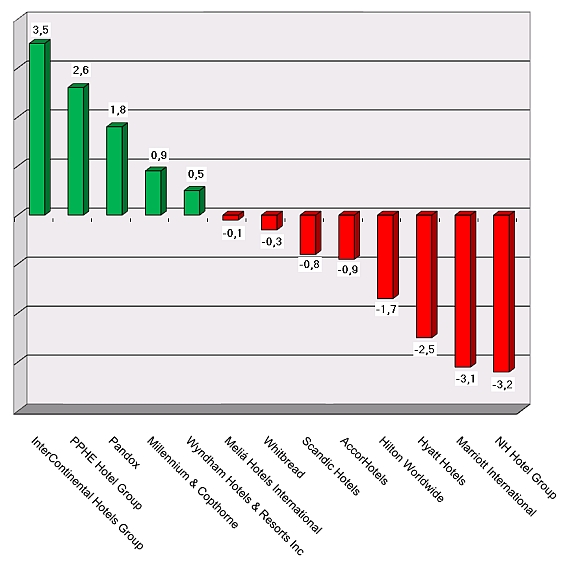

HI+Share price performance of the week 17/05/19 - 23/05/19

Changes compared to the previous week in %.

Bad Doberan. The new owners of the Grand Hotel Heiligendamm in northern Germany should have presented themselves to their employees on July 1, but things turned out differently. Part of the agreed purchase sum wasn't transferred. Meanwhile, the Director of Public Prosecutions is looking into the possibility of gang fraud against the presented buyers. The rumour here is of falsified finance documents. At the same time, there is also rumours of already completed entry in the land register. The general shock will now again be followed by difficult, long and complicated legal procedures in order to unpick the legal steps in the sales process. Only then can a new buyer again be sought and concrete negotiations begin. Meanwhile, Anno August Jagdfeld is selling the villas from the "pearl chain".

Zurich. Despite the rather difficult market environment, the Swiss hotel market continues to grow – especially luxury hotels are in great demand. With good reason, as hotel investors and operators say. A survey of the 5-star hotel industry in Switzerland reveals how attractive the Swiss hotel industry is for foreign investors. According to the survey, 40 percent were already owned by foreign investors in 2012. However, the motives are various. Only one thing is clear: the former family business has changed into an international real estate business, where the time of the transaction has become decisive.

Munich. Whilst South Africa is in the process of introducing REIT structures and sees them as an enrichment for investors, particularly in the hotel sector, Germany is having problems with the issue. Introduction of the REITs has been cautious. Then, they were to be included under the new AIFM Directive. Guidance provided by the German Federal Financial Regulator has, however, not included them.

Munich. Business with hotels continues to improve. Investors are tempted into hotels by higher returns than are available through offices. And tourists are again beginning to travel with Germany city tours on vogue. This means good figures for the hotel industry. Yet the industry shouldn't be blinded by this success as there are certainly a few areas which could become problematic in future. For the time being though, hoteliers are likely to see good results.

Heiligendamm. A real bargain for the investors in the end, but a total loss for fund stakeholders: Grandhotel Heiligendamm worth 127 million euros has been sold for 30 million euros. The future GM could be an old familiar to the luxury hotel sector.

Berlin. The wait appears to be almost over. Following the decision of the Finance Committee, implementation of the EU AIFM Directive has begun in Germany. The continued existence of open-ended and closed-ended real estate funds and special funds which also invest in hotels is now assured.

Bregenz. Family businesses dominate Austrian holiday tourism, but many of these businesses are heavily indebted. Now, an own fund is to encourage business takeovers.

Hamburg. Demand for low cost accommodation is rising with the economic crisis. With the UII Hotel No. 1 fund, Union Investment has now established a special fund for institutional investors primarily investing in budget hotels in a good micro-location. The fund makes 400 million Euro available for this purpose; a sum large enough to trigger the next budget boost on the German and European market. A look at the investment universe of the Hamburg-based fund company and its new approach with strong signal effect shows: The once ridiculed "cheap segment" has now taken the final hurdle.

Cannes. It would be wrong to understand the bad weather during the commercial real estate fair MIPIM as a sign of further problems to come for the real estate market. Commentators can certainly no longer speak on an "ice age" in the sector. The mood at the 24th MIPIM was, as many trade fair participants confirmed, certainly not exceptional, but it wasn't bad either. The sector appears to be on the up. The focus is again on "safe havens". Yet there are signs that investors are becoming less risk averse. New major projects were also again announced, and hotels are included in many of these.

Berlin. NH wants to further expand, but with the two new partners HNA and HPT on board, the financial situation of the Spanish hotel group remains strained. Central Europe boss Marten Markus explained the growth strategy of the group at the ITB.