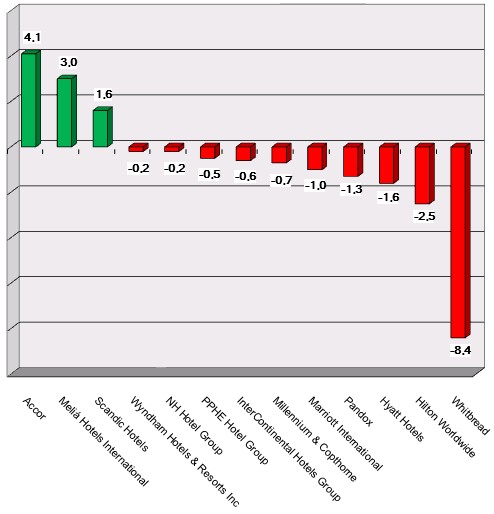

HI+Share price performance of the week 19/07/19 - 25/07/19

Changes compared to the previous week in %.

McLean. After a long drought during the years of financial crisis, IPO's of hotel companies are back in style. Prior to the onset of the financial crisis, which got underway in late 2007, several hotel groups were bought out by private equity investors, including Four Seasons, Fairmont, Extended Stay of America, La Quinta and, of course, Hilton, which was purchased at the top of the market for US$26 billion in cash and debt in the summer of 2007. Notably, four major private equity owners of hotel chains, including Blackstone, Colony Capital, Prince Al-Waleed's Kingdom Holdings and Bill Gates' Cascade Holdings, have either already completed share offerings, announced IPOs or are mulling the prospect.

Paris. Last night's news, due to media reports: Private-equity group Starwood Capital has sold the real estate and business assets of 40 Louvre Hotels in order to reduce debt and also finance more international expansion.

Dublin. The Irish hotel industry suffered the consequences of the Lehman crash in full force. Since 2009, Ireland has lost 2,500 hotel rooms; however, the industry is seeing an upward trend again. Occupancy and room revenue are increasing, but it is mainly Dublin and a few other cities that benefit from this trend. Generally speaking, hotel properties are losing their value; a considerable percentage of the hotels are still owned by banks. In addition, the wages have gone up, which is reason for worry, whereas the reduced value added tax can still be maintained for the hotel industry for the time being. An update by Macy Marvel.

Munich. Private equity and institutional investors are buying properties as investments and as of recently are increasingly looking to the hotel sector again. Yet, as an Expo Real discussion round with representatives from both sides revealed, despite the same targets, their approaches and expectations vary significantly. Investor knowledge of the hotel industry and the finer points of these markets is increasing which is why return expectations are drifting apart in areas. The search for quality properties remains difficult as the number of distressed assets coming on to the market is low.

London. The Maldives are the most popular destination for luxury travel, Chanel is the most popular fashion brand and first-class travel even surpasses cars, jewellery and fashion when it comes to the most popular luxury product. These are the findings of a recent survey by an international consortium.

Vienna. Finance for hotel real estate has changed considerably over recent years. Whereas the majority of projects were previously financed by banks, today only one in ten projects are successful in arranging classic bank finance. The banks must find a new role.

McLean. Hilton's long anticipated IPO was finally officially made public last Wednesday, 12 September when the chain's owner Blackstone, the large private equity fund manager, filed an S-1 document with the US SEC. It should be understood that only US$1.25 billion worth of shares representing a scant 5% of Hilton's estimated total value will be sold in this initial offering.

Hanover. Deutsche Hypo has provided hotel finance since the beginning of the 1980s. And it's to stay that way, Board Member Andreas Pohl tells hospitalityInside.com. However, since the Lehman collapse, the Hanover-based Pfandbrief bank has imposed more rigid conditions on customers. And the Managing Director makes no secret of this. His criticism of the hotel industry is that there are still many half-baked finance concepts. On the other hand, the bank appears to have a lot of patience when it notices that it has chosen the wrong operator. A conversation on principles and hotel finance.

London. In future, capital will increasingly come from Asia and Arabia, as markets there will continue to grow reliably and increase the desire of investors to commit funds to Europe. However, there is no need to fear hotel investors from these parts of the world, equity expert Ramsey Mankarious says. Hotel real estate insiders got to know the friendly and modest American who is considered a distinguished investment expert with top contacts. His company, Cedar Capital Partners, specialises in the European hotel industry. Ramsey Mankarious on his own business model and the big trends on the hotel investment market.

Berlin. Hotels in Germany could in future face high costs - both in terms of finance and in terms of construction. The reason is to be found in two changes: Firstly, the draft Accommodation Establishments Ordinance, which places comprehensve obligations on hotels with regard to barrier-free access and secondly, the regulation of open-ended, closed-ended and special funds by the AIFM Directive, which finally entered into force on July 22, 2013, after long discussions.