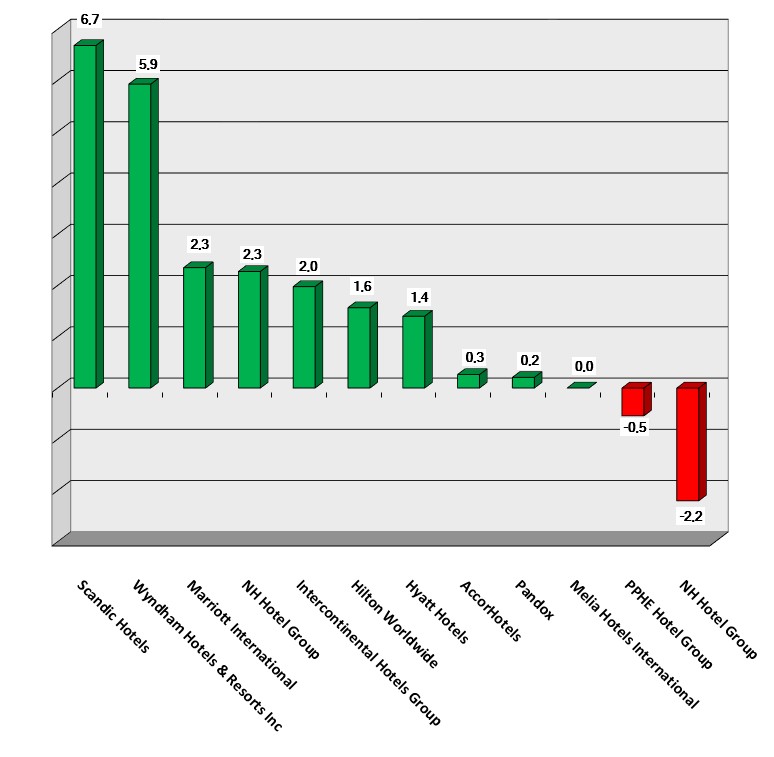

HI+Share price performance of the week 24/10/19 - 30/10/19

Changes compared to the previous week in %.

Rome. Unicredit, the second largest Italian banking group, has recently signed an agreement with Federalberghi, the national hospitality association linked to the Italian commercial confederation, Confcommercio.

Berlin / Frankfurt. "This type of private equity has never been with Steigenberger before," said Steigenberger CEO Puneet Chhatwal, after an increasing number of institutional investors have now become interested in InterCity Hotels. Moreover, he announced additional projects abroad this week and an agreement with a car rental service.

Berlin. The comprehensive regulation of closed-ended funds hasn't made life any easier in the new year. It is expensive and complex. Six months after its introduction, all market participants are cautiously feeling their way around the new rules - with new names, new tasks but very few new products. Hotels in the economy segment are used to diversify portfolios and make interesting investments. Yet if the good weather at this year's BSI conference in Frankfurt this year were to be transferred to sentiment of the sector this year, after frost and snow chaos, the outlook for closed-ended funds would be very good. The figures tell another tale though.

Frankfurt/M. Steigenberger Hotels has announced a big deal for InterCity Hotels for the next few days.

Berlin. 2013 wasn't an easy year. Regulation again shook up the open-ended funds sector. New capital investment legislation signalled the dawn of a new world for funds: regulated, safer and cleared of those market participants who didn't only have investor benefit in mind. Now that everything has again been set to "start", both remaining and new open-ended have an opportunity to show what they're made of. And all of them have kept hotel investments on their to-do list. The hotel has its circle of friends and has made its benefits clear.

Bad Hofgastein. In the Austrian Bad Gastein, in the Salzburger Land, the town centre was in danger of becoming abandoned. Neighbouring Bad Hofgastein could not allow this to happen at all. And as a result, 52 enterprisers forked out millions to acquire the Hotel Salzburgerhof in the town centre, rescued it and ultimately, the entire town. And they now have a desire for more.

Vienna. On the outside, the Austrian hotel industry seems to be better off with its small and medium-sized businesses than it is in reality. Oesterreichische Hotel- und Tourismusbank, the Austrian Hotel and Tourism Bank, outlined the background circumstances of the current development at the start of the year.

Vienna. Austrian tourism has been regularly celebrating the number of overnights stays at their highest levels, likewise in 2013. However, the previous years have also brought disillusionment: The larger hotel investments are concentrated on the federal capital where the room occupancy is pointing in a downward direction. In order to utilise additional potentials for Austria, Oesterreich Werbung focused on new trade show formats and web presence. Meanwhile, the resort hotel industry continues to tremble at the "booking" power, in spite of the latest anti-trust success against the Best Price Guarantee.

McLean. Is Blackstone making money on Hilton? In fact, the question should be rather, "will they make money on the purchase and re-floating of Hilton shares?" In spite of congratulatory declarations in the press stating that the New York-based private equity manager has more than doubled its money with a US$8 billion-US$9 billion gain, the jury is still out.

McLean. Since yesterday, Hilton Worldwide Holdings Inc. has been quoted on the New York Stock Exchange again. Due to media, Hilton's IPO was a success and brought in 2.3 billion dollars. Thus, the owners have achieved their goal even surpassing Twitter's IPO this year. Hyatt Hotels Corporation, the last pre-crisis IPO, went public already in 2009 generating roughly 950 million dollars.