News & Stories

Paris. Ennismore is taking over Accor's stakes in Rixos and Paris Society. At the same time, Accor, as majority shareholder in Ennismore, has announced it is in exclusive negotiations to sell a 10.8% stake in Ennismore to a Qatari consortium for a total amount of 185 million euros. This includes a Shari'a-compliant financing of 20 euros million by Qatar First Bank LLC to the Qatari consortium's investment vehicle.

Berlin. In mid-January this year, seven larger German hotel groups documented their hardships since Corona in facts and figures to Economics Minister Dr Robert Habeck. Since February, there have been several responses to this from several levels of government, but all with the same negative conclusion: the subsidy cap for the large medium-sized enterprises will not be lifted under any circumstances. Yet the government would have the power to do just that - even without the EU. Since May it has been clear: the doors in Berlin have been slammed shut. But not everyone wants to put up with that.

Frankfurt/London. The British, listed Whitbread Group sees its growth strategy in the German hotel market confirmed with the Premier Inn hotel brand. This is a central message at the presentation of the Whitbread balance sheet of the financial year 2021/22.

Wiesbaden. Local leisure business still dominates the upswing among international hotel groups, but international tourism also picked up again in the first quarter of 2022. Business was negatively influenced above all by the tightening restrictions in China. The results of the Global Hotel Alliance, Hilton, Hyatt and IHG.

Berlin. Rising costs erode GOP margins as expense ratios increase. In the first quarter of 2021, GOPPAR was negative in all major European cities. In addition, the figures show that the gap between extended stay and full service hotels has widened significantly. Labour costs have also become immense.

London/Berlin. How will the ESG goals translate into practice in concrete terms? That is what everyone would like to know. In London, in October 2020, the Energy and Environment Alliance was founded. This non-profit coalition brings together hospitality leaders from all over the world with whom one wants to define standards, measurement methods, green finance and legal issues, among others - and to do so uniformly. hospitalityInside met EEA CEO Ufi Ibrahim at the IHIF in Berlin.

Augsburg. Motel One and especially Marriott are confident with a view to the Q1 results that the markets are moving ever closer to pre-crisis times. Marriott is looking at a strong North American business, while China is weakening. Motel One enters May with 60% occupancy expectations in April.

Munich. For the first time, Munich-based MHP Hotel AG, which has been listed on the stock exchange since 2021, published its - preliminary - balance sheet figures for 2021. With a positive outlook for 2022 to 2024.

Milan. The past year marked a significant rebound for the Italian hotel investment market. Transactions amounted to a total volume of 2.1 billion euros, with 57 sales completed and about 12,000 rooms that changed hands.

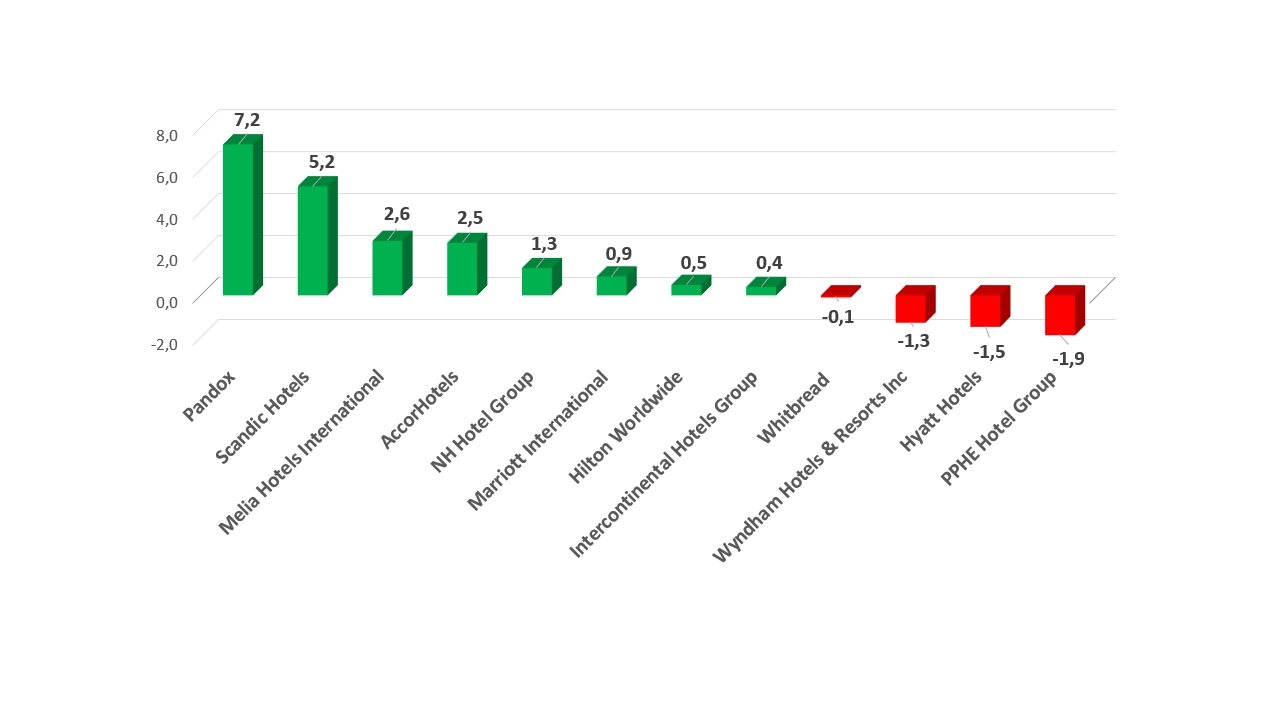

Stockholm. Pandox and Scandic have already published their 2021 balance sheets and agree: the Omicron variation spoiled the end of the year, but the advanced bookings for this year and the always quick return of the markets when corona measures are relaxed give a lot of hope.