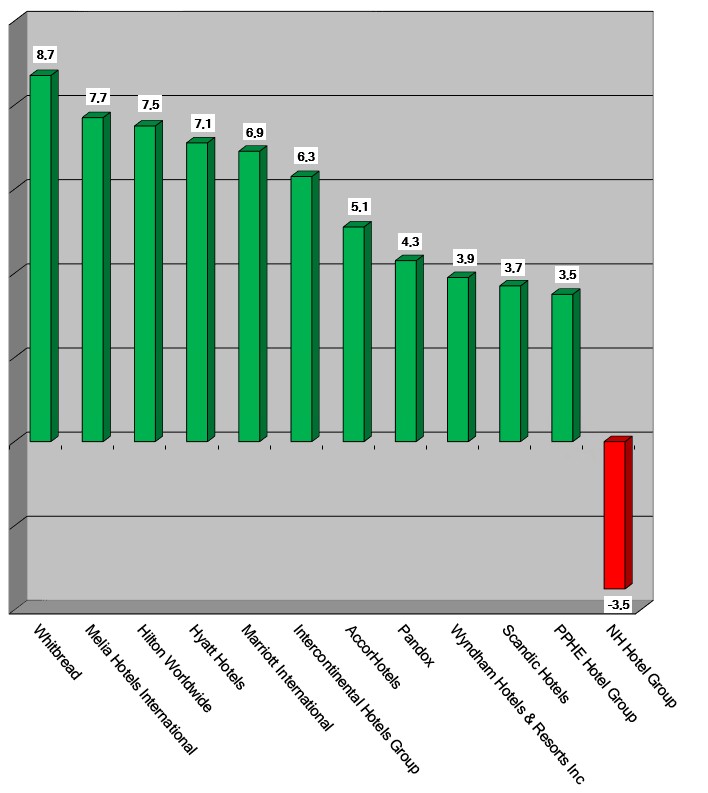

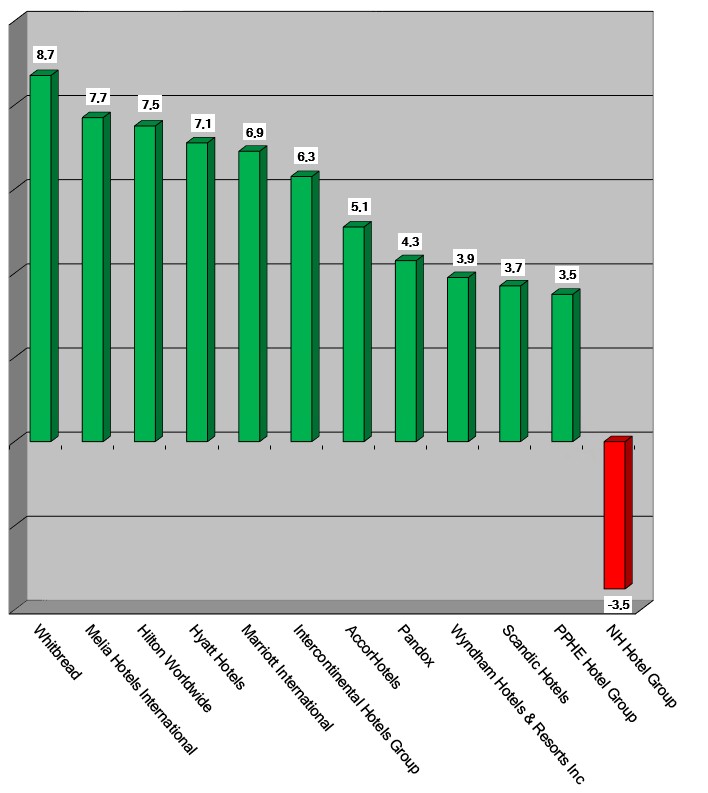

HI+Share price performance of the week 01/10/2020 - 07/10/2020

Changes compared to the previous week in %.

Source: Reuters

powered by HVS EMEA Enews

Munich. Investments in the real estate sector are currently experiencing a veritable boom. Outside Germany – in particular in the US and in Asia – Real Estate Investment Trusts, or REITs for short, are very much in demand. They shape the face of the real estate markets, providing a transparent and simple investment vehicle for indirect investments in hotels, offices or shopping centres and with attractive returns too. In the US, this vehicle is also popular in the hotel industry. In Germany though, investors have difficulty with this special form of real estate stock which represents a sort of stock-market listed real estate portfolio. Beatrix Boutonnet explains.

Frankfurt. More and more investors are placing their chips on the asset class "hotels" in their search for yield. The former niche product has in recent years evolved into an established product - driven by falling returns and a lack of opportunity in classic real estate. Yet as before, only those investors with corresponding insider knowledge are happy with hotels. This fact is meanwhile well-known. At the annual conference of the Federal Association of Real Estate Investment Experts in Frankfurt, even high-calibre experts warned of the end of the general cycle in the sector.

Stockholm/Amsterdam. When it comes to investing abroad, China is "a big spender". According to the Chinese Minister of Commerce, the country's investments in global markets in the nonfinancial sector surged by 53.3% year on year to reach 145.96 billion dollars between January and October 2016, already surpassing the total for 2015 of about 121.4 billion dollars. A fair share of these investments concerns real estate and hospitality industry. Now China is about to set new rules for outbound investments, it was heard. With hospitalityInside.com, three hospitality experts share their opinion about the Chinese hunger for investments overseas, their strategic thoughts, their non-communicative attitude, the culture clash, and labor: Professor Dr Wolfgang Georg Arlt, Director at COTRI who has 30 years of experience working with Chinese partners; Jileen Loo, Director International Capital Markets at CBRE Hotels Limited in London, and Cornelia Kausch, Head of Development at Pandox Hotels.

Augsburg. Is your hotel real estate located in Germany? No? Then you're missing out. "Located in Germany" appears to be worth a lot of late, more than in the rest of Europe. Valuation multiples soar. At the same time, complaints of greedy price-inflating bidding processes are impossible to miss. The entire scene is also driven by geopolitical factors, recent election results and persistently low interest rates. As the year draws to a close, real estate scouts are becoming increasingly breathless as they race from deal to deal. Renowned buyers and vendors, consultants and brokers give their responses.

Cologne. The long and arduous restructuring process for the German Dorint Hotels & Resorts is now entering its final phase: The close web of relations between Dorint Hotels and the underlying funds of the parent company E&P is being systematically picked apart. Dirk Iserlohe, Managing Partner of E&P Holding based in Cologne, has established HONESTIS AG - together with new investors and a new company structure. In the following interview with hospitalityInside.com, he speaks comprehensively and with figures on the plans and details of the restructuring. "HONESTIS represents a clear 'cut' away from the prior connection between operator and lessee," he says. "I will continue to shore up the market position of Dorint Hotels & Resorts in the 4-star full-service conference hotel sector in German-speaking Europe and will not be distracted from this goal - from 2017 with HONESTIS AG - by anything or by anyone."

Vienna. On 20 September 2016, a neutral crowdfunding platform went into operation for Austrian tourism: www.we4tourism.at. Since levels of equity in the hospitality sector are low, the Basel III reforms, which have introduced a barrier to necessary investment, have given rise to alternative forms of finance for Austria's tourism industry. The new form of finance has become possible thanks to the Alternative Finance Act, which entered into force in September 2015. A number of trailblazers have already used crowdfunding for tourism projects, both before and immediately after the introduction of the new law. Here, not everyone acts with as much security and as successfully as Harry's Home though, a company with hotels in Munich, Graz, Linz, Dornbirn and, from 2018, also in Zurich.

Amsterdam. Uber, Airbnb, etc…has the business model of these companies reached its limit? Financial results of both entities show an increasing number of bookings but constant losses. Keeping market shares costs a lot, so do drivers' subsidies for Uber and legal actions and new regulations for Airbnb.

Munich. The new standard for lease accounting is allegedly intended to ensure greater transparency and improved comparability. IFRS 16 therefore puts an end to off-balance sheet models - without transitional provisions or exceptions for existing contracts. From 1 January 2019, every type of leasing agreement must be included on the balance sheet. This also poses a challenge to certain sections of the hotel industry as lease contracts - both new as well as existing - are included under the definition of leasing. What listed hotel operating companies must now expect - and what solutions are available, is explained in this article by our author Beatrix Boutonnet and is based on her interviews with experts at Colliers Int., JLL, Roedl & Partner, Jung & Schleicher, Bayern LB, DG Hyp and the Deutsche Hypothekenbank.

Munich. For professional investors such as pension funds, family offices, banks and insurers, hotels play an increasingly important role. This is the finding of a survey by the Austrian project developer Soravia Capital GmbH, which was conducted in collaboration with REFIRE. According to the opinion of the 80 experts and managers surveyed, hotels, residential property, offices and retail property are in demand as investors expect an interesting return. The lion's share of those surveyed saw design budget hotels at the top of this trend. But does popular property also serve as protection from inflation? According to experts, the idea that concrete gold protects the investor from inflation is only partially true, also for hotels.

Berlin. Everything is getting more digital, tight, scarce and expensive. The real estate market faces major challenges with respect to all asset classes – hotels and office, residential and commercial buildings. Innovative solutions for today's problems was thus the main focus of the German Property Federation's "Property Industry Day" in Berlin. Obviously, about 300 protesters wanted to speed up the process massively protesting against lodgings that are increasingly becoming luxury goods.