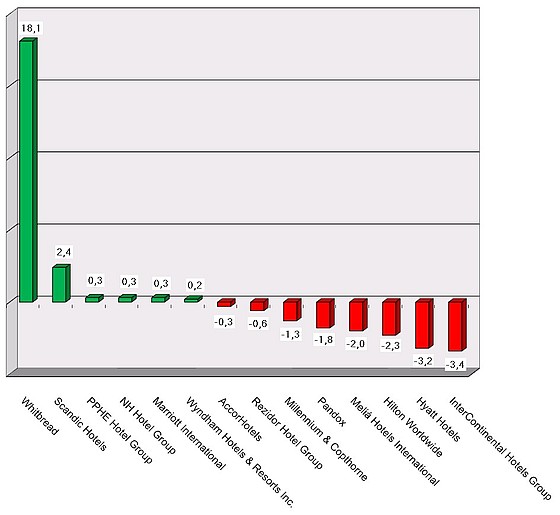

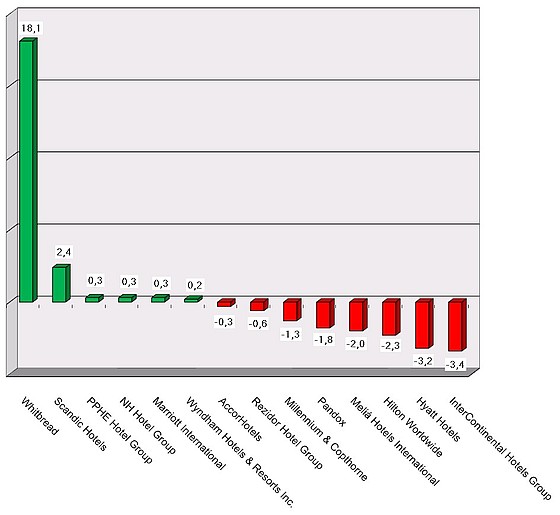

HI+Share price performance of the week 31/08/18 - 06/09/18

Changes compared to the previous week in %.

Source: Faktiva / powered by HVS EMEA Enews

Vienna. The private resort hotel industry of Austria is also concerned by the credit crunch. Now the industry association OEHV, along with partners, is offering a credit alternative for hotels. At the same time, the largest purchasing cooperative in Austria is assisting in financing.

Munich. Siemens Financial Services "goes green": Speaking at the Expo Real hotel conference "Hospitality Industry Dialogue" on Monday, October 8, 2012, the company will present a finance model for sustainable hospitality projects.

Augsburg. Securing finance is very difficult at the moment. This was underpinned by responses from the eleven consulting companies which hospitalityInside.com recently surveyed: What sort of finance is being granted, and what is not being granted? Does franchising have a chance for finance? And how much equity must investors today commit to projects of up to EUR 20 million, EUR 50 million or over EUR 100 million? Their answers show that framework conditions are now more difficult that ever. With this, there is certain to be lots to talk about at the Expo Real in Munich. Even the hotel conference there, the "Hospitality Industry Dialogue", will start with a two-hour discussion on this very subject. Each trade fair visitor can take an active part in the discussion.

Leonberg. What blunders do investors, tenants and banks commit in terms of finance? Quite large ones it seems, as a meeting with Antje Zumsande reveals, Managing Director of the consulting company Consilium Hotellerie in Leonberg near Stuttgart. Hotel real estate advisors like her see and hear a lot. General contractors, hoteliers, bankers, local politicians and planners include her in their plans and projects; come to her with their problems - and sometimes also with daring proposals or schemes. Five examples from real life show how "creative" the parties involved are when they want to reach their goals: From a defrauded franchisor, a greedy investor, a negligent bank, jumpy partners and a fiddling owner.

Wiesbaden. The scars of the financial crisis are deep and the hotel industry has been especially affected by the current funding shortfall. Without perfect preparation, nothing works anymore; however, many credit applicants have still make the same old mistakes. What is the industry doing wrong? Subsequently, consultants describe their observations and bankers their expectations. One side advises the hotel managers to examine their banks as carefully as the banks examine their borrowers. And hotel managers should not get their hopes up too high, despite complete documentation. On the other hand, the banks attest to a much higher degree of professionalism in the industry in the meantime.

Augsburg. The banks are no longer pursuing financing projects. They are continually adverse to risk and with this, are strangling an increasing amount of hotel projects. The equity ratio rises and rises, the lease leaves no opportunity to management and franchise. The projects that still seek financing are squeezed into a simple model of conditions. While central European financing suffers from Basel III, the euro discussion brings international investors to hesitation. hospitalityInside.com has questioned eleven well-known consulting and broker companies on how they see the current financing situation in the central European hotel industry. Seldom are the appraisals of experts so closely together – and laying negatively in this trend.

Munich. The national implementation of the European Directive on Alternative Investment Fund Managers could have a fundamentally negative effect on the German real estate and financial industry. The industry associations are fighting against this draft as not all funds are as bad as consumer protectors and politicians think they are. Many of them, among them hotel funds, paid off well for the investors. Even banks do not understand why open-ended funds should be prohibited. An interim result with respect to the AIFM Directive, and the associations' and consumer protectors' major points of criticism.

Cologne. The Public Prosecutor's Office in Cologne has filed proceedings against Anno August Jagdfeld from Fundus before the Regional Court in Aachen for embezzlement. If convicted, he could face a maximum sentence of 5 years.

Munich. The question as to the direction of the transaction and investment market for hotels is of crucial importance for the hotel sector. On the one hand, investment volume recorded in 2012 is still not really good. On the other, many hoteliers are looking for successors, particularly in Germany. Many of these are positioned in the midscale segment. According to those that know the market, current framework conditions and economic rationale will largely favour the budget hotels. The next crisis is then likely to hit the midscale segment hardest. An analysis of the German situation.

Brussels. What a development! Last Friday, the German Federal Ministry of Finance presented the long-awaited draft for the implementation of the European Directive on Alternative Investment Fund Managers. The draft caused much concern among both open and closed-ended funds last week, which in the past have often provided hotel finance. The fund industry has reached a turning point. The draft, if it were to be approved, would prohibit the inception of new open-ended real estate funds. To date, though, not all points covered by the draft are clear. Many points appear ill-tailored. The draft will therefore need considerable reshaping. And much is likely to be lost along the way. After all, it not only seeks to regulate the managers, but also the products themselves.