News & Stories

Paris. Once again French politicians and lawmakers are showing poor sense of creativity when it comes to taxes. Last week, the Assemblée Nationale considered a proposal to increase the limit on hotel taxes – up to 8 euros!

Frankfurt/M. The hotel certification of the German Business Travel Association VDR has now developed a certificate for serviced apartments in addition to its already existing certificates for business travel hotels and conference hotels. It was introduced at the VDR conference at the beginning of April.

Vienna. "Mmmmm, the orange juice in the minibar, the refreshing shower gel... Fair tastes and smells better" or "the soft cotton bedding, the coffee in the morning... I love it when hotels offer Fairtrade products." Is such ebullient praise by a small number of people on Expedia, TripAdvisor, Facebook and Twitter to be taken seriously? Those who calm the social and ecological conscience of their guests are in trend - and remain in conversation. Ethical trade and sustainability are also to be found within the hotel industry.

Dubai. Dubai has introduced a new charge, called "Tourism Dirham", on tourists staying at hotels as part of efforts to fund the promotion of the emirate as a travel destination.

Kruen/Garmisch-Partenkirchen. Angela Merkel has a good memory. Dietmar Mueller-Elmau has no less than Chancellor Merkel to thank for the decision to use Schloss Elmau in Bavaria as host to the G8 summit 2015. The hideaway & spa resort in the idyllic Elmau valley would shine a global camera light on the entire region around Garmisch-Partenkirchen, the equivalent of a lottery win for the area as tourism has fallen quiet over the past few years – especially since the Americans began staying away. Many hotels in Munich and in the Allgaeu region will benefit from the summit which will attract 7,000 journalists alone. With its philanthropic past, its status as luxury hotel today and its secluded location in a high valley, Schloss Elmau has all the features required to host a high-profile political summit. A "hotel in the hotel" will also be set up alongside Schloss Elmau, a new retreat with 12 identical presidential suites. Dietmar Mueller-Elmau, owner of Schloss Elmau, and his direct hotel neighbour, Jakob Edinger, owner of the spa resort Das Kranzbach, explain why they will reserve their hotels for a full four weeks exclusively for the summit.

Berlin. On October 16, 2013, the German Federal Government enacted the new Energy Efficiency Ordinance. By 2016, the annual primary energy requirement for new-build properties is to fall by a further 25 percent. In the real estate world, EnEV 2014 has met with a mixed response. Many view the ordinance as a bitter pill.

All hot air?

Wiesbaden. Is it all hot air about Facebook, HolidayCheck, Twitter & Co? The entire hotel world meanwhile uses social media and review portals, yet the benefits of this form of communication appear to be few. hospitalityInside.com asked a dozen hotel groups and individual businesses this simple question: "Have you ever received a sensible suggestion from a comment on Facebook, another social network or other review portal which was then successfully implemented by your hotel/group?" The result was - in short - devastating. Only two groups provided interesting information: Lindner Hotels and Vienna International.

Bonn. Contrary to hotels, serviced apartments are still a young segment. In the worldwide hospitality industry, the businesses which focus on offers for long-stay guests make up less than two percent of the market. This means: there is still a large potential for growth in this segment. At the same time, however, serviced apartments have to master great challenges: there is no unified name, there are no unified standards – and travellers search for accommodations for extended stays amongst 1000 terms but not under the desired ones. At the 4th "Serviced Apartment Camp" in Bonn last week, there was a glimmer of hope. Five large providers sat at one table for the first time: Accor/Adagio, Adina, Citadines, Derag Livinghotels, and Marriott/Residence Inn discussed common features and differences, figures and emotions in a friendly atmosphere for three hours. The new spirit ended with a promise by the five players to draft a guideline for the segment by next October in order to attract investors.

London. The exposures by the news magazine "Spiegel" last week about spying on hotel reservations has sent cold shivers down everyone´s back but ultimately, it is only one piece in the grand spy game puzzle. However, the hotel industry is also not particularly known for its especially good data protection.

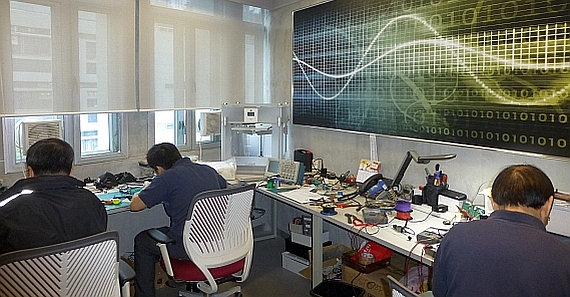

Hong Kong. It has a touch of James Bond: The limousine careens along its way from the Peninsula Hotel Hong Kong in the glittering shopping quarter of Kowloon to Aberdeen, a former industrial quarter on Hong Kong Island. Dilapidated factory buildings everywhere, no one on the street … Here sits the technology brain of the five-star hotel group. As the only hotel company in the world Peninsula Hotels disposes of its own research and technology department that solely looks after the optimisation of the technology in the guestrooms. Moreover, it is less about the latest gadget, but more about a simple and well thought-out usability and the integration of different systems. A visit to a somewhat different "garage company".