InterContinental Davos is insolvent! Which professionals miscalculated here? Well-known names like Credit Suisse and the German developer, Feuring, are behind the prestige construction in the noble ski and conference location. Hotel experts such as Fred Huerst don't understand the case.

Munich. Finance in the hotel industry has become easier again, experts say. However, this is true only for 1A locations and, above all, for brand hotels. The many midscale hotels on the other hand are still hampered by Basel III in their attempts to obtain credit. If credit is granted, it is expensive and the collateral demanded is high. As a result, more and more medium-sized hoteliers are looking for alternative forms of new or follow-up finance - including participation certificates. These aren't bad forms of finance per se, yet the risks and uncertainties are great - above all for subscribers. And it must also be said, that they're often not as easy as they seem for hoteliers either.

Geneva. Over the past half year a series of hotel IPO have been either rumoured, announced or actually transacted on stock exchanges around the world. In most cases, this trend represents the unwinding of private equity purchases in the years running up to the financial crisis which began in late 2007. Now the private equity groups are under pressure to return cash to their long-suffering investors by taking advantage of the tail end of a buoyant phase in global financial markets before it all comes to an end. Improving operational performance has also boosted the underlying value of hotel operations. A closer look to the IPOs of La Quinta and Playa Hotels, Dalata, Prince Hotels, Scandic Hotels and Gruppo Statuto.

Turin. The largest Italian bank, Intesa Sanpaolo, recently signed an agreement under which it will sell its 44.5% stake in the subsidiary NH Italia to the Spanish hospitality company.