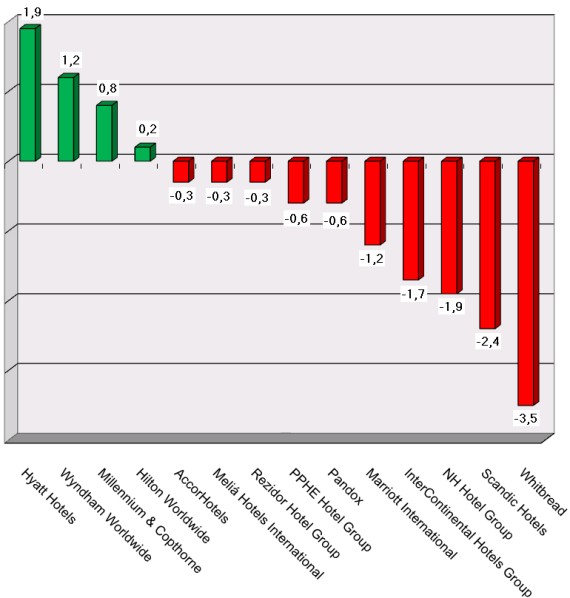

HI+Share price performance of the week 09/06/17 - 15/06/17

Changes %

Source: Faktiva / powered by HVS EMEA Enews

Vienna/London. The shareholders meeting of Kneissl Holding on November 23rd went off very successfully for Kneissl's Managing Director Andreas Gebauer. Mohamed Ben Issa Al Jaber apparently wants to invest an additional 1.2 million euros in the business - apparently in order to protect his daughter.

Vienna/London. Several petitions for bankruptcy are threatening “Kneissl”, the traditional brand from Tyrol. The ski manufacturer has been resurrected under new ownership time and again after economic disorder, but the latest alarm call surprises owner Mohamed Bin Issa Al Jaber due to his 60-percent share of Kneissl. Among other things, Al Jaber owns JJW Hotels.

Munich. Equity capital is still rare. Consequently, security and fixed lease agreements are at the top of the agenda among banks and investors. In the meantime, they grant credits solely to “model students”. From the banks’ perspective, these are mainly well-established hotel chains and operators. However, medium-sized hotel companies go away empty-handed for the most part. They are suffering increasingly from the massively tightened lending restrictions. At first sight, the economy is developing surprisingly dynamically in the German real estate and hotel market, but on the other hand, it is highly dependent on the global industrial and financial markets. And that is the catch.

Frankfurt. The times when the initiators of Euro Ejendomme AG celebrated their debut in Germany with champagne are over; the Danish commercial real estate investor located in Frankfurt is now facing its end. The Frankfurt local court ordered preliminary insolvency proceedings on September 22, 2010.

Bangkok. Dusit Thani’s shareholders have approved a major property management project to have three of its luxury hotels under the umbrella of a property fund, as well as to invest in up to one-third of the fund’s investment units and manage the three hotels.

London. Invesco Real Estate announced the launch of a second pan-European hotel fund with an exclusivity agreement to purchase a 168 million Euro seed portfolio.

Munich. Even two years after the dramatic start of the financial crisis, the financial resources are only coming in a slow trickle. And this will not change in the next few years, said experts at the hotel conference "Hospitality Industry Dialogue" during the Expo Real 2010 last Monday. The funds and finance representatives gave the high spirits at the trade fair stands a hard dampener – and pointed out the contradictions between the capital overflow in the market and the slow cash flow.

Paris. On Tuesday, the French listed real estate investment trust Foncière des Murs has signed a purchase agreement with the B&B group for a portfolio of hotels, representing 1,980 rooms, for a price of approximately 85 million Euro including fees.

Hamburg. Union Investment is not adverse towards concluding franchise agreements. This type of operation is another opportunity for the open investment fund of investing in hotels. However, strong brands are in high demand as partners. But Union Investment is also interested in professional franchisees in the form of individual hotels at highly attractive locations. Dr. Frank Billand, Managing Director of Union Investment, on funds and franchising – an issue he and his team would like to discuss at this year’s Expo Real.

Frankfurt/M. According to Hotour consultancy, a second wave of the structural change lies ahead of the German hotel industry. After the number of chain hotels has nearly tripled in the last ten years, lease agreements are now expiring for many hotels.