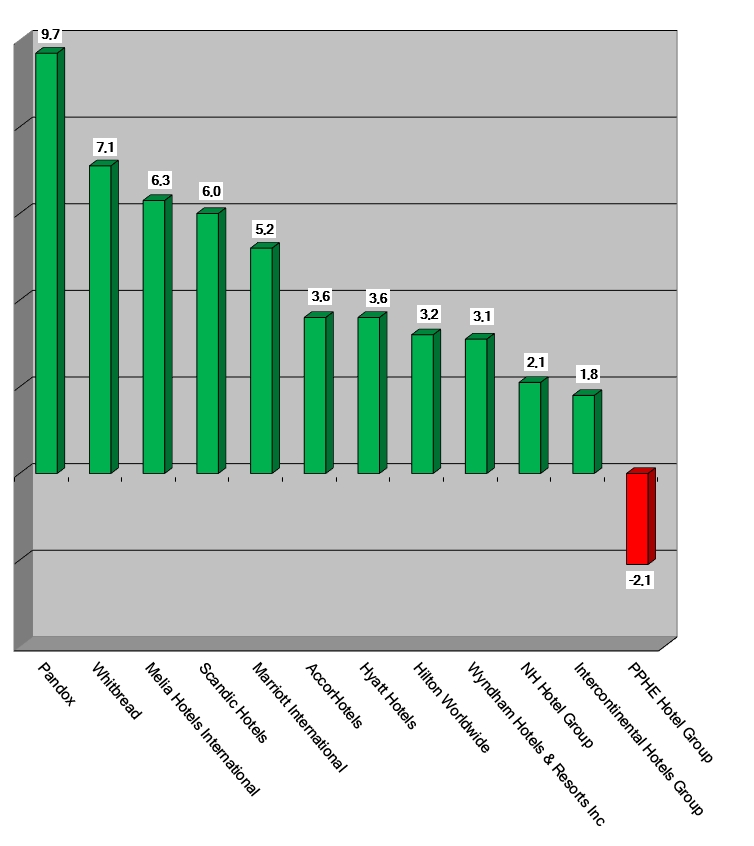

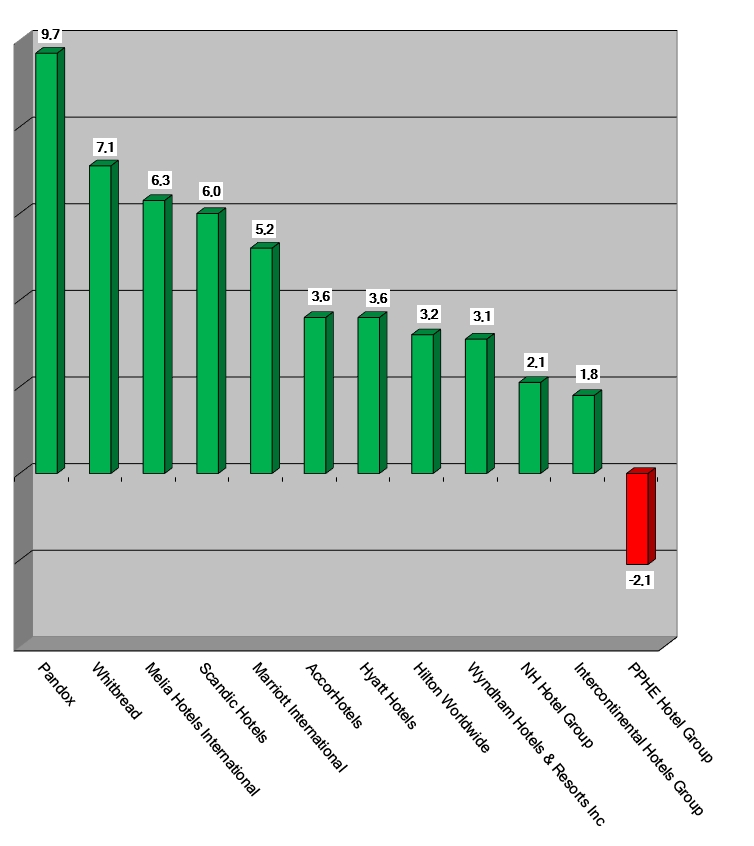

HI+Share price performance of the week 24/03/2022 - 30/03/2022

Changes compared to the previous week in %.

Source: Reuters

powered by HVS EMEA Enews

Munich. Digital tools help to make things faster and more efficient. For the construction, proptechs and contechs, as the startups in the real estate and construction industry are called, help to speed-up processes. They approach many things differently; behind the scenes, they are equipped with a lot of IT knowledge, invest a lot of work effort and entrepreneurship. And it is worth taking a closer look, also in the hotel industry's interest. A growing number of startups are discovering this industry, partly driven by Covid-19 as well as the technological progress in China.

Munich. It's a bizarre situation: While storm clouds increasingly gather over the hotel operators, open-ended mutual property funds are still able to hold their own, even in the corona crisis. Yet it will be near impossible to escape yield losses and devaluations entirely. After all, lease deferrals and defaults are likely to increase. This does not seem to be worrying investors yet though.

Cologne. In the middle of the crisis, Cologne-based Art-Invest Real Estate has placed a €200 million equity hotel fund with institutional investors. Including a new strategy.

Los Angeles/Zürich. The industry is beginning to shake, especially on the owners side. Both large hotel portfolios and individual hotels are being hit. Last week Accor shareholder Colony Capital withdrew completely from the hospitality business, the American Service Properties Trust is now confronting Marriott with payments just like IHG, and in Switzerland Credit Suisse is getting rid of its next hotel, the Swissôtel in Zurich-Oerlikon.

Berlin. The German government has extended and expanded its corona bridging aid for small and medium-sized enterprises. Access has also been simplified. However, large parts of the hospitality industry will not be reached by it at all.

Berlin. With a "support loan" of 700 million euros per year, the Berlin entrepreneur Michael Zehden, founder of the hotel operator Albeck & Zehden, wants to help the almost 800 accommodation facilities in the German capital. The loan is to be repaid after ten years at the latest - via a so-called "Corona levy" of three percent, to be paid by the guest. Zehden's proposal has now reached Berlin's politicians and public, we are presenting the idea and also putting it up for discussion.

Stuttgart. While Dehoga Federal Association is still struggling to expand the current bridging allowance for the hospitality industry, the state of Baden-Württemberg has extended the application deadline and funding period for its own aid programme. Dehoga Hessen and Bavaria continue to rely on the initiatives of the federal government.

Hamburg. The opportunities for German hotel operators to be able to straighten out their financial losses from official sources are limited. An update on this was provided by the law firm Hogan Lovells.

Hamburg. Already, brokers and lawyers offices are being stormed by capital providers from outside Germany on a daily basis. The focus of their interest: distressed assets from Germany. Whimsical banks are dropping the asset class hotel without second thought, and stubborn owners insist on their rights. "Over the next 12 months, we will be faced with many things," Marc Werner said, Managing Partner of Hogan Lovells Frankfurt, at the 12th Hogan Lovells Hotel Day.

Hamburg. The corona crisis has led to a significant change in the investment strategy of institutional property investors. "Less risk, lower return" is the motto of the day. Climate-friendly investments are picking up speed.