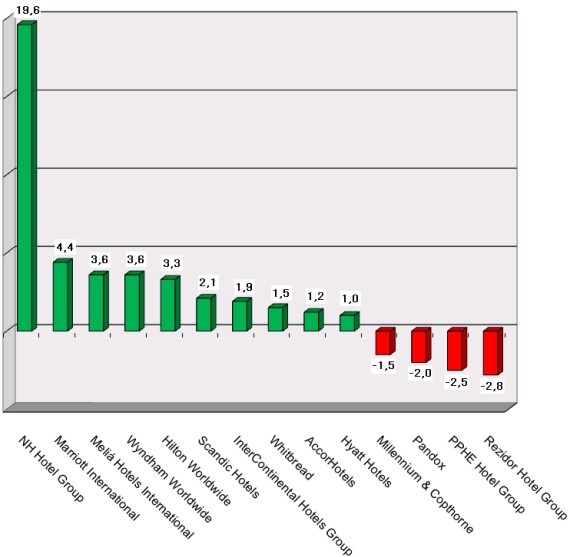

HI+Share price performance of the week 17/11/17 - 23/11/17

Changes %

Source: Faktiva / powered by HVS EMEA Enews

Munich. The financial crisis has ensured that financial terms for hotels have become considerably more onerous. Meanwhile, however, both the economy and the results of most hotels have recovered well. All the same, hotel consultants and hoteliers are quick to remind that it's still tough. Franchise systems and private hoteliers in particular still have a struggle on their hands. Some banks have even dropped properties altogether - and thus put an end to otherwise good concepts. The approach taken by Austrian banks seems more adventurous. After analysing the credit-provider position last week, we now look at things from the perspective of the hotel consultant and hotelier.

Munich. The financial crisis has ensured that the terms under which finance is obtained have become notably more onerous for hotels. Meanwhile, however, the economy and so the results of most hotels have recovered well. Yet bank still remain very cautious. New rules such as Basel III ensure banks are even more selective in their choices on when and how far to provide finance. Equity-weak hoteliers and project developers often don't get a look in and the only option remaining open to them is the sale. Prices may be low but many international investors still see Germany as a safe haven. Nevertheless, the question is now increasingly posed as to which way the hotel industry will turn if return-orientated investors now begin to dominate decisions. In the first part today: The view of the creditors.

Dueren. Anno August Jagdfeld is leading the power struggle for his part in the Hotel Adlon Berlin with unusual openness and intensity. Here, he has placed his chips on textbook crisis PR aimed at investors and the press. And so, in the foreground to the crucial shareholder's meeting on 26 August, he has voluntarily provided copious amounts of information.

Dueren. "Successful with Premium Real Estate: Security, Profitability and Value Appreciation". This is the slogan that adorns the homepage of the Dueren-based Fundus Group. According to its own statements, the company manages five billion EUR entrusted to it by 56,000 investors and invests in more than 800 projects.But not all of these 56,000 investors - private and institutional - are satisfied with the Fundus investments nor with Fundus Chief Anno August Jagdfeld. Despite them already having paid in high sums, Fundus always seems to lack money somewhere. In the Grand Hotel Heiligendamm, a new director is to put things right. But a storm is brewing over the Hotel Adlon in Berlin: At the next general meeting, Adlon investors plan on removing Jagdfeld from Fundus Fund 31 management. That would be Jagdfeld's end. And so a heated and in parts very public battle is now in full swing between Jagdfeld and the Adlon Shareholder Protection Association.

Munich. Continuity and normality this is not: After the surprising and rapid termination of management contracts, at the end of March InterContinental's hotel sign was taken down and the Dorint flag was hoisted at three German hotels. Two months later - after various operators had weighed up their chances - InterConti had returned to the hotels in Berlin and Dusseldorf. Yet despite the ultimate clarity as to operator, rumours and mysteries still remain. The entire toing and froing was the result of the "good old" German lease contract - though a management contract was also in play. Now, not only Jones Lang LaSalle Hotels is asking: What is a lease contract worth? Christoph Härle, Managing Director, and Ursula Kriegl, Executive Vice President Germany, from JLL Hotels venture their answers.

Frankfurt am Main. A global study of Chief Financial Officers shows that the financially responsible people in Germany are especially confident in regard to their view of economic growth in their own country. They count on a clearly earlier and larger growth than their colleagues. A look over the rim of the tea cup

Dubai. "I can’t tell you how bad it was," Joe Sita, president of IFA Hotel Investments, the asset management unit of Kuwait-based property developer of mixed-use tourism projects IFA Hotels & Resorts, told participants at the Arabian Hotel Investment Conference that was recently held in Dubai. He wasn’t taking about the impact of the unrest on the region’s hotel business, but recounting his ordeal last year in trying to secure financing for a Fairmont hotel being built in Dubai’s man-made Palm Jumeirah Island. Banks are still reluctant to lend, liquidity remains tight and real estate investment index says that Arabian markets are still semi-transparent and opaque.

Wiesbaden. The majority of real estate companies expects that the demand for instruments of alternative financing will rise. According to a recent survey, this mainly referred to large-scale projects recording investment volumes of 50 million euros and more.

Berlin. Where is Europe headed? Will hotels be financed again and if so, how? At the International Hotel Investment Forum in Berlin, ways of financing, types of agreements and expansion strategies were in the focus as usual. The willingness to lend still differs strongly from the willingness before the crisis. For the operators this means: they have to spend money in order to get agreements.

Munich. In 2010, providers of closed-end funds relied less often on hotels in German investments than in the year before. However, concerning foreign funds objects, the niche segment has come back into the focus of investors again more frequently.