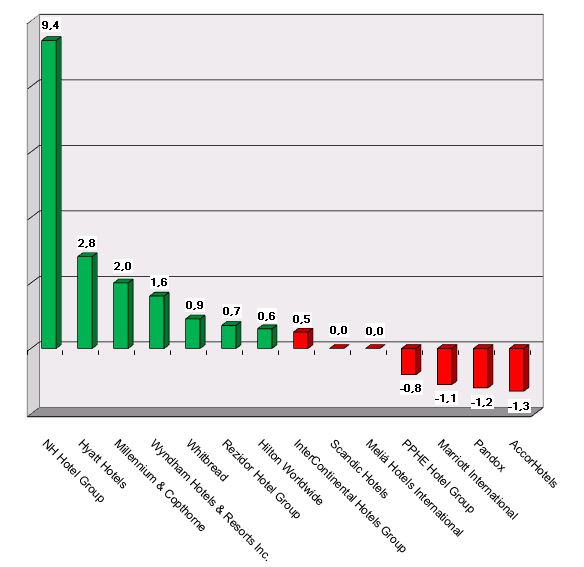

HI+Share price performance of the week 01/03/19 - 07/03/19

Changes compared to the previous week in %.

Berlin/Frankfurt. With a capital pool of ten million Euro, a new company intends to buy ailing medium-sized hotels in Germany, place them under interim management, improve returns and sell them again after just four years. The new company includes some famous names from the sector.

Berlin. Trends, investments and emerging markets were the subject of the panel discussion "Around the World in 40 Minutes" at the 16th International Hotel Investment Forum in Berlin last week. But in the end, it all comes down to the burning question: Where do the investors come from for the takeovers and projects in Africa, China, Europe and Russia? The appetite of the purchasers is enormous, there should be enough purchase opportunities everywhere, but foreign investors do not seize the opportunity everywhere.

Bremen. The budget design hotel brand prizeotel from Bremen has won over a strategic investor for further expansion.

Vienna. The building sector and capital pushing for properties that are stable in value stimulate Austria's hotel investments. This is the reason why the Oesterreichische Hotelier-Vereinigung sees established private hoteliers – especially resort hoteliers – under pressure. Hotels run by families have to deal with issues like real estate and added value more intently. Experts point out that revenue is primarily generated by hotel property; however, hotel financing via apartments is a cause for concern, according to the experts.

Berlin/London. In April 2013, the German Meininger Hotel and Hostel Group will become a one hundred percent subsidiary of its current shareholder, Holidaybreak, from Great Britain. The current Managing Directors will leave the company.

Frankfurt. As of July 22, 2013, everything will change for the funds industry - for open-ended, closed-ended and special funds. On this date, the new AIFM Directive enters into force, providing a uniform framework throughout the European Union. Germany has taken an especially thorough approach and has also regulated the products. This was allowed by Brussels. Now, fund initiators and distributors must find their way around in this new world. At the "VGF Summit", the fund industry‘s annual jour fixe in Frankfurt, it was clear: Not all fund managers will survive the change. Since many funds are used to finance hotels, the development is also a serious matter for the hotel sector.

Bad Doberan. The Grandhotel Heiligendamm and initiator Anno August Jagdfeld just don't seem to escape the headlines. Whilst the next, already the third, public prosecutor is investigating Jagdfeld, the administrator of Heiligendamm, Joerg Zumbaum, is searching desperately for investors for the insolvent Grandhotel Heiligendamm.

Vienna. This year, more hotels should make use of the Austrian "tourism bond". However, the next credits are already subject to restrictions.

Bremen/Hamburg. The industry has pulled through the recent financial and economic crisis well. Yet now, the signs are increasing that the luxury hotel industry may be one of the biggest losers - and more: It may even be threatened in entirety. The insolvency of the 5-star Parkhotel in Bremen this week and the knock-down sale of Hamburg's world famous Vier Jahreszeiten all point in this direction. Today, Germany's luxury hoteliers are increasingly having to perform a balancing act in dependency of incalculable banks at one end and a volatile economy at the other.

Munich. Is the entire debate about crises really necessary? Regarding the figures in the real estate market superficially, this seems to be true. The results of the properties were top in 2012, and experts are expecting a similarly high demand in 2013. Because of the low interest, material assets are still very popular. However, when analysing the matter in depth, it quickly becomes obvious that the framework conditions are not developing very well. In Europe, the north-south divide is becoming more apparent, amongst others. Due to Basel III the banks are even more restrictive. Private equity is replacing vanishing funds... Experts are giving only special segments a chance – such as the hotel industry.