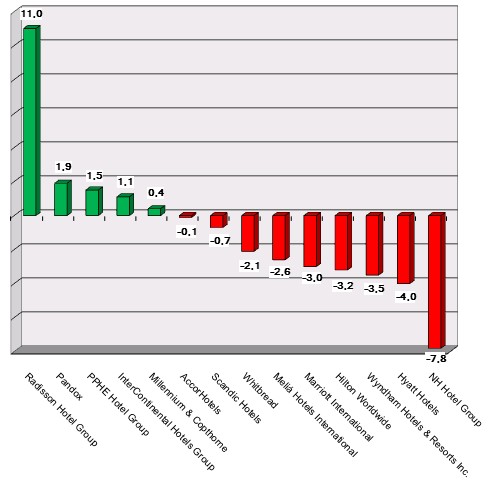

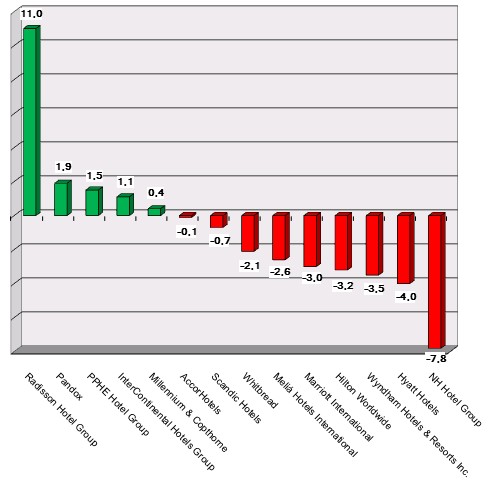

HI+Share price performance of the week 07/12/18 - 13/12/18

Changes compared to the previous week in %.

Source: Faktiva / powered by HVS EMEA Enews

Berlin. Negative headlines abound again with regard to the Hotel Adlon Kempinski and the man who had the Berlin luxury hotel built with investor funds: Anno August Jagdfeld. As was announced two days ago, Jagdfeld's son Benedikt is to spearhead the newly structured group. No easy job, as many criticisms of Fundus and Jagdfeld are justified. In the case of the Hotel Adlon Kempinski though, a more subtle assessment is required, in particular after the ratings agency Moody's warned this week of the possibility of default by Adlon. The complex inter-relationship is explained by Beatrix Boutonnet.

Berlin. Last week, millions of TV viewers and certainly also many Adlon investors enjoyed the final part of the three-part "Adlon Saga". Yet no sooner had it finished, and the next storm begins to brew over Fundus Fund No. 31. Perhaps unrightly this time though.

Hamburg. After 41 years, the InterContinental name will have to bow out of the Hamburg market: The insolvency administrator has ordered the closing of the hotel on the 31st of January because no new buyer has yet been found for the property.

Bad Doberan. An end to the saga in Heiligendamm is becoming ever more improbable for this year. Even the hot potential candidate, Median, is reported to have meanwhile surprisingly changed its offer.

Berlin. The German legislator has taken on board arguments from the funds industry. As was reported in summary last week, the German Ministry of Finance conceded many points on the first draft of implementing legislation of the EU's Alternative Investment Fund Managers Directive - and the financial sector breathes a sigh of relief in many points. Open-ended real estate funds and specialist funds are to stay and closed-ended funds will be less strictly regulated than initially proposed. Some adjustments are still to be made, overall though, the funds industry appears satisfied; it remains operative.

Berlin. The amended draft for the implementation of the controversial Alternative Investment Fund Managers directive comes with a sigh of relief from Germany's financial sector. Open-ended real estate funds and specialist funds are to stay and closed-ended funds will be less strictly regulated than initially proposed.

Vienna. Equity hurdles for bank loans still have little impact on Austria's resorts. Largely because the assumption of liability by the Hotel and Tourism Bank provides critical support: Two thirds of the EUR 500 million allocated for the assumption of this liability are still available. The role of ÖHT is becoming increasingly important as it is feeling just how much commercial banks are holding back with hotel finance. If loans are made available, then today these are only for new rooms and no longer for luxury spa projects.

Bad Doberan. "No decision has been made to sell," said the insolvency administrator of the Grand Hotel Heiligendamm to hospitalityInside.com. A final decision needs more time.

Munich. Crowd-funding has been made possible with the rise of the internet. The principle is as simple as it is creative - as we explained in the first part of this series last week: Anyone who fails to secure credit through traditional means can fall back on finance from the internet community. Crowd-funding platforms bring together people with ideas with investors interested in supporting these ideas. If an investor likes a certain project presented on the crowd-funding platform, he or she need provide only a small amount - mostly between one and ten euros. This is the basic idea. For start-ups, the contributions are somewhat higher. The platforms in detail.

Munich. Hotel financing is an urgent subject for the industry. Who is still financing where, which way are the big players going, and under which criteria are they expanding at all? And how do established banks face up to the current funding shortfall? Last week at the Expo Real, the 11th dialogue of the hospitality industry shed light on many of these aspects in the detailed opening talk with seven experts from the hotel industry, classical and alternative financial world. The opinions, at least, those of investors and operators – Starwood Capital and Hyatt – were quite similar. The banks, Aareal and Deutsche Hypothekenbank, defined their criteria, and Siemens Financial Services presented a niche-financing model as a silver lining on the green horizon. One assessment specialist has only seen little change since 2008. The highlights in the summary.