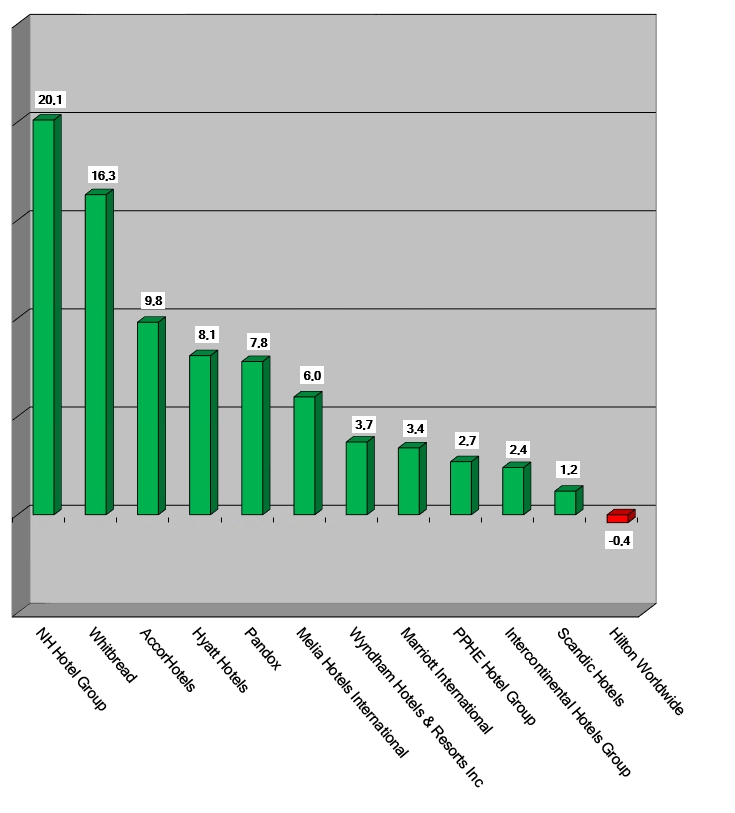

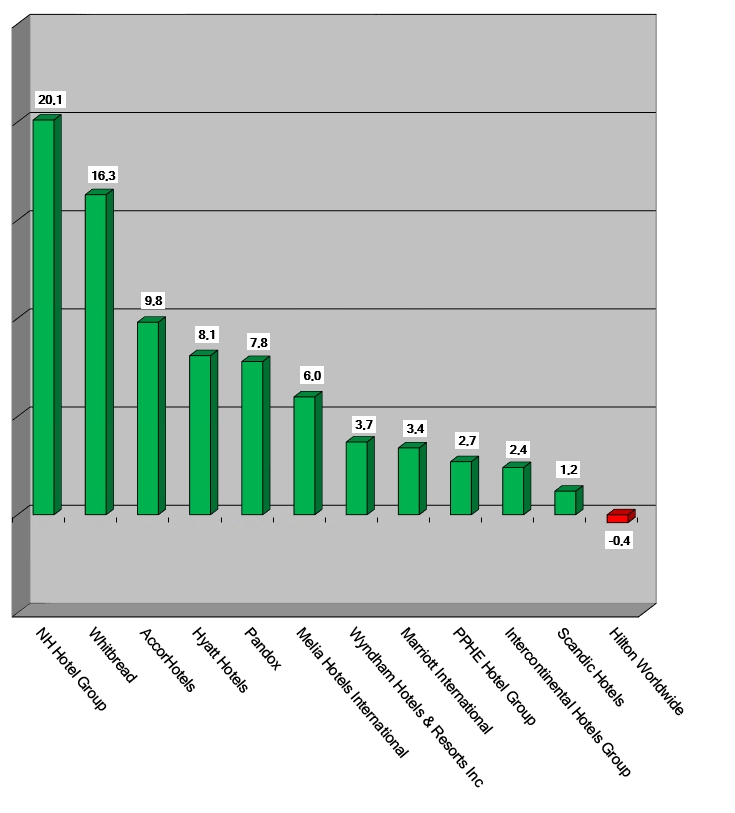

HI+Share price performance of the week 12/11/2020 - 18/11/2020

Changes compared to the previous week in %.

Vienna. As of now, investors are able to invest in Falkensteiner Hotels & Residences via the financing platform Finnest. This way, the expansion into new markets will be supported, amongst others. Other hoteliers have already chosen this route to obtain financing.

Beijing. Irrational outbound investment in hotels, real estate, entertainment, and sports clubs are over for aggressive Chinese dealmakers whose acquisition strategy is now restricted by local authorities' new investment policies. HNA, Anbang, Fosun, etc. are now limited in their moves which raises concerns abroad regarding their due payments and further ongoing acquisitions. Will HNA be able to actually buy Rezidor's remaining shares as it is compelled to? Nothing is sure at this point. The company needs to make decisions and "big brother" is watching.

London/Munich. After the liquidation of its first two hotel funds, Invesco Real Estate now issues its third hotel fund, the "Invesco Real Estate European Hotel Fund". The investment portfolio with an investment volume of around EUR 200 million will consist of four hotels in Germany and the Netherlands.

Hamburg. Union Investment and bulwiengesa have calculated the market volume of investable hotels in Germany again. According to their calculations, the market value of investable hotels in Germany increased by 8.3% to EUR 51 billion between 2015 and 2016.

Vienna. The Deloitte OEHV "Tourismusbarometer" 2017 attests a cautiously yet optimistic mood among Austrian tourism companies with an index value of 2.99. They mainly complain about difficult financing and an increasing skilled labor shortage.

Paris. The "Booster project" has been causing a commotion at AccorHotels for months. Now, it stands shortly before completion: From 1 July 2017, AccorHotels and AccorInvest will act as completely separate companies, and until investors for AccorInvest are found, they will both operate as 100-percent subsidiaries of Accor SA. For this, the formal requirements have now been created.

Milan. In Italy, the hospitality industry is finally in the spotlight – thanks also to the decreasing profitability of more traditional real estate assets. Several influential and big asset management companies and hotel groups, new kids on the block as well as established players, recently gathered at a round table in Milan organized by the Master of Tourism Economy division of Bocconi University, in cooperation with Confindustria Alberghi and Horwath HTL. The discussion followed Horwath HTL's presentation of its "Hotels & Chains report" and focused on Italian hotel investment scenarios. The industry is learning: splitting assets and operations, initiating funds and watching properties to achieve profitability.

London. Europe has seen an upturn in the availability of hotel financing due to low interest rates and strong performance, according to the annual "European Hotel Lending Survey".

Munich. Investments in the real estate sector are currently experiencing a veritable boom. Outside Germany – in particular in the US and in Asia – Real Estate Investment Trusts, or REITs for short, are very much in demand. They shape the face of the real estate markets, providing a transparent and simple investment vehicle for indirect investments in hotels, offices or shopping centres and with attractive returns too. In the US, this vehicle is also popular in the hotel industry. In Germany though, investors have difficulty with this special form of real estate stock which represents a sort of stock-market listed real estate portfolio. Beatrix Boutonnet explains.

Frankfurt. More and more investors are placing their chips on the asset class "hotels" in their search for yield. The former niche product has in recent years evolved into an established product - driven by falling returns and a lack of opportunity in classic real estate. Yet as before, only those investors with corresponding insider knowledge are happy with hotels. This fact is meanwhile well-known. At the annual conference of the Federal Association of Real Estate Investment Experts in Frankfurt, even high-calibre experts warned of the end of the general cycle in the sector.