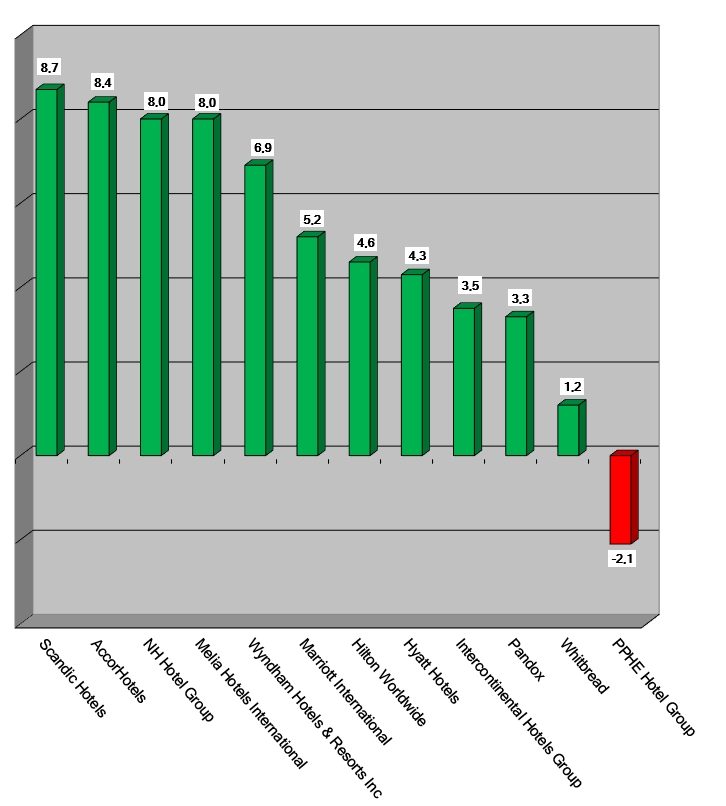

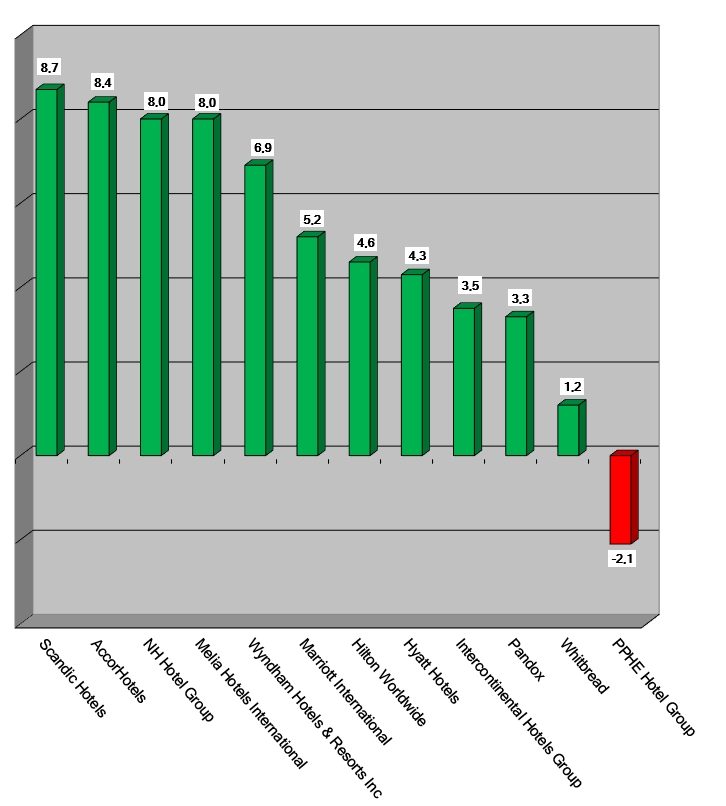

HI+Share price performance of the week 23/09/2021 - 29/09/2021

Changes compared to the previous week in %.

Source: Reuters

powered by HVS EMEA Enews

London. Hotel values across Europe gained a further 3% last year according to the annual "European Hotel Valuation Index", marking the third year of increase for Europe's hotel sector.

Wiesbaden. The demographic change and the still unabated general desire to travel have considerably reduced the investors' shyness when it comes to operator-run properties such as hotels, nursing homes and serviced apartments in Germany in the last few years. Micro apartments are also booming, which are partly allocated to the housing market. But which of these real estate types are favoured the most by investors at the moment and why? hospitalityInside.com did some research.

Rimini. There are plenty of opportunities around the corner now: Hotel real estate transactions in Italy reached the expected 2-billion-euro threshold in the first half of 2019, representing 42% of the overall transaction value in the real estate market. The appetite for hotel assets is still strong but investors continue to shy away from Italy. It's not the country's bad legal reputation but the specific old-fashioned legal framework behind the lease and management contracts. Experts talk about their concerns, legal experts explain the backgrounds.

Munich/Hamburg. Ruby Hotels gains a new, renowned shareholder: the family office of Alexander Otto, who is also CEO of the Europe-wide project developer ECE. Together, they intend to make the move into the US-American market.

Lisbon. The crisis discussions that have flared up in the industry again do not trouble Josef Brandhuber at all. He is a sustainable investor and does not let himself be manipulated by panic-mongering, says the Managing Partner of SoReal Invest GmbH from Munich. This also goes for the hotel business. With its new hotel funds concept, presented in May this year, the company wants to move into B and C locations preferably. So far, this has not often been the case.

Munich. More and more banks are expecting the economic development to deteriorate and are responding with more restrictive lending. In addition, they fear stronger competition from tech and digital companies such as Google, Amazon & Co.

Hamburg. Increasing political regulation and further slowdown in economic performance in Germany are having only a limited impact on sentiment in the investment market. This market is apparently bucking the trend, driven by low interest rates and high volumes of available capital and defying the increasing challenges.

Hamburg. Hotel operators and investors continue to view the mood on the German hotel real estate market positively. However, an ever increasing scarcity of supply has resulted in a further shift of investment activity within the various city categories. Investors remain sceptical about C-locations.

Munich. In many cities and asset classes, real estate has long been overpriced. In locations with lower prices, the risk is often higher because prospects are more difficult to assess. All the same, concrete gold remains the favoured choice for an investor. They are even prepared to accept ever lower yields – even in the hotel sector. Here, the average yield fell to 3.2%. Yet investors and operators remain undeterred. This could all end in tears. A hot topic before Expo Real.

Berlin. The German magazine Finanztest gives closed-end alternative investment funds mixed scores. Providers criticise the approach.