News & Stories

Berlin. The noticeable public pressure led to a five-step plan for gradual relaxation in the corona country Germany. It met with great criticism and disappointed the gastronomy and hotel industry in particular. The pressure continues to grow. Meanwhile, Martina Fidlschuster, Head of Hotour Consulting has other ideas for the benefit of the hotel industry.

Madrid. Spain's tourism is facing a high risk: high unemployment. Statistics see 40% of the working population being inactive. More than half of them work in tourism.

Bern. Despite open hotels and cable car stations, the Swiss hotel industry continued to lose heavily in turnover in February. The prospects for the summer are dramatically poor. Assistance for hardship cases is becoming increasingly important.

Wiesbaden. The hotel industry is tired of the absurd Corona measures. And not only them. Hesse's Prime Minister Volker Bouffier summed up the current mood: "People are fed up," said the CDU politician. At last there is movement. The unjustly scapegoated hotel industry stand at the barricades. Also because the statements of politicians and virologists on vaccination, testing and relaxation are becoming more and more opaque and contradictory. An overview with headlines.

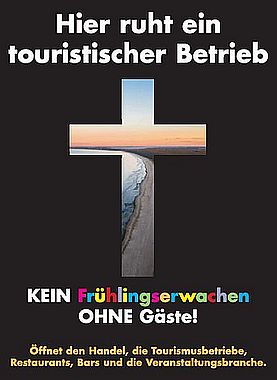

On Germany's sunny island of Usedom, the hotel industry will be laid to rest this weekend: the Usedom Hotel Association, whose establishments are still not allowed to open after four months of lockdown despite dreamlike spring temperatures, is organizing a drastic poster campaign to draw attention to the sad situation of the tourism industry. The black posters depict a tombstone, with the designated inscription "Here rests a tourist business" emblazoned above it in large letters.

Vienna. Fresh from market researchers: planning of travellers is in full swing. They are ready to go. Only quarantine rules might keep them from taking a trip to another country. Among others, Austria is spending 10 million euros on promoting city and culture tourism.

Rome. Italy has a Ministry of Tourism again, Massimo Garavaglia. He inspires some hope, but reality is tough. Hoteliers expect 14 measures to be adopted. The current disaster is obvious.

Bern. Open hotels, interest-free loans from the state, even transferred on time, as well as testing in the near term have so far kept the pandemic in Switzerland within reasonable limits. The government and all tourism associations recently met to demand an exit strategy. "The Swiss way is the good way" declares Andreas Züllig, President of Hotelleriesuisse, the Swiss hoteliers association, in our interview.

Madrid. The Spanish hotel industry wants to benefit from the EU Recovery Fund and expects 2 billion euros for investments in hotels, hotel groups and destinations.

Innsbruck. Historically a first: Austria issues special restrictions for its own province Tyrol. The aim is to stop the dangerous virus mutation from South Africa. It looks like a farce.

Berlin. It was a bad symbol: the cancellation of ITB 2020. It was the prelude to the pandemic drama in tourism and the hotel industry. In 2021, the trade fair will attract visitors purely virtually for the first time. But who is "going"? Not so many, say our research. Hotels, hotel groups and PR agencies are hesitant. The fair speaks of 300 hotel exhibitors. The world's largest contact exchange in tourism is turning into the world's largest PR event on the screen.