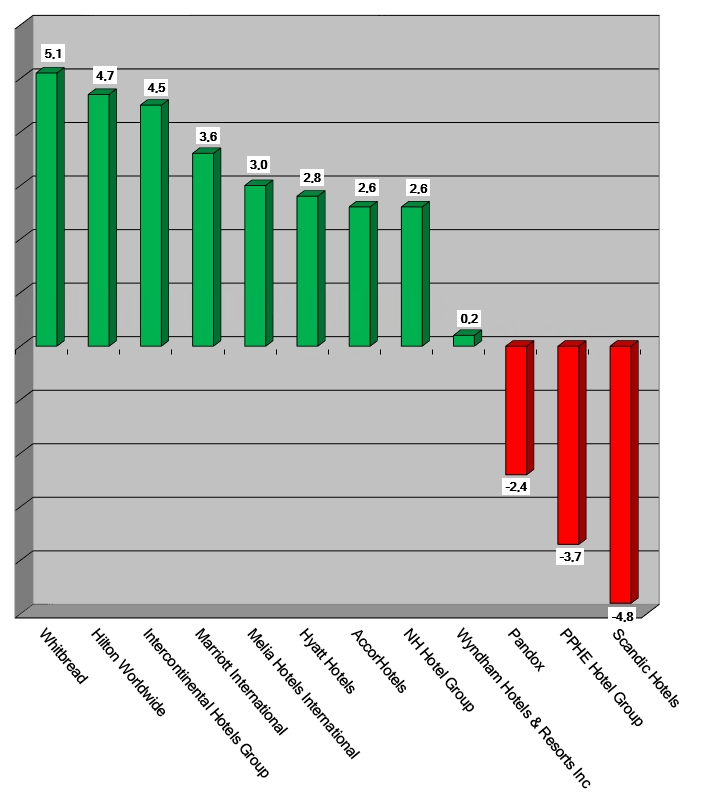

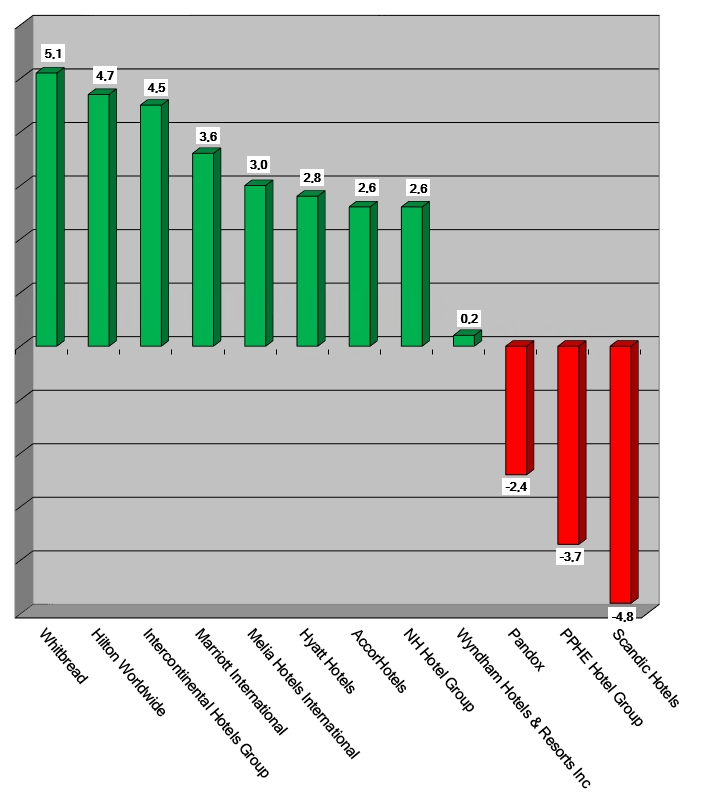

HI+Share price performance of the week 20/05/2021 - 26/05/2021

Changes compared to the previous week in %.

Source: Reuters

powered by HVS EMEA Enews

Munich. The discussion on return is taking a new path: It's no longer looking for the classical performance data but for new "KPIs" like revenue per square meter – given that hotel operators and investors alike are open-minded to check out new hybrid brand models, innovative services and new partners coming in from the non-hotel industry, such as co-working providers for instance. There is not much choice since from the outside, guest demand and local residents are urging the hotel groups as well. Facing the next downturn – the only question is when? – hotel investors, lateral entrants, and hotel operators discussed at Expo Real last week how to secure a stable ROI for the near future.

Munich. Boom times are times of inspiration. Strong demand from German and international investors has catapulted the hotel sector to new heights. The main challenge now is in project development. There, the sector's ascent has meant an enormous change. Investment funds also support growth. A discussion round at the "Hospitality Industry Dialogue" last week, the hotel conference at Expo Real, focused on the deals of today.

Milan. Non-performing Loans have been a hot topic in Italy for a long time: bad debts are impacting national bank performance and remain a critical issue in discussions about the European credit system regulation. In tourism, however, NPLs are often viewed as an opportunity: a way that Italian and international investors could explore in order to acquire assets at competitive prices, to renovate or convert them into brand-new hospitality projects. But beyond many generic commitments, no one has tried to quantify the actual scale of these opportunities up to now. What is the value of these assets? And above all, which is their appeal towards investors?

Amsterdam. The Lehman crash ten years ago also changed the hotel industry. Many funds were created, the rate of return increased enormously and then became more modest, and the asset-light model of the hotel operators bore fruit. Parallel to the – still – increasing demand among tourists, new, young and fresh brand concepts appeared. The next crisis should not cause any severe harm to the hotel industry, according to Dirk Bakker, CEO Netherlands & Head of Hotels EMEA at Colliers International, Amsterdam – even if the industry has not learned anything from the crisis. An assessment for the opening of Expo Real Munich, which will start next Monday.

Brussels. Less than a year after the enforcement of the GDPR, European businesses are facing new regulations. In January 1, 2019, the new lease standard or IFRS16 will come into effect and businesses will have to comply. As with the GDPR, the topic is legally sensitive and will have an impact on more European companies than one thinks. Experts say: The new standard will increase debt ratio by 22% in general. Be prepared!

Frankfurt. Rising real estate prices, horrendous rents and a shortage of properties are causing concern in the sector – and not only in Munich, the city which has seen the sharpest price increases. There are many presumed causes for these trends. Gradually though, there are increasing signs that ever new record profits are becoming less likely as investors are having increasing difficulty in finding profitable properties. A new study from the real estate research company Bulwiengesa put yields at between 2 and 7%. Hotels were in mid-field at 3.5%, but are also under pressure. Compared to other asset classes, the sector still makes a good figure though.

Amsterdam. "Trying to understand the cycle of investment is…complicated. Even economists often don't get it right." Head of investment properties EMEA at CBRE Hotels in London, Colin Low set the tone when he took center stage at the annual "Hotel Investment Seminar" organized in Amsterdam last week. Taking on the challenge anyway, the former investor took a look at the past ten years and considered the billions of dollars of capital that have gone into real estate. Focusing on Europe, Low shared one big number: 290 billion euros.

Paris. News from the financial world: This week, Katara Hospitality based in Qatar and AccorHotels announced the creation of an investment fund of over USD 1bn dedicated to hospitality in various Sub-Saharan African countries.

Milan. The Council of Ministers has just approved a new law decree called “Decreto dignità”, aimed at reducing job insecurity. The new measure is intended to reform a few working measures, including provisions regarding compensations for illegitimate dismissals and fixed-term contracts. Investor interest towards Italy keeps growing, but the country still struggles to take advantage of all its potential. If we accept Cassa Depositi e Prestiti and its tourism investment fund, the market substantially lacks capital provided with a long-term approach, while the hospitality real estate segment is dominated by opportunistic investors with a five-year vision at most. "The real issue is that we need more certainty on the timeframe: the only way to let international investors develop reliable business plans for long-term projects," explained Giampiero Schiavo, CEO of the asset management company Castello SGR. He spoke during a recent hospitality forum organized in Milan in collaboration with the consulting firm Scenari Immobiliari.

London. The Serviced Apartment segment is reaching a new peak. And: The number of corporate travelers staying in serviced apartments is growing tremendously. A new study underlines the huge success of this branch of the hospitality industry.