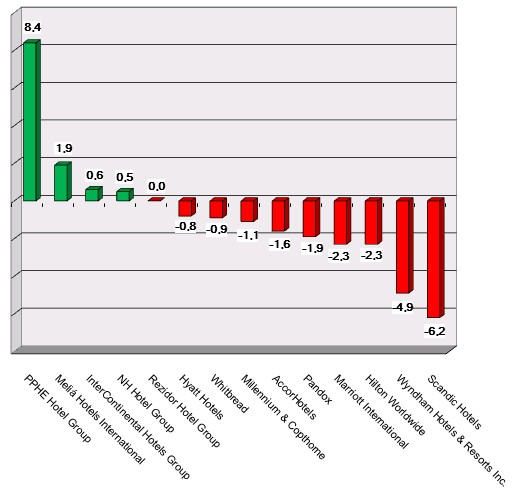

HI+Share price performance of the week 08/06/18 - 14/06/18

Changes in %.

Adenau/Eifel. Following the insolvency application of the Nuerburgring GmbH on Wednesday, the future of the race track and its new leisure park hangs in the balance. With this, the resident hotel operators Lindner and Dorint wait with mixed feelings.

Heiligendamm. The unending story of the Grand Hotel Heiligendamm continues: Now, the hotel is to give up 80 beds. There are also administrative threats. And some investors have even pressed criminal charges.

New York. The unconventional cabin hotel brand Yotel hit the headlines this week in the US: On the one hand, Yotel announced to issue a 250-million-dollar fund with three partners; in the next five years, the group plans to expand in North America. On the other hand, Yotel's first robotic luggage concierge led to chuckles all round. He works in New York.

Frankfurt/M. Another fund heavyweight falls as CS Euroreal is liquidated. The decision has been taken and a clear signal has been sent to the entire industry.

Dubai. The hotel investment climate in the Middle East and North Africa maybe improving, but the financial crisis in Europe, anemic appetite of MENA lenders to dabble in property financing and lack of transparency over hotel transactions is deterring genuine pickup. While sentiment to hotel investments has improved with the stellar performance in cities such as Dubai and Riyadh, banks have not been quick to complement the rosier outlook, said speakers at the "Arabian Hotel Investment Conference" that recently took place in Dubai.

Heiligendamm/Berlin. Insolvency proceedings have been opened; a suitable buyer for the Grand Hotel Heiligendamm has not yet been found and more and more investors have taken recourse to the courts.

Frankfurt. Now it's official: SEB Asset Management AG is set to liquidate the SEB ImmoInvest fund with a portfolio valued at over six billion Euro. The Frankfurt-based investment house cleverly decided to leave the decision to investors. And their will was clear: On the crucial date, EUR 1.9 billion in liquidity was insufficient to satisfy all redemption requests. As a result, SEB was forced to announce that the fund will be liquidated. Now, 132 properties must be sold over the next five years, including some renowned hotels in Berlin. The fund industry now stands at a crucial turning point, in particular since CS Euroreal also tries to follow the SEB model.

Munich. Times are difficult. Security is the key. Hotel properties as niche products and special properties with a lot of knowhow requirements hence seem to be questioned even more than before by current buyers. And this happens even more often as many open-ended real estate funds have to cope with their own problems. Closed-end real-estate funds have problems as well. Consequently, they tend to "play safe" when it comes to new investments. But not all investors regard office properties and retail properties as a panacea. Some established providers like Deka Immobilien, Invesco Real Estate and Fondshaus Hamburg deliberately rely on hotel properties as investment objects. They have good reason to do so.

Frankfurt. The hotel transaction volume in the EMEA region totalled nearly 1.5 billion Euro in the first quarter of 2012; about three quarters of this comprised single transactions. But it lags significantly behind the previous year.

Munich. Against the backdrop of the debt crisis, the increasing regulation of the financial market and Basel III, the shortage in financing is developing into the largest problem of the real-estate industry – and the hotel industry is no exception to that. Alternative forms of financing are needed. Is the financial crisis being followed by a financing crisis? The evaluations of banks, real-estate experts and loan agents. Amazing: Despite the continuing refinancing restrictions, market experts are not talking about a real credit crunch so far.