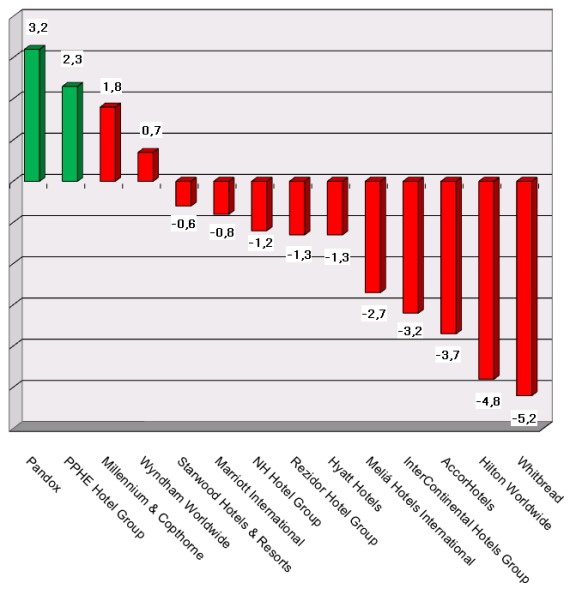

HI+Share price performance of the week 04/12/15 - 10/12/15

Changes %

Hamburg. Union Investment Real Estate, active in the hotel business since 1971, is among those German real estate funds which have invested most heavily in the hotel sector. The company is also among the leading real estate investment managers in Europe. The real estate portfolio held by Union Investment Real Estate currently includes 17 hotels with over 5,200 rooms at a value of approximately 1.3 billion Euros. Across all funds, hotel investments account for 9.5 percent of the value of the fund. The photo shows the Steigenberger Hotel Hamburg, part of the Europa funds of Union Investment.

Frankfurt. DekaBank plans on extending its real estate product palette for institutional investors. The new product family goes by the name of "WestInvest Target Select" and is aimed exclusively at institutional investors looking to invest in specially tailored and very individual funds concentrating on the asset classes: logistic, hotel and retail property.

Paris. Colony Capital and Eurazeo will keep 17,5 percent of Accor's capital und announced to own 30 percent of the company's shares. Both investors said that they are not interested in gaining the control of Accor. Accor's Board of Directors comments the plans.

Berlin. Finance crisis? Credit crisis? Money crisis? Whatever you call it, a palpable loss of confidence has taken foothold within the financial industry, and its roots are in the USA. "Confidence has been scattered by the wind", Norbert Walter recently said, chief economist of the Deutsche Bank. Several banks in the USA, England, France, Switzerland and even in some German states stood/stand before meltdown. Across the globe, financial markets went crazy and central banks rapidly approved cash injections - the most aggressive from the Fed, America's central bank. The aim: To recreate trust among banks and so encourage inter-bank lending. A summary of the current state of play and thoughts on the question 'Who rates the rating agencies?'

Vienna. Austria's 4-star hotels pay an average 6.42 percent of their turnover for lending rates. This is the result of a recent query of the Webmark Hotellerie industrial comparison system initiated by hospitalityInside.com. The data are based on the 2006 balance sheets. In future, hoteliers will have better tools for monitoring banks at hand. Thanks to a new application, they can make their own bank rating.

Wimbledon/London. The US Blackstone investment company is entrusting an external entity with its hotel business: Axios Hospitality headquartered in Wimbledon near London. A team of 15 specialised asset managers and financial experts is currently providing operational asset management advisory services on a portfolio of 136 hotels with 24,000 rooms all over Europe. Most of these hotels are located in Germany and France. Managing Director Andrew Katz talked with hospitalityInside.com about the company itself and Axios' expectations of the hotel industry.

Cairo/Zurich. The Orascom hotel group of the Egyptian entrepreneur Samih Sawiris, which is strongly engaged in the canton of Uri, will move its headquarters to Switzerland and will be listed on the Swiss stock exchange. With this move, the Egyptian entrepreneur backs up his gigantic tourism project in Andermatt.

Berlin. If last year's IHIF had a slightly "top of the wave" feel to it then the clouds have moved in and a far more cautious mood prevailed last week. Unsurprisingly less so amongst than those reliant on a transacting market and the economists and forecasters. The International Hotel Investment Conference in Berlin focuses on the hotel market there is less talk about hospitality and more about creating shareholder value, churning assets and share price. "We don't sell hotels to hoteliers anymore but to investors who are looking at all types of real estate investment", explained Derek Gammage, Managing Director, CBRE Hotels. Or as the conference chair, Andre Martinez, Managing Director and Charirman Global Lodging, Morgan Stanley put it "delegates are here for deals, debt or jobs".

Munich. Never have there been more providers, more fund models and more fund investors as in the last year. Total fund volume came close to record levels. In the real estate industry, hotel investment funds grew alongside foreign property funds. Currently, hotel funds are particularly attractive to institutional investors.

Munich. The corporate tax reform, effective from 1 January 2008 not only entails trade tax advantages for German companies, but also considerable trade tax disadvantages, especially for lessees of hotel properties. A comparison shows the significant new tax burden according to the new law.