News & Stories

InterContinental Hotels Group PLC (IHG) has acquired from Ruby SARL the RubyTM brand and related intellectual property for initial purchase consideration of €110.5m (~$116m). This was reported by IHG at 8.30 a.m. (CET).

The Austrian Loisium Group is injecting new momentum into its expansion plans with a crowd-investing campaign. Investors, wine and food lovers can now invest directly in the wine hotels.

Following Donald Trump's election victory in November, several major US financial institutions have reconsidered their environmental commitments. In recent weeks, nearly all leading American banks have withdrawn from the Net Zero Banking Alliance (NZBA), a UN-backed initiative promoting "Green Financing". Their decision highlights a growing divide between American and European financial institutions.

Aimbridge Hospitality was formed in 2019 following the acquisition of Interstate Hotels & Resorts. On 16 January 2025, the CEO of the super platform for third-party management announced that it was 1.1 billion US dollars in debt. Now he wants to turn the lenders into owners.

"A year ago at this time, we had extremely weak demand for credit. That's why we budgeted very cautiously." Then the investments suddenly piled up.

The European hotel investment market has regained considerable momentum since the coronavirus pandemic, while the German market is only recovering slowly. The challenges in Q4 2024 remain.

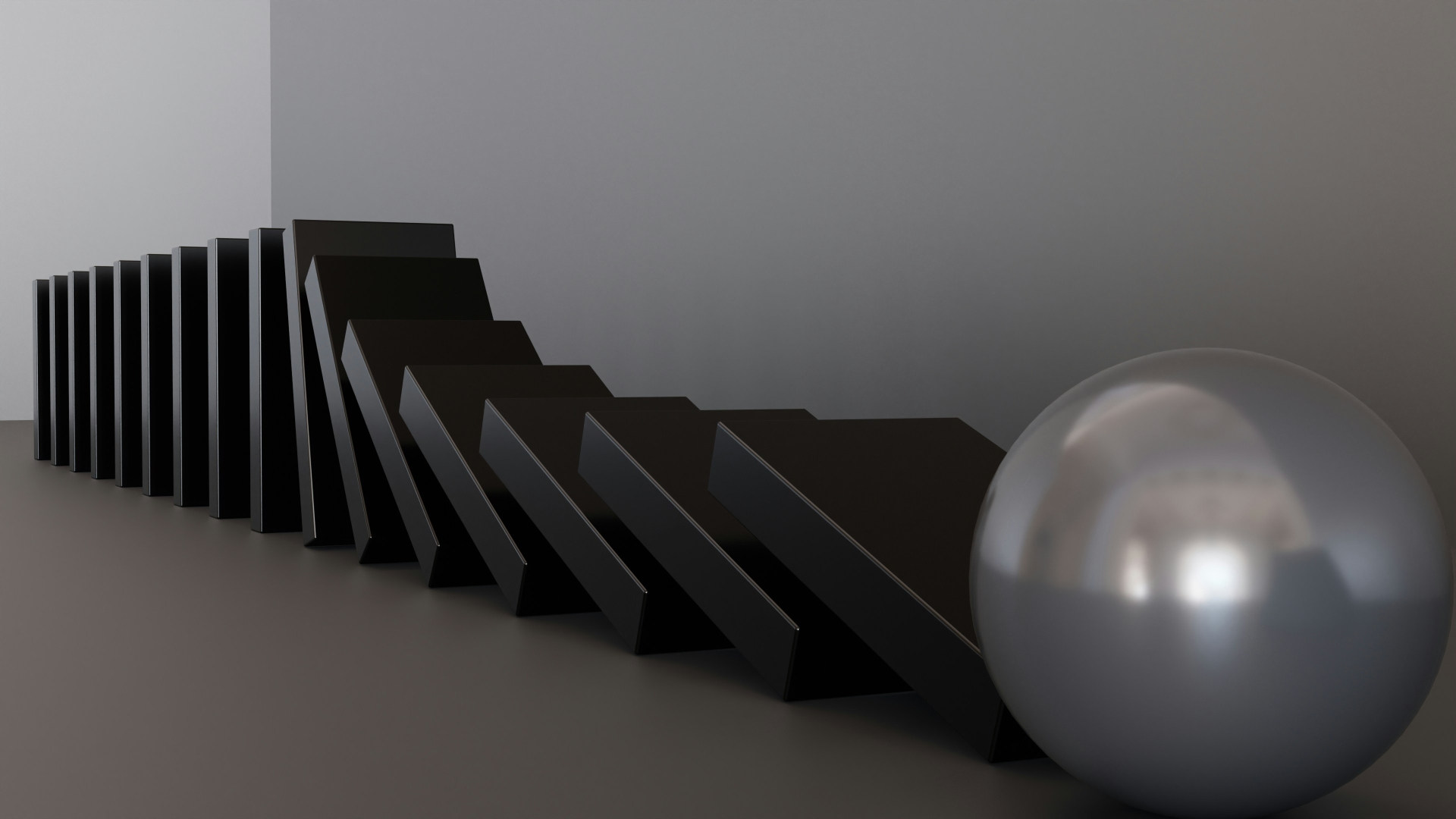

Insolvency administrators are currently operating in high season. Germany is entering its third year of recession. The negative spiral continues to drag down restaurants, but now also medium-sized hotel groups. Almost all of them file for insolvency under debtor-in-possession management. But how does this work? How do insolvency administrators work and think? An interview with the specialist Dr. Florian Harig from the law firm Anchor, based in Hanover, and the experienced insolvency communicator Alexander Görbing.

Lindner Hotels AG filed for insolvency under self-administration this week. It concerns 13 of 41 hotels, which are apparently buckling under the weight of rents and costs. Nevertheless, many questions remain unanswered.

The coronavirus pandemic, inflation and price increases have put Achat Hotels and its subsidiary Loginn Hotels under massive pressure. The group has now filed for insolvency under self-administration.

The investor Aroundtown wants to push digitalisation with its own new platform, hologram boxes and an incubator, offer hospitality services in all properties and connect tenants and guests.