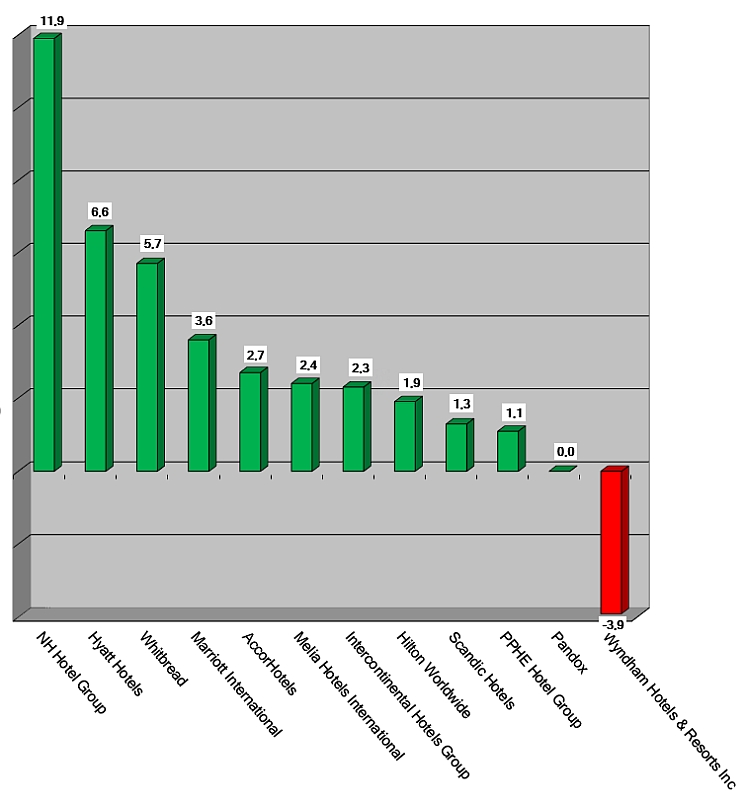

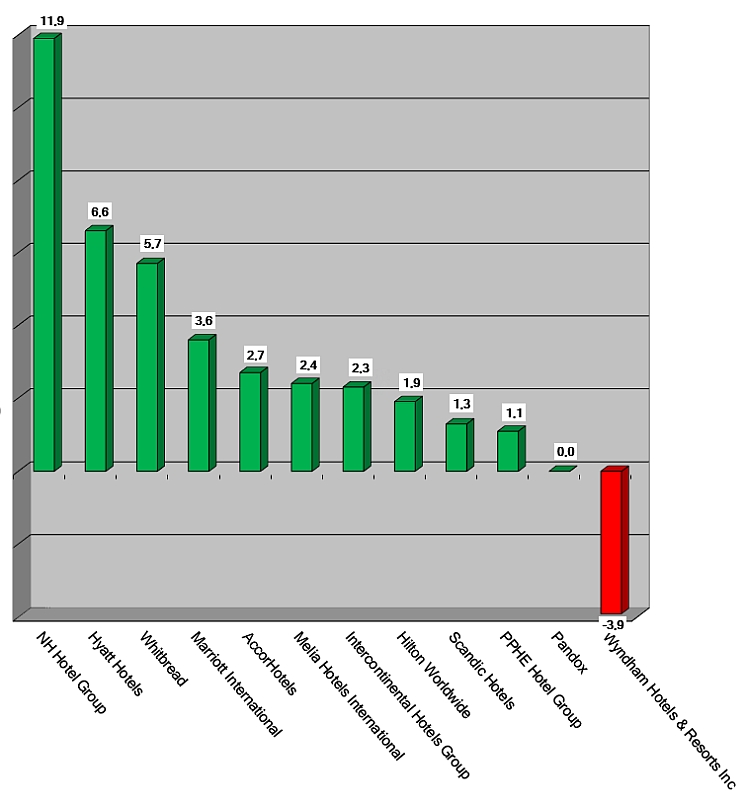

HI+Share price performance of the week 11/02/2021 - 17/02/2021

Changes compared to the previous week in %.

Source: Reuters

powered by HVS EMEA Enews

Wiesbaden. The German hotel real estate market remains very popular for both domestic as well as foreign investors. Nonetheless, the transaction volume in 2017 lagged behind that from 2016, which was certainly in part due to the shortage of properties. However, another factor could be in play here, namely the fall in yield expectations. That yields are falling – and not only in Germany – is meanwhile fact. The pendulum has swung towards Eastern Europe, it seems. Poland, above all, has increasingly attracted investors' attention.

London. Hotel lenders' confidence in the hotel industry has not suffered from the geopolitical headwinds of the last year: Debt is available across all hotel projects and segment types, including new developments. But banks remain cautious. A study reveals details of the current hotel financing.

Riad. Prince Alwaleed bin Talal is free. The chairman of Kingdom Holding Company has been released from his detention at the Ritz Carlton in Riyadh after more than two months. The multi-billionaire seems to have reached an agreement with the government, although he still denies allegations of corruption, money laundering and extortion against him.

Riyadh. It's been two months now since Prince Alwaleed has been under arrest over corruption allegations. Rumor has it that his cousin wants his empire in exchange for freedom. While Alwaleed is challenging his own cousin, according to "Forbes", his Kingdom Holding Company has lost nearly a fifth of its value since the prince has been in detention.

London. Key money constitutes an upfront payment by a hotel chain to a hotel property owner in order to secure a management or franchise agreement and is most frequently used in markets where the competition amongst chains to secure a desirable property is particularly intense.

London. Besides new alternative lodging concepts, there are some emerging financing structures which are providing innovative ways to fund deals. Ground leases and income strips are gaining broader acceptance, while sale/leasebacks are making a comeback.

Riyadh. Since Prince Alwaleed bin Talal's arrest two weeks ago in Saudi Arabia's anti-corruption crackdown, things aren't going as smoothly as before for his Kingdom Holding Company. Banks are showing some concern lending more money to the corporation whose investments are on hold.

Vienna. With its latest equity crowdfunding, Falkensteiner Hotels & Residences has set a new record for investments among medium-sized enterprises. Within one month only, the hotel group collected 2.5 million euros from investors. The interest rate is four percent. The funding was oversubscribed by about one million euros, investors offered more than 7,000 euros to Falkensteiner on average.

Munich. Open-ended real estate funds are currently swimming in money - much as though the financial crisis had never happened. Yet this isn’t really deja-vu. Since the prices for offices, shopping centres and residential properties have risen ever more sharply, fund managers have discovered a new favourite asset class: hotels. Is the new love of hotels by open-ended real estate funds a flash in the pan? Beatrix Boutonnet from hospitalityInside.com says not.

Munich. They have probably closed the biggest European hotel real estate deal of the year: In late summer 2017, Invesco Real Estate acquired the EUR 530 million heavy portfolio from the US American private equity investor Apollo Global Management. Robert Stolfo, Invesco Real Estate Managing Director - Client Portfolio Management Europe, and Hans-Peter Hermann, Invesco Real Estate Director - Asset Management Hotels Europe, gave an interview to Beatrix Boutonnet on their first open-ended fund for institutional investors, the increasing time pressure facing their segment, the new investor caution as regards leverage and on the interesting question on how best to package assets.