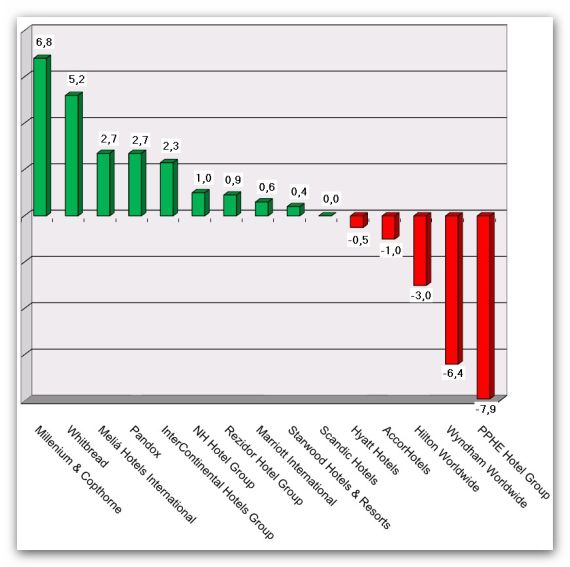

HI+Share price performance of the week 22/07/16 - 28/07/16

Changes %

Source: Factiva / powered by HVS EMEA Enews

Amersfoort. Ailing Golden Tulip Hospitality Group is still negotiating with potential split up. The background behind the difficulties is slowly getting clearer. In the meantime, Golden Tulip keeps stony silence.

Lausanne. Golden Tulip Hospitality Group voluntarily applied for receivership on March 31. However, by its own account, the group is negotiating with two potential partners about continued existence.

London. A "Global Hospitality Recovery Fund' is raised up to 500 million Euro in order to acquire luxury hotels, and is now actively seeking investment from both institutions and individuals. Sought-after are non-performing assets with negative cash flow, delinquent assets being disposed of by institutional investors, distressed assets in negative equity and assets that are in breach of covenants by borrowers.

Zurich. Alongside Switzerland's secretive banking laws which have come under fire from many fronts of late, the right of lump-sum taxation for rich foreigners has now also been questioned. Following a referendum in Zurich, this privilege will be revoked as from 2010 in the Swiss capital. Opponents of lump-sum taxation in other cantons have drawn strength from the move. Should this prevent rich foreigners moving to Switzerland, the Swiss luxury hotel industry is also likely to be affected. Many hotels were and continue to be financed by means of luxury apartments in or in the vicinity of the hotel.

Frankfurt. The 40th fund launched by the Danish real estate investor Euro Ejendomme will be administered and controlled in Frankfurt. It is the first institutional fund to be set up by the company in Germany. The plan to offer such a fund for subscription was announced as far back as October last year; now, details have been published.

Moenchengladbach. Since January, NewGen AG, Moenchengladbach, has been under transaction. Now, the company remaining out of the failed takeover of Dorint Hotels by Accor S.A. has started the squeeze out finally.

Munich. Initiators of closed German real estate funds are returning to simplicity. For a long time, more risky constructs such as opportunity funds and project developments were popular; now, the classical real estate funds with portfolio real estate are entering market again. This development became obvious at the "Feri Symposium der Beteiligungsmodelle 2009" in the Kempinski Airport Hotel Munich last week. Hotels could move into the focus of investors again. In the past, this was not always the case. However, exotic products remained attractive as nice products among real estate investments.

Berlin. Design Hotels AG announced a few days ago it will suspend the continuous trading facility for its shares on Xetra from 1st February 2009 till further notice.