News & Stories

Madrid. Idiso, the Spansih booking platform and service provider, is soon to enter the German market, targeting medium-sized hotels as well as chains and enabling its customers to pay for individual services "per use”. Idiso originates from Meliá Hotels.

Paris. Expedia has been sentenced to pay 1 million euros by a French court for "illegal practices". The group is not willing to accept this decision – in contrast to Booking.com earlier. Meanwhile, Expedia's competitor is building up benefits – by allowing its users to now book flights, cars and even restaurants.

London. Higher Google search volumes are strongly correlated with higher hotel demand levels, according to an analysis from STR and Google.

Mayrhofen. Digitisation at the highest level can bring tourism organisations better into play – for example, by supporting hotels with new forms of technology when it comes to pricing. Artificial intelligence will set room rates in the future. Chatbots in guest service and solutions for "headless Internet" provide further opportunities for destination management organisations in defining their role anew. "The DMO will become the digital hub within a region, as individual service providers are not able to cope with this task in terms of technology," said Reinhard Lanner, social media consultant from Salzburg, Austria, in the course of "Tourism Fast Forward", Austria's hotspot for tourism experts and e-business start-ups.

Nuremberg. The Semantic Web is changing the world. Machines recognise language and learn to speak with people – ever faster and increasingly better. The "great leap" is imminent, University Professor Dieter Fensel is convinced, Head of the Semantic Technology Institute at the University of Innsbruck. The internet has been around now for 25 years, Fensel reminds us. "Yet the future no longer belongs to websites, but rather to personal assistance services. Many young people, who only go online with their mobile phones, will no longer know the World Wide Web." The world will become a global village and privacy an illusion. And platforms such as Booking.com will soon disappear. Fred Fettner interviewed an academic who can explain the trend towards more Artificial Intelligence and a very different life.

Amsterdam. New. Power. Distribution. This was the title of Simon Lehman's introduction speech during the last European Phocuswright event in Amsterdam. In a twenty-minute statement, the President of Phocuswright drew a portrait of the European travel market, which grew only by +2% in 2016. He also outlined the "revolutionary" changes of the airline and hospitality industry.

Amsterdam. OTAs are growing much faster than the US hotel market itself – for the first time in 2016. Phocuswright revealed this milestone at its European conference in Amsterdam some weeks ago. By the same token, hoteliers are now increasing the pressure on online agencies – from direct booking campaigns and loyalty program incentives to concerted lobbying efforts by the unions. Will Expedia and Priceline, which combined, share 90% of the American market, feel the heat? The tech giants play in a different league where hotels have become commodities. Hoteliers have only one chance and that is to increase their multi-channel presence and drive traffic via their own website.

Cologne. HRS wants to bring hotels and companies with business travel needs even closer together – via its "Market Place". Advertising for this new platform commenced last week and is intended to help individual hotels to secure their piece of the corporate business cake.

Paris. AccorHotels' mutation from a hotel group to an OTA is in progress. This week, the group launched a new service of pre-packaged trips on the French market including flights and is betting at the same time on the upscale catering group Noctis.

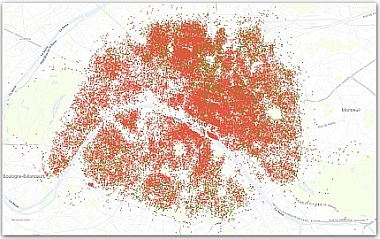

San Francisco. Enforcement of regulations by French authorities towards the Sharing Economy is getting tighter. Since May 1, 2017, a new decree published in the Official Journal allows major cities in France to obligate Airbnb's hosts to officially register. Only licensed units can now legally be listed online. It takes time and plenty of energy to fight against multi-billion dollar corporations, but French hotel unions are proving once again that sometimes, tenacity pays off. Amsterdam is also suffering: Research shows that 35% of rooms in the Airbnb Amsterdam section are offered by professional landlords. The city is reacting, too. And Airbnb is feeling the heat, but still not playing fair.