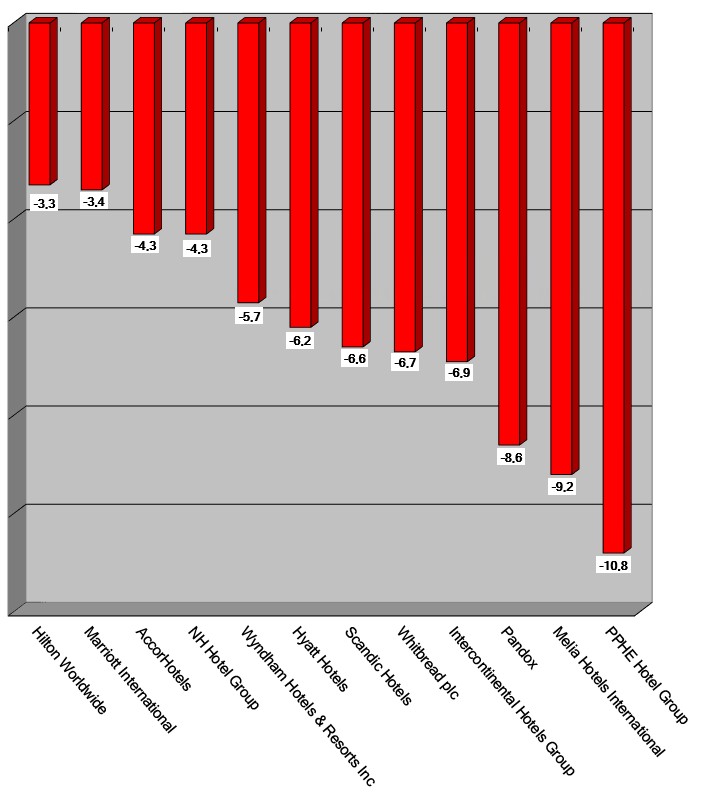

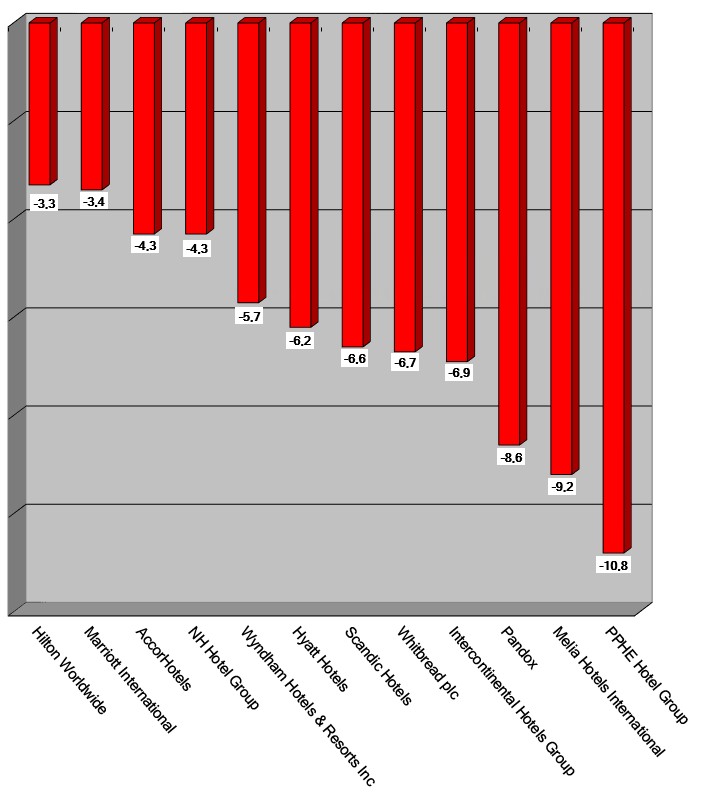

HI+Share price performance of the week 18/06/2020 - 24/06/2020

Changes compared to the previous week in %.

Berlin. The figures for mutual funds have grown small. And so too has the number of providers. This was made clear at the "Funds Summit" in Berlin. But there are also exceptions. Whilst many initiators still approach private investors with caution, the Augsburg-based Patrizia Immobilien AG has established a new subsidiary in order to expand precisely this segment. With Patrizia GrundInvest Stuttgart Suedtor, it has now put its second fund into distribution and again it focuses on hotels. And something completely new on the market: a new online platform for funds! Who else is still active and what's happening in the world of funds is explained by Beatrix Boutonnet.

Cologne. Difficulties experienced by two funds managed by the Cologne-based company E&P will lead to the closure of the Dorint Hotel in Seefeld, Austria next week. The situation for the Dorint Hotel Augsburg is not yet clear.

Munich. New capital requirements for banks, in short Basel III, have caused much upheaval. In order to maintain their margins in the low interest rate environment, banks have tightened their terms. This has hit Germany's Mittelstand hard, and along with it many hoteliers. For them, loans and roll-over finance have meanwhile become much more difficult and expensive. Alternative means of finance such as debt funds have therefore moved more sharply into focus. The market for corporate finance in Germany is currently in a state of profound change.

Munich. Robert Bambach is a real estate man through and through. A former Managing Director of Hochtief Projektentwicklung GmbH, he has been CEO of Commerz Real AG since January 2015 and is responsible for real estate transactions - inter alia for hausInvest. The latter is a giant among real estate funds with a total volume of EUR 10.1 billion invested in 104 properties in 62 cities and 18 countries. The proportion of hotels among these properties is still small though. Yet this is all set to change now that CR has brought Dirk Schuldes on board, one of the most renowned hotel experts. Bambach on the new hotel motivation: "I don't know of any vacant hotels in top locations, though I know many such empty office properties." Now, CR plans a hotel fund.

Bergamo. Hotels yes, hotels no... How much do Italian banks believe in hospitality investments? In the current scenario of the real estate market's moderate recovery, the national banking institutions are trying to take advantage of the new trends as well as the tourism potential of the Italian destination. Their interest in the hospitality sector is therefore growing again, albeit a series of prudential stakes still limit the scope of the bank's credit. The answer to the question appears then to be neither a convinced "yes" nor an absolute "no". The answer is more cautious, and probably pragmatic. Just a few days before Europe's leading real estate fair Expo Real in Munich started, Italian bankers and investors met in Bergamo to describe the state of the art of the national hotel investment scene.

Munich. Hotel properties have become presentable. Germany's hotel investment market, regarded as a "safe haven", is heading for a new record result of three billion euros. However, especially the vast amounts of cheap money provided by the central bank lead to massive increases in property prices while the number of available properties decreases at the same time. And the number of investors, which are new to the industry, is increasing too. This, in combination with higher risk-taking, is not a good precondition for long-lasting and sustainable investments! At least this was the opinion of experienced hotel experts taking part in the panel discussion at Expo Real's hotel conference in Munich last week. They criticised the current, unhealthy situation in the market and see different solutions to this dilemma. However, without knowledge of the hotel industry, failure seems inevitable.

Munich. Earning money with hotels sounds good, and even a bit sexy. The appeal of the hotel as an asset class is high, especially as it's often subconsciously associated with the luxury, travel and holiday - positive terms to which office and residential properties can't lay claim. But this has little to do with reality. Hotel real estate is operator real estate. The demands on investors are therefore high. All the same, their hunger for hotels is large. Especially popular are hotel funds. And it looks like the relationship between funds and hotels is becoming ever closer. A current look at the funds scene with the old and the newcomers.

Cagliari. The facts are simple: Following a decision of the European Union Commission in 2008, a recent judgment of the civil tribunal of Cagliari, the administrative centre of the island, is forcing 30 Sardinian hoteliers to return regional funding in a total amount of 35 million euros, interest and penalties included. A severe sanction that could threaten the existence of many of the properties involved, from 3- to 5-star hotels, along with their more than 1,500 employees, almost 9,000 beds and a total yearly turnover of about 60 million Euros, according to the local hospitality association, Federalberghi Sardegna. The story, however, is rather complex and quite grotesque.

Larnaca/Paris. Since last autumn, one company on the German hotel finance landscape in particular has undergone a remarkable change. Until October 31, 2014, it was privately run. Then, Yakir Gabay quietly had his hotel holding company, Primecity Investment, listed on the Paris Stock Exchange. The move meant he immediately acquired a strong capital base from which to drive forward a lightening-quick cash-driven expansion. Over night, the investor had EUR 150 million at his disposal; EUR 100 million from the IPO in October 2014 and a further EUR 50 million from a convertible bond issued in February 2015. Philipp von Bodman, CEO of Primecity Investment Plc, on the new asset profile, the new investment drive and the more comprehensive operator strategy.

Seefeld/Bad Gastein. The 5-star For Friends spa hotel in Moesern near Seefeld, Austria, achieved a record-breaking insolvency. Not even a single year passed between the opening of the hotel and insolvency proceedings. Now, the spa hotel is to be closed. Another insolvency has been arising from the culmination of many years full of wrong decisions revolving around the famous Hotel Village Gruener Baum in Bad Gastein.